Trian Partners Activist Presentation Deck

Competitors Have Grown EPS Faster than P&G

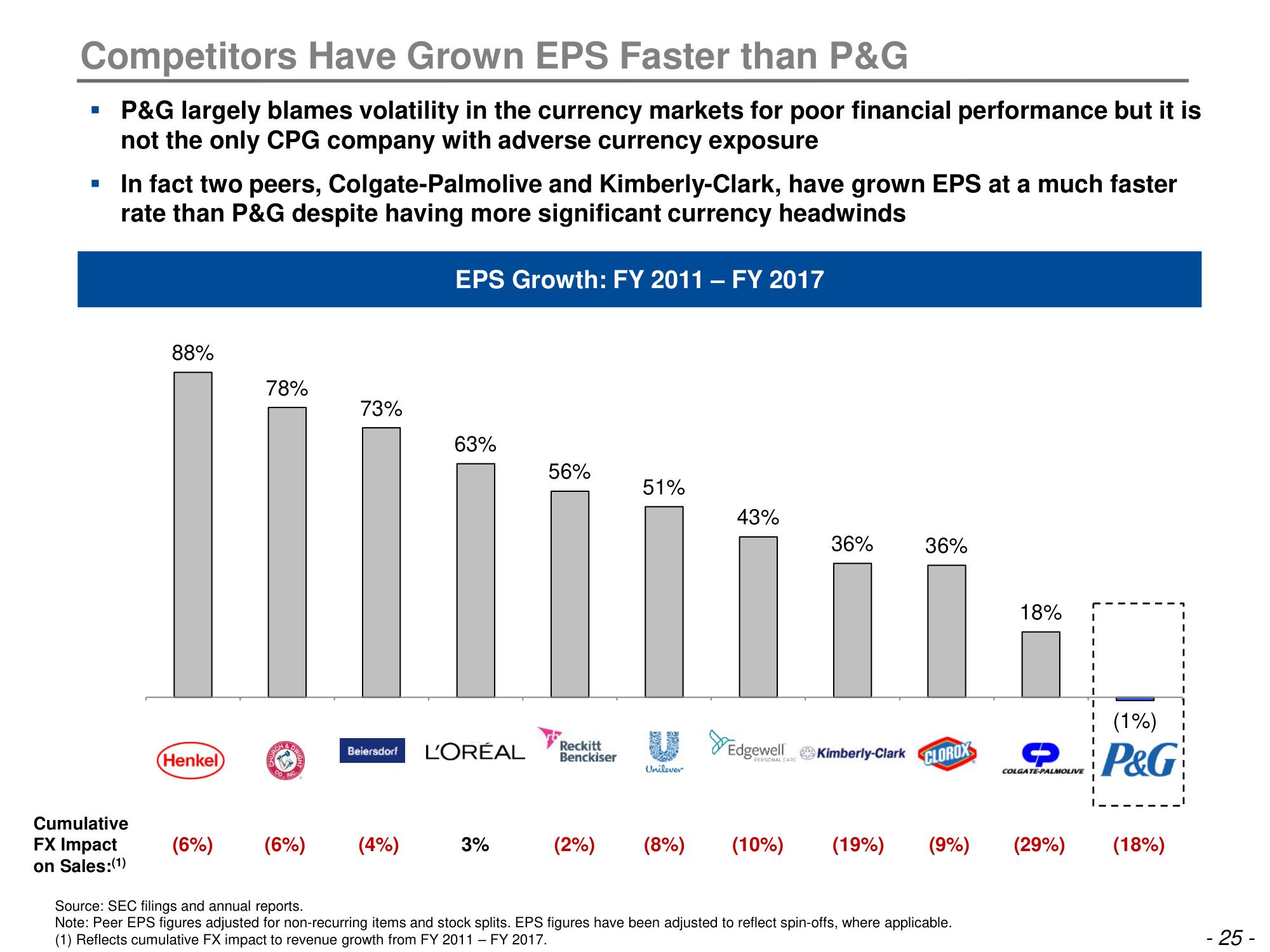

▪ P&G largely blames volatility in the currency markets for poor financial performance but it is

not the only CPG company with adverse currency exposure

In fact two peers, Colgate-Palmolive and Kimberly-Clark, have grown EPS at a much faster

rate than P&G despite having more significant currency headwinds

Cumulative

FX Impact

on Sales: (1)

88%

|

(Henkel

(6%)

78%

Son

Co

INC

73%

Beiersdorf

(6%) (4%)

EPS Growth: FY 2011 - FY 2017

63%

L'ORÉAL

3%

56%

Reckitt

Benckiser

51%

Unilever

(2%) (8%)

43%

36%

36%

I

Edgewell Kimberly-Clark

PERSONAL CARE

(10%) (19%)

CLOROX

(9%)

Source: SEC filings and annual reports.

Note: Peer EPS figures adjusted for non-recurring items and stock splits. EPS figures have been adjusted to reflect spin-offs, where applicable.

(1) Reflects cumulative FX impact to revenue growth from FY 2011 - FY 2017.

18%

COLGATE-PALMOLIVE

(29%)

I

(1%)

P&G

(18%)

- 25-View entire presentation