J.P.Morgan Results Presentation Deck

JPMORGAN CHASE & CO.

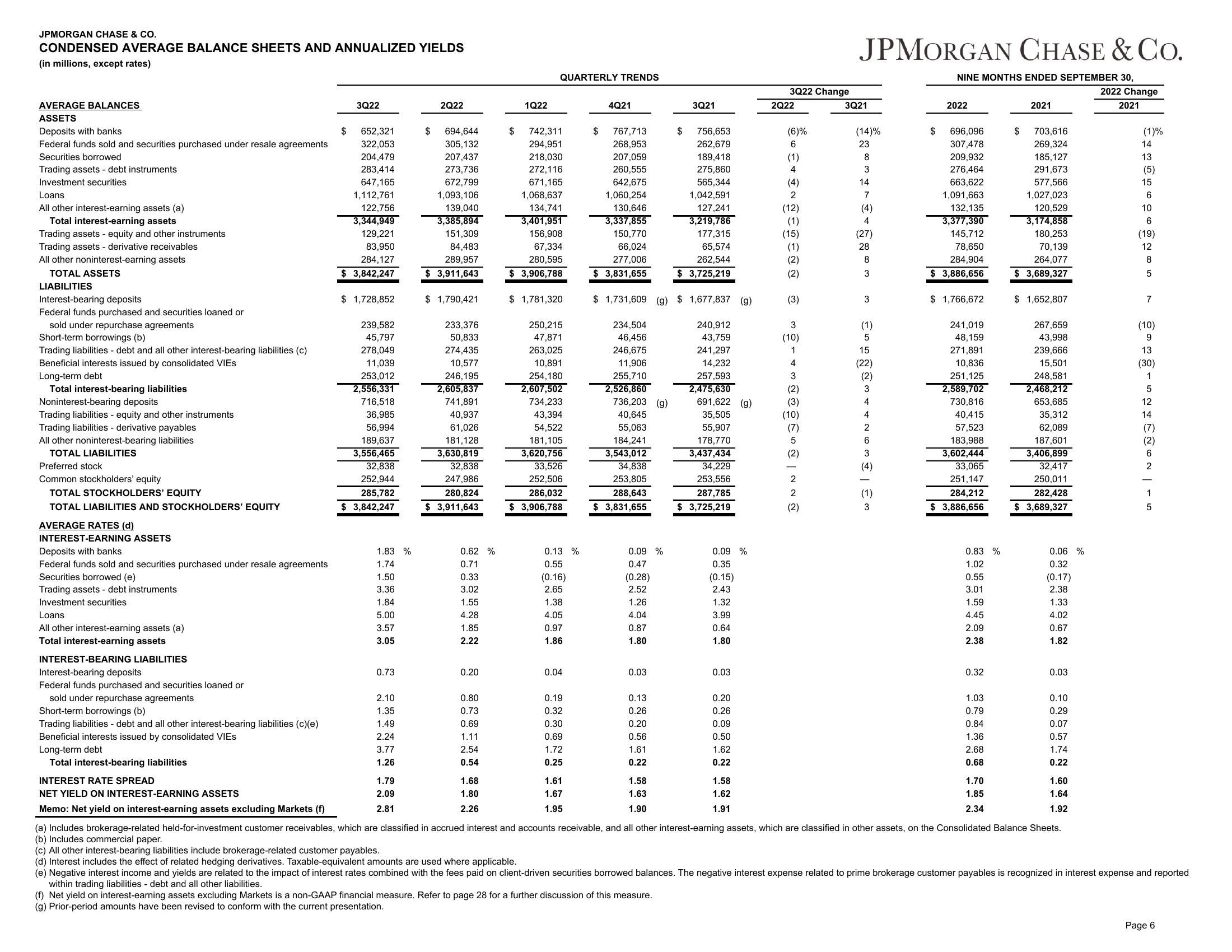

CONDENSED AVERAGE BALANCE SHEETS AND ANNUALIZED YIELDS

(in millions, except rates)

AVERAGE BALANCES

ASSETS

Deposits with banks

Federal funds sold and securities purchased under resale agreements

Securities borrowed

Trading assets - debt instruments

Investment securities

Loans

All other interest-earning assets (a)

Total interest-earning assets

Trading assets - equity and other instruments

Trading assets - derivative receivables

All other noninterest-earning assets

TOTAL ASSETS

LIABILITIES

Interest-bearing deposits

Federal funds purchased and securities loaned or

sold under repurchase agreements

Short-term borrowings (b)

Trading liabilities - debt and all other interest-bearing liabilities (c)

Beneficial interests issued by consolidated VIES

Long-term debt

Total interest-bearing liabilities

Noninterest-bearing deposits

Trading liabilities - equity and other instruments

Trading liabilities - derivative payables

All other noninterest-bearing liabilities

TOTAL LIABILITIES

Preferred stock

Common stockholders' equity

TOTAL STOCKHOLDERS' EQUITY

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

AVERAGE RATES (d)

INTEREST-EARNING ASSETS

Deposits with banks

Federal funds sold and securities purchased under resale agreements

Securities borrowed (e)

Trading assets - debt instruments

Investment securities

Loans

All other interest-earning assets (a)

Total interest-earning assets

INTEREST-BEARING LIABILITIES

Interest-bearing deposits

Federal funds purchased and securities loaned or

sold under repurchase agreements

Short-term borrowings (b)

Trading liabilities - debt and all other interest-bearing liabilities (c)(e)

