Trian Partners Activist Presentation Deck

(1)

Confidential-Not for Reproduction or Distribution

Disney Materially Overpaid For The Fox Assets

d

(7)

6

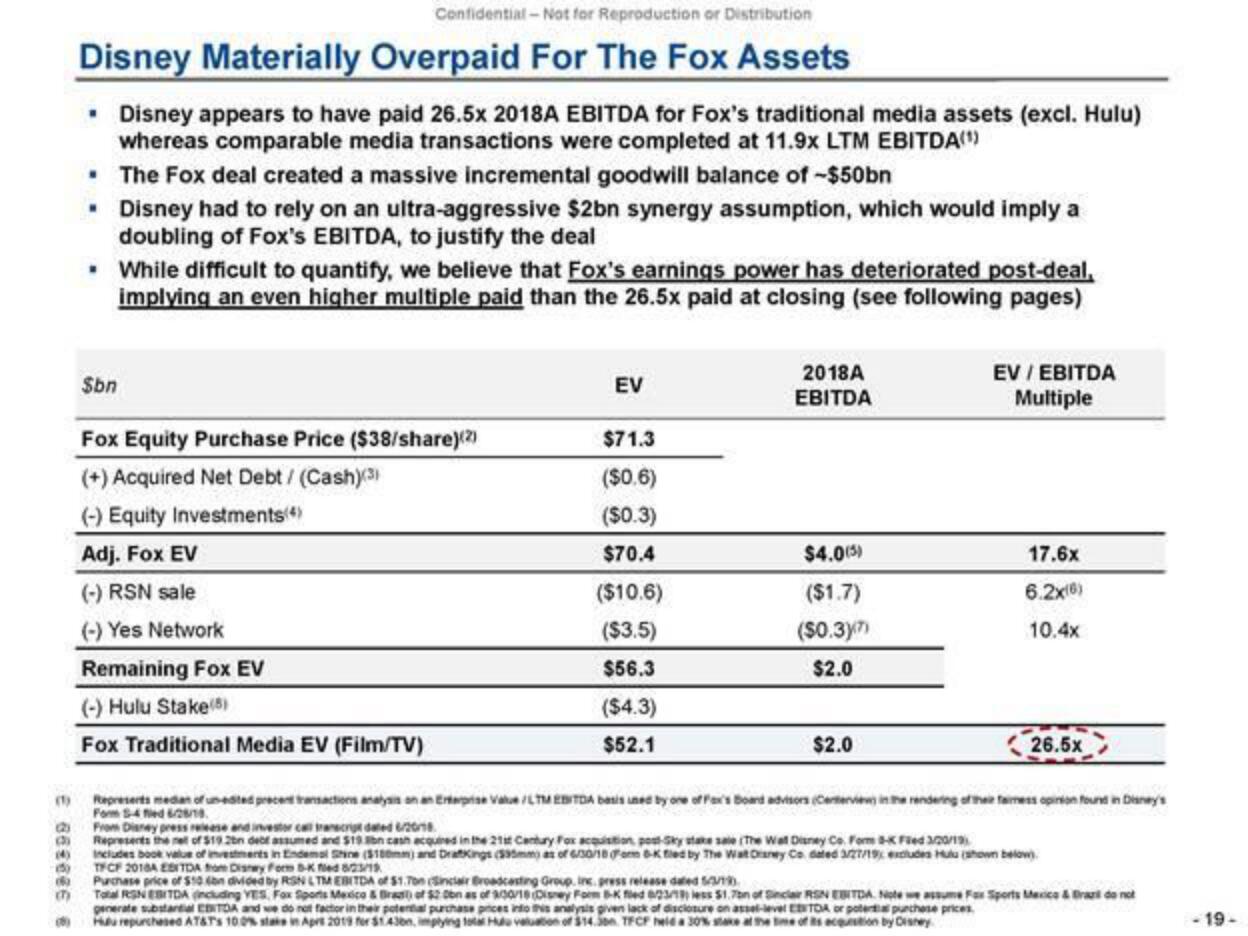

• Disney appears to have paid 26.5x 2018A EBITDA for Fox's traditional media assets (excl. Hulu)

whereas comparable media transactions were completed at 11.9x LTM EBITDA(¹)

• The Fox deal created a massive incremental goodwill balance of -$50bn

• Disney had to rely on an ultra-aggressive $2bn synergy assumption, which would imply a

doubling of Fox's EBITDA, to justify the deal

.

While difficult to quantify, we believe that Fox's earnings power has deteriorated post-deal,

implying an even higher multiple paid than the 26.5x paid at closing (see following pages)

Sbn

Fox Equity Purchase Price ($38/share)(2)

(+) Acquired Net Debt / (Cash)(3)

(-) Equity Investments(4)

Adj. Fox EV

(-) RSN sale

(-) Yes Network

Remaining Fox EV

(-) Hulu Stake(8)

Fox Traditional Media EV (Film/TV)

EV

$71.3

($0.6)

($0.3)

$70.4

($10.6)

($3.5)

$56.3

($4.3)

$52.1

2018A

EBITDA

TFCF 2018A EBITDA from Disney Form B-K fed 8/23/1

Purchase price of $10 on divided by RSN LTM EBITDA of $1.7bn Sinclair Broadcasting Group, Inc. press release dated 5/3/19)

$4.0(5)

($1.7)

($0.3)(7)

$2.0

4 26.5x

,

Represents median of un-edited precent transactions analysis on an Enterprise Value /LTM EBITDA basis uned by one of Fax's Board advisors (Centerview in the rendering of their faimess opinion found in Disney's

Form 5-4 fied 6/28/18

From Disney press release and investor call transcript dated 6/2018

Represents the net of $19.2bn dect assumed and $19 bn cash acquired in the 21st Century Fox acquisition post-Sky stake sale (The Walt Disney Co. Form 8-K Fied 3/20/19

(4) Includes book value of investments in Endemol Shine ($180mm) and DraftKings (35mm) as of 6/30/18 (Form 6-K filed by The Walt Disney Co. dated 3/27/19 excludes Hulu (shown below

EV / EBITDA

Multiple

$2.0

17.6x

6.2x(6)

10.4x

Total RN EBITDA (including YES, Fox Sports Mexico & Bras) of $2 Obn as of 900/18 (Disney Form 8-K fed 8/23/1 less $1.7on of Sinclair RSN EBITDA Note we assume Fox Sports Mexico & Bran do not

generate substantial EDITDA and we do not factor in their potential purchase prices into this analysis given lack of disclosure on assel-level EBITDA or potential purchase prices.

Huu repurchased AT&T's 100% state in Apr 2019 for $1.436n, implying total Hulu valuation of $14.30 TFCF held a 30% stake at the time of its acquisition by Disney

19-View entire presentation