NewFortress Energy 2Q23 Results

(in thousands of $)

Appendix

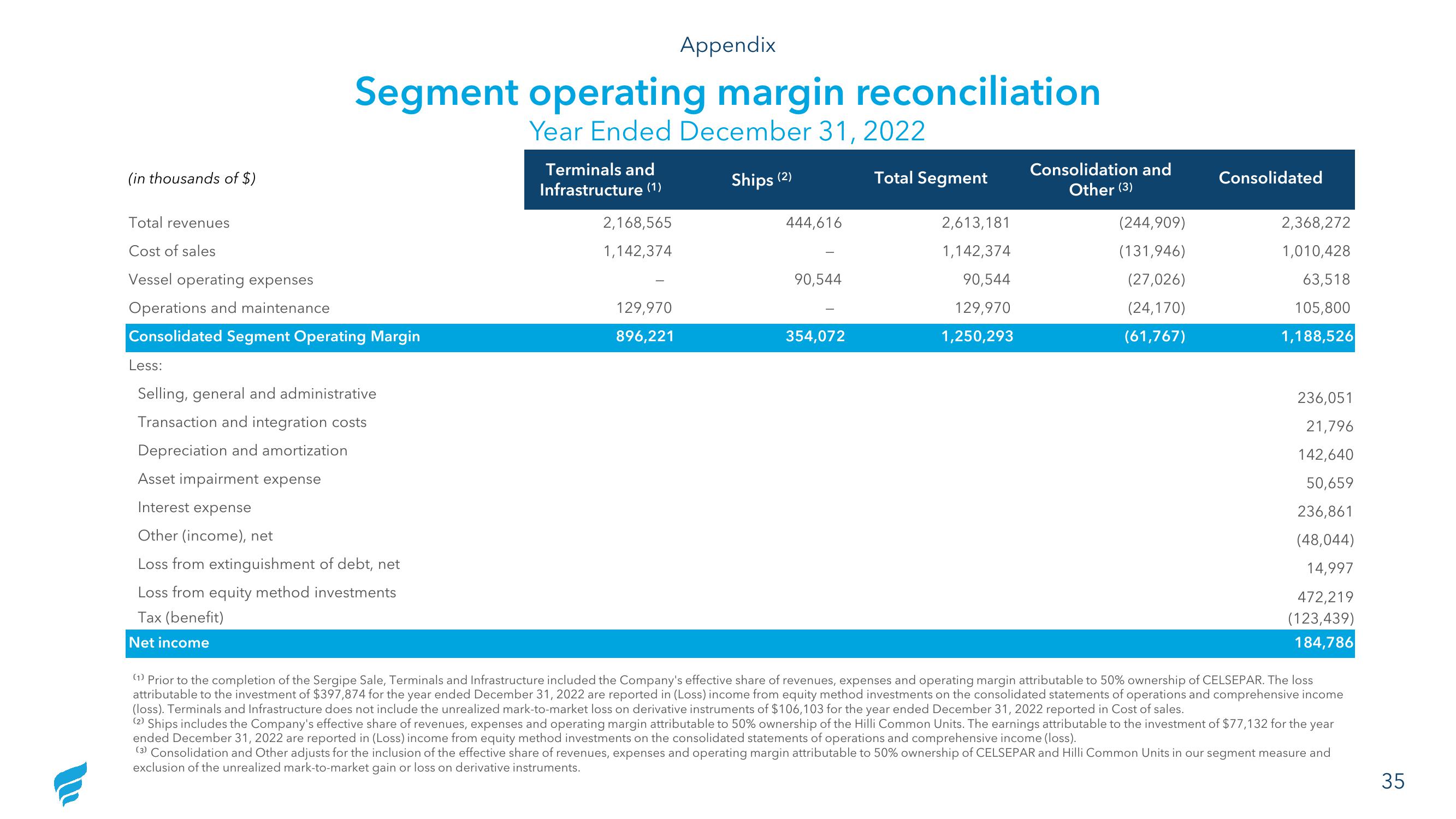

Segment operating margin reconciliation

Year Ended December 31, 2022

Ships (2)

Total revenues

Cost of sales

Vessel operating expenses

Operations and maintenance

Consolidated Segment Operating Margin

Less:

Selling, general and administrative

Transaction and integration costs

Depreciation and amortization

Asset impairment expense

Interest expense

Other (income), net

Loss from extinguishment of debt, net

Loss from equity method investments

Tax (benefit)

Net income

Terminals and

Infrastructure (1)

2,168,565

1,142,374

129,970

896,221

444,616

90,544

354,072

Total Segment

2,613,181

1,142,374

90,544

129,970

1,250,293

Consolidation and

Other (3)

(244,909)

(131,946)

(27,026)

(24,170)

(61,767)

Consolidated

2,368,272

1,010,428

63,518

105,800

1,188,526

236,051

21,796

142,640

50,659

236,861

(48,044)

14,997

472,219

(123,439)

184,786

(1) Prior to the completion of the Sergipe Sale, Terminals and Infrastructure included the Company's effective share of revenues, expenses and operating margin attributable to 50% ownership of CELSEPAR. The loss

attributable to the investment of $397,874 for the year ended December 31, 2022 are reported in (Loss) income from equity method investments on the consolidated statements of operations and comprehensive income

(loss). Terminals and Infrastructure does not include the unrealized mark-to-market loss on derivative instruments of $106,103 for the year ended December 31, 2022 reported in Cost of sales.

(2) Ships includes the Company's effective share of revenues, expenses and operating margin attributable to 50% ownership of the Hilli Common Units. The earnings attributable to the investment of $77,132 for the year

ended December 31, 2022 are reported in (Loss) income from equity method investments on the consolidated statements of operations and comprehensive income (loss).

(3) Consolidation and Other adjusts for the inclusion of the effective share of revenues, expenses and operating margin attributable to 50% ownership of CELSEPAR and Hilli Common Units in our segment measure and

exclusion of the unrealized mark-to-market gain or loss on derivative instruments.

35View entire presentation