Antero Midstream Partners Investor Presentation Deck

Antero Definitions

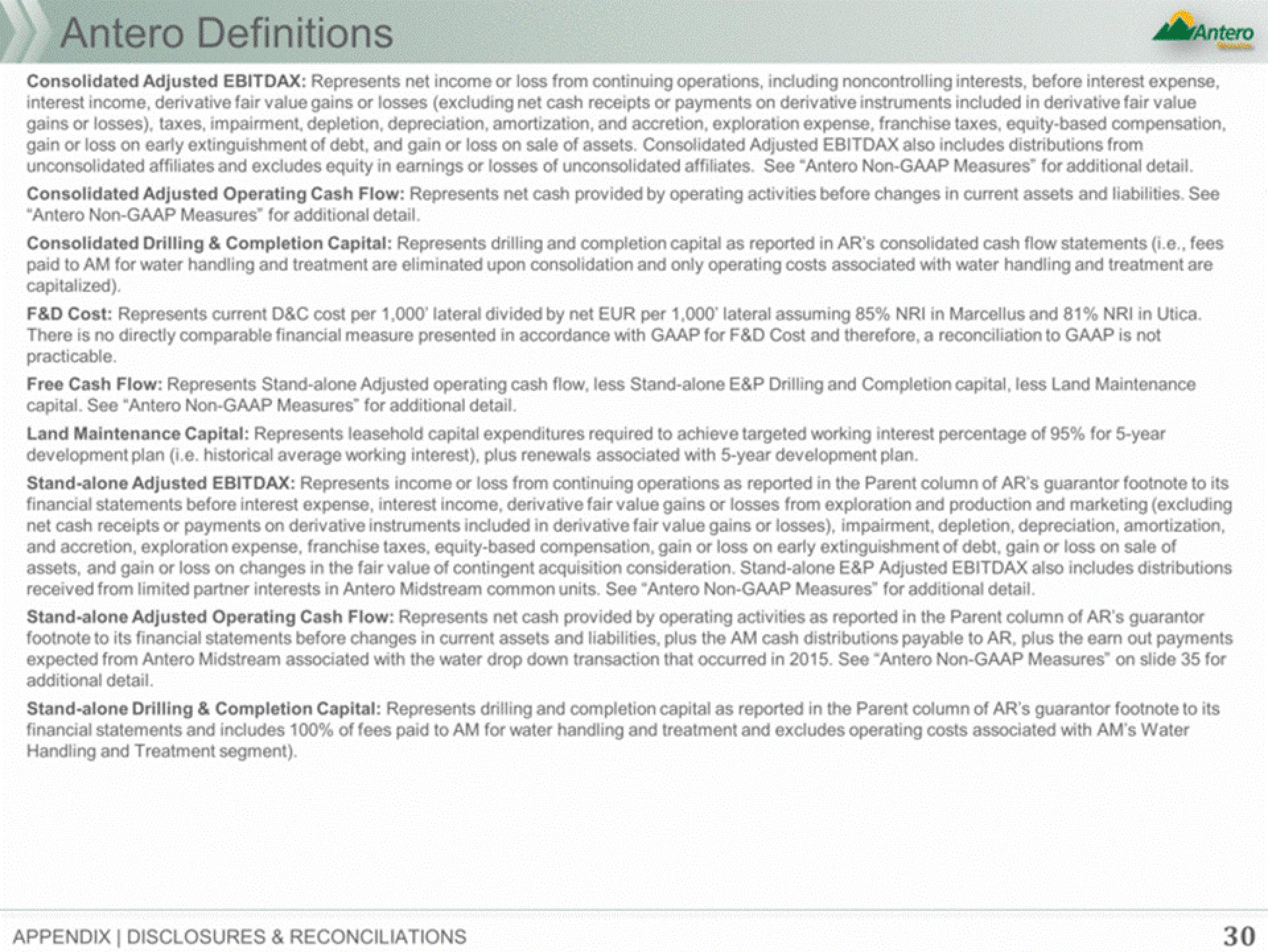

Consolidated Adjusted EBITDAX: Represents net income or loss from continuing operations, including noncontrolling interests, before interest expense,

interest income, derivative fair value gains or losses (excluding net cash receipts or payments on derivative instruments included in derivative fair value

gains or losses), taxes, impairment, depletion, depreciation, amortization, and accretion, exploration expense, franchise taxes, equity-based compensation,

gain or loss on early extinguishment of debt, and gain or loss on sale of assets. Consolidated Adjusted EBITDAX also includes distributions from

unconsolidated affiliates and excludes equity in earnings or losses of unconsolidated affiliates. See "Antero Non-GAAP Measures for additional detail.

Consolidated Adjusted Operating Cash Flow: Represents net cash provided by operating activities before changes in current assets and liabilities. See

"Antero Non-GAAP Measures" for additional detail.

Antero

Consolidated Drilling & Completion Capital: Represents drilling and completion capital as reported in AR's consolidated cash flow statements (i.e., fees

paid to AM for water handling and treatment are eliminated upon consolidation and only operating costs associated with water handling and treatment are

capitalized).

F&D Cost: Represents current D&C cost per 1,000 lateral divided by net EUR per 1,000 lateral assuming 85% NRI in Marcellus and 81% NRI in Utica.

There is no directly comparable financial measure presented in accordance with GAAP for F&D Cost and therefore, a reconciliation to GAAP is not

practicable.

Free Cash Flow: Represents Stand-alone Adjusted operating cash flow, less Stand-alone E&P Drilling and Completion capital, less Land Maintenance

capital. See "Antero Non-GAAP Measures for additional detail.

Land Maintenance Capital: Represents leasehold capital expenditures required to achieve targeted working interest percentage of 95% for 5-year

development plan (i.e. historical average working interest), plus renewals associated with 5-year development plan.

Stand-alone Adjusted EBITDAX: Represents income or loss from continuing operations as reported in the Parent column of AR's guarantor footnote to its

financial statements before interest expense, interest income, derivative fair value gains or losses from exploration and production and marketing (excluding

net cash receipts or payments on derivative instruments included in derivative fair value gains or losses), impairment, depletion, depreciation, amortization,

and accretion, exploration expense, franchise taxes, equity-based compensation, gain or loss on early extinguishment of debt, gain or loss on sale of

assets, and gain or loss on changes in the fair value of contingent acquisition consideration. Stand-alone E&P Adjusted EBITDAX also includes distributions

received from limited partner interests in Antero Midstream common units. See "Antero Non-GAAP Measures" for additional detail.

Stand-alone Adjusted Operating Cash Flow: Represents net cash provided by operating activities as reported in the Parent column of AR's guarantor

footnote to its financial statements before changes in current assets and liabilities, plus the AM cash distributions payable to AR, plus the earn out payments

expected from Antero Midstream associated with the water drop down transaction that occurred in 2015. See "Antero Non-GAAP Measures" on slide 35 for

additional detail.

Stand-alone Drilling & Completion Capital: Represents drilling and completion capital as reported in the Parent column of AR's guarantor footnote to its

financial statements and includes 100% of fees paid to AM for water handling and treatment and excludes operating costs associated with AM's Water

Handling and Treatment segment).

APPENDIX | DISCLOSURES & RECONCILIATIONS

30View entire presentation