Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

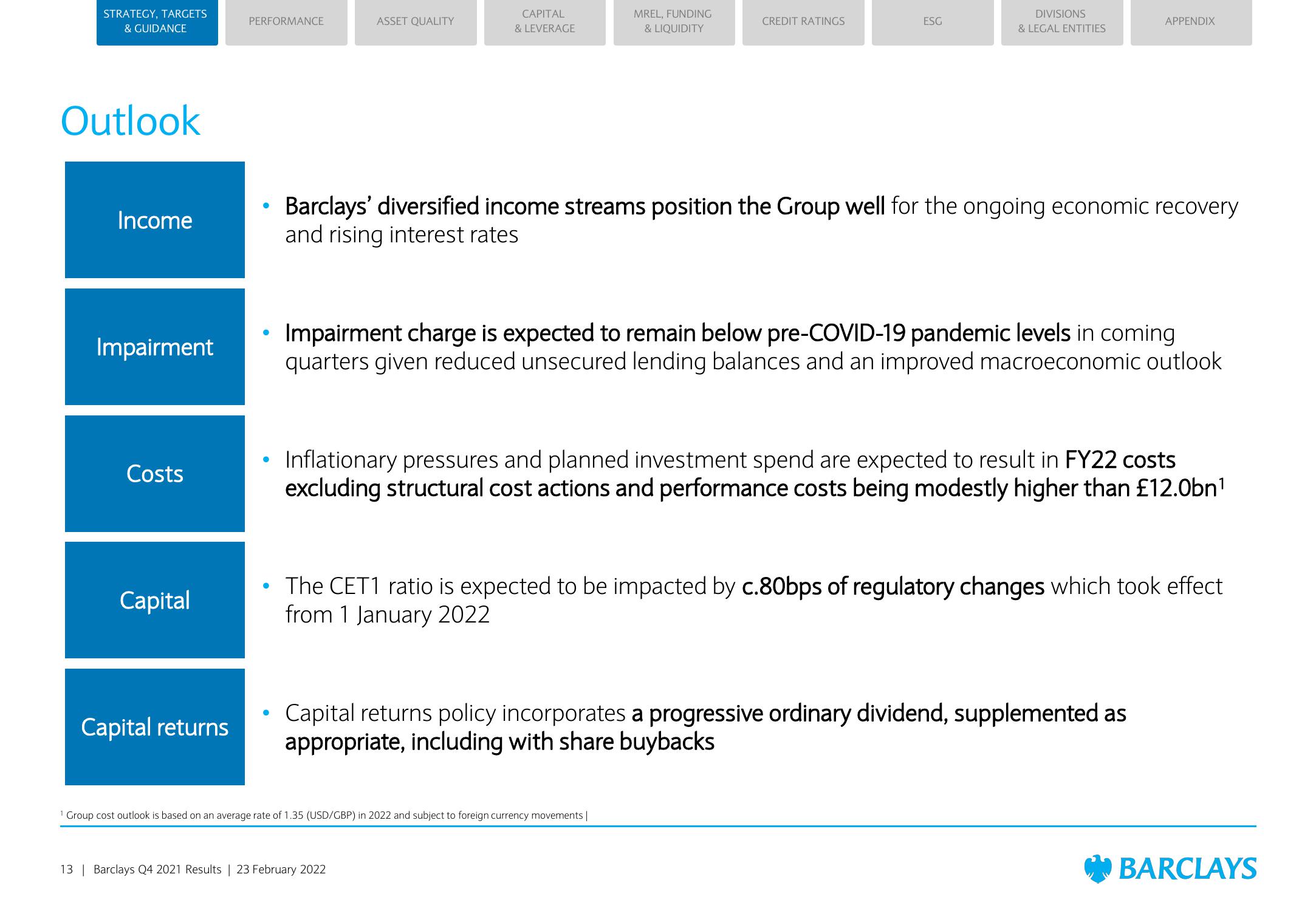

Outlook

Income

Impairment

Costs

Capital

Capital returns

PERFORMANCE

•

●

ASSET QUALITY

CAPITAL

& LEVERAGE

MREL, FUNDING

& LIQUIDITY

CREDIT RATINGS

ESG

13 | Barclays Q4 2021 Results | 23 February 2022

DIVISIONS

& LEGAL ENTITIES

Barclays' diversified income streams position the Group well for the ongoing economic recovery

and rising interest rates

1 Group cost outlook is based on an average rate of 1.35 (USD/GBP) in 2022 and subject to foreign currency movements |

Impairment charge is expected to remain below pre-COVID-19 pandemic levels in coming

quarters given reduced unsecured lending balances and an improved macroeconomic outlook

APPENDIX

Inflationary pressures and planned investment spend are expected to result in FY22 costs

excluding structural cost actions and performance costs being modestly higher than £12.0bn¹

The CET1 ratio is expected to be impacted by c.80bps of regulatory changes which took effect

from 1 January 2022

Capital returns policy incorporates a progressive ordinary dividend, supplemented as

appropriate, including with share buybacks

BARCLAYSView entire presentation