Beneficial interests issued by consolidated VIES

Long-term debt

Total interest-bearing liabilities

INTEREST RATE SPREAD

NET YIELD ON INTEREST-EARNING ASSETS

Memo: Net yield on interest-earning assets excluding Markets (f)

$

3Q22

652,321

322,053

204,479

283,414

647,165

1,112,761

122,756

3,344,949

129,221

83,950

284,127

$ 3,842,247

$ 1,728,852

239,582

45,797

278,049

11,039

253,012

2,556,331

716,518

36,985

56,994

189,637

3,556,465

32,838

252,944

285,782

$ 3,842,247

1.83 %

1.74

1.50

3.36

1.84

5.00

3.57

3.05

0.73

2.10

1.35

1.49

2.24

3.77

1.26

1.79

2.09

2.81

$

2Q22

694,644

305,132

207,437

273,736

672,799

1,093,106

139,040

3,385,894

151,309

84,483

289,957

$ 3,911,643

$ 1,790,421

233,376

50,833

274,435

10,577

246,195

2,605,837

741,891

40,937

61,026

181,128

3,630,819

32,838

247,986

280,824

$ 3,911,643

0.62 %

0.71

0.33

3.02

1.55

4.28

1.85

2.22

0.20

0.80

0.73

0.69

1.11

2.54

0.54

1.68

1.80

2.26

1Q22

$

QUARTERLY TRENDS

742,311

294,951

218,030

272,116

671,165

1,068,637

134,741

3,401,951

156,908

67,334

280,595

$ 3,906,788

$ 1,781,320

250,215

47,871

263,025

10,891

254,180

2,607,502

734,233

43,394

54,522

181,105

3,620,756

33,526

252,506

286,032

$ 3,906,788

0.13%

0.55

(0.16)

2.65

1.38

4.05

0.97

1.86

0.04

0.19

0.32

0.30

0.69

1.72

0.25

1.61

1.67

1.95

4Q21

$

767,713

268,953

207,059

260,555

642,675

1,060,254

130,646

3,337,855

150,770

66,024

277,006

$ 3,831,655

736,203 (g)

40,645

55,063

184,241

3,543,012

34,838

253,805

288,643

$ 3,831,655

0.09 %

0.47

$ 1,731,609 (g) $ 1,677,837 (g)

234,504

46,456

246,675

240,912

43,759

241,297

14,232

257,593

2,475,630

11,906

255,710

2,526,860

(0.28)

2.52

1.26

4.04

0.87

1.80

0.03

0.13

0.26

0.20

0.56

1.61

0.22

1.58

1.63

1.90

3Q21

$

756,653

262,679

189,418

275,860

565,344

1,042,591

127,241

3,219,786

177,315

65,574

262,544

$ 3,725,219

691,622 (g)

35,505

55,907

178,770

3,437,434

34,229

253,556

287,785

$ 3,725,219

0.09 %

0.35

(0.15)

2.43

1.32

3.99

0.64

1.80

0.03

0.20

0.26

0.09

0.50

1.62

0.22

1.58

1.62

1.91

3Q22 Change

2Q22

(6)%

6

(1)

4

* -ENN

(4)

(12)

(1)

(15)

(2)

(2)

(3)

(10)

(2)

(10)

(2)

(2)

JPMORGAN CHASE & CO.

NINE MONTHS ENDED SEPTEMBER 30,

3Q21

(14)%

23

8

3

14

7

(4)

4

(27)

28

8

3

3

WEIE WONA AWNN GGE

(22)

$

2022

696,096

307,478

209,932

276,464

663,622

1,091,663

132,135

3,377,390

145,712

78,650

284,904

$ 3,886,656

$ 1,766,672

241,019

48,159

271,891

10,836

251,125

2,589,702

730,816

40,415

57,523

183,988

3,602,444

33,065

251,147

284,212

$ 3,886,656

0.83 %

1.02

0.55

3.01

1.59

4.45

2.09

2.38

0.32

1.03

0.79

0.84

1.36

2.68

0.68

1.70

1.85

2.34

$

2021

703,616

269,324

185,127

291,673

577,566

1,027,023

120,529

3,174,858

180,253

70,139

264,077

$ 3,689,327

$1,652,807

267,659

43,998

239,666

15,501

248,581

2,468,212

653,685

35,312

62,089

187,601

3,406,899

32,417

250,011

282,428

$ 3,689,327

0.06 %

0.32

(0.17)

2.38

1.33

4.02

0.67

1.82

0.03

0.10

0.29

0.07

0.57

1.74

0.22

1.60

1.64

1.92

(a) Includes brokerage-related held-for-investment customer receivables, which are classified in accrued interest and accounts receivable, and all other interest-earning assets, which are classified in other assets, on the Consolidated Balance Sheets.

(b) Includes commercial paper.

2022 Change

2021

(1)%

០៣ លឺ ១៩ ១ ហិ ច ៨

(19)

7

(10)

(30)

G| NONANG-

(c) All other interest-bearing liabilities include brokerage-related customer payables.

(d) Interest includes the effect of related hedging derivatives. Taxable-equivalent amounts are used where applicable.

(e) Negative interest income and yields are related to the impact of interest rates combined with the fees paid on client-driven securities borrowed balances. The negative interest expense related to prime brokerage customer payables is recognized in interest expense and reported

within trading liabilities - debt and all other liabilities.

(f) Net yield on interest-earning assets excluding Markets is a non-GAAP financial measure. Refer to page 28 for a further discussion of this measure.

(g) Prior-period amounts have been revised to conform with the current presentation.

Page 6View entire presentation