Pathward Financial Results Presentation Deck

Summary Financial Results

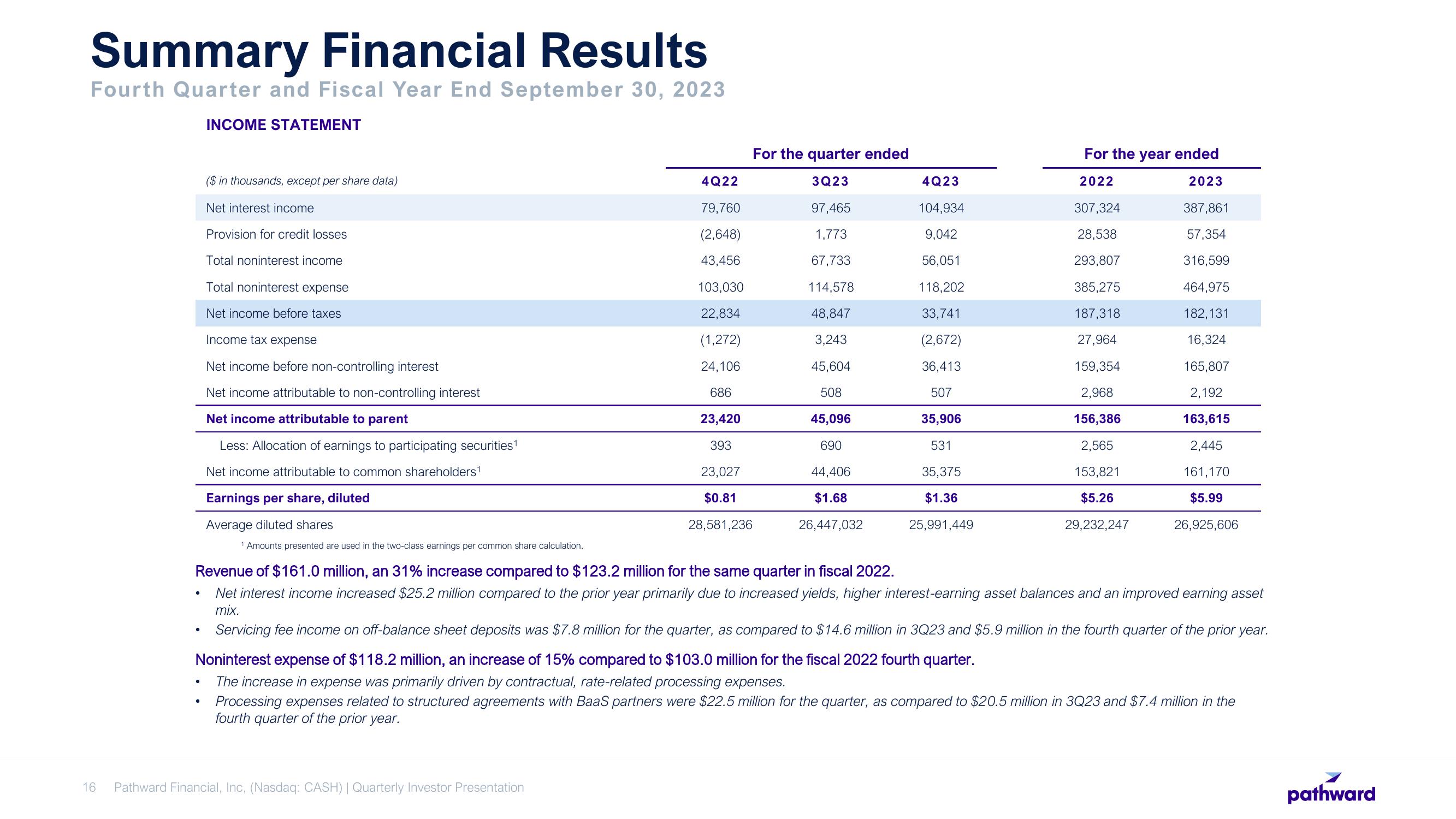

Fourth Quarter and Fiscal Year End September 30, 2023

INCOME STATEMENT

16

●

●

●

($ in thousands, except per share data)

Net interest income

Provision for credit losses

Total noninterest income

Total noninterest expense

Net income before taxes

●

Income tax expense

Net income before non-controlling interest

Net income attributable to non-controlling interest

Net income attributable to parent

Less: Allocation of earnings to participating securities¹

Net income attributable to common shareholders¹

Earnings per share, diluted

Average diluted shares

4Q22

79,760

(2,648)

43,456

103,030

22,834

(1,272)

24,106

686

23,420

393

23,027

$0.81

28,581,236

1 Amounts presented are used in the two-class earnings per common share calculation.

Revenue of $161.0 million, an 31% increase compared to $123.2 million for the same quarter in fiscal 2022.

Net interest income increased $25.2 million compared to the prior year primarily due to increased yields, higher interest-earning asset balances and an improved earning asset

mix.

Servicing fee income on off-balance sheet deposits was $7.8 million for the quarter, as compared to $14.6 million in 3Q23 and $5.9 million in the fourth quarter of the prior year.

Noninterest expense of $118.2 million, an increase of 15% compared to $103.0 million for the fiscal 2022 fourth quarter.

The increase in expense was primarily driven by contractual, rate-related processing expenses.

Processing expenses related to structured agreements with BaaS partners were $22.5 million for the

fourth quarter of the prior year.

Pathward Financial, Inc, (Nasdaq: CASH) | Quarterly Investor Presentation

For the quarter ended

3Q23

97,465

1,773

67,733

114,578

48,847

3,243

45,604

508

45,096

690

44,406

$1.68

26,447,032

4Q23

104,934

9,042

56,051

118,202

33,741

(2,672)

36,413

507

35,906

531

35,375

$1.36

25,991,449

For the year ended

2022

2023

387,861

57,354

316,599

464,975

182,131

16,324

165,807

2,192

163,615

2,445

161,170

$5.99

26,925,606

307,324

28,538

293,807

385,275

187,318

27,964

159,354

2,968

156,386

2,565

153,821

$5.26

29,232,247

ter, as compared to $20.5 million in 3Q23 and $7.4 million in the

pathwardView entire presentation