Trian Partners Activist Presentation Deck

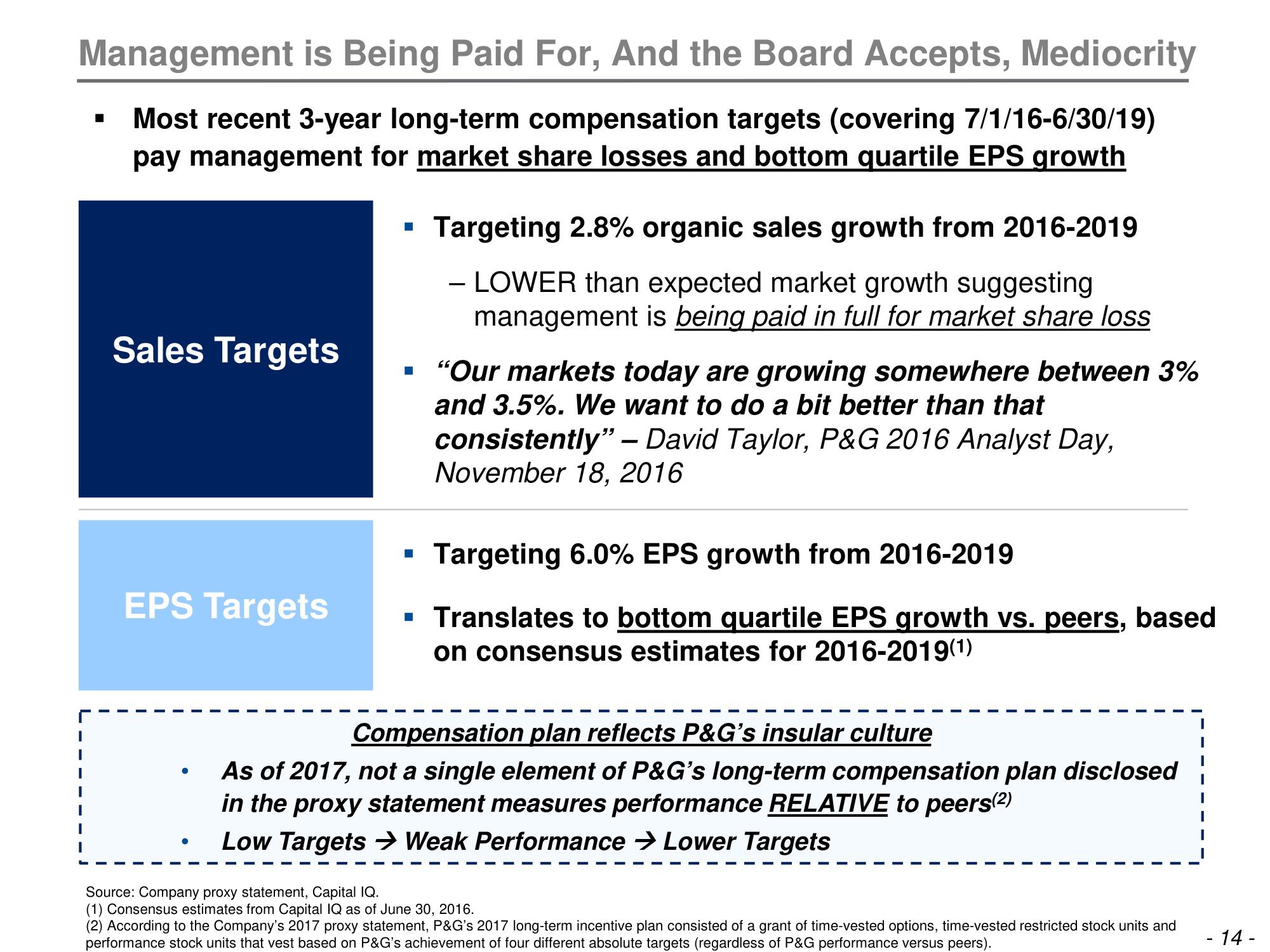

Management is Being Paid For, And the Board Accepts, Mediocrity

Most recent 3-year long-term compensation targets (covering 7/1/16-6/30/19)

pay management for market share losses and bottom quartile EPS growth

■

Sales Targets

EPS Targets

●

■

Targeting 2.8% organic sales growth from 2016-2019

- LOWER than expected market growth suggesting

management is being paid in full for market share loss

"Our markets today are growing somewhere between 3%

and 3.5%. We want to do a bit better than that

consistently" - David Taylor, P&G 2016 Analyst Day,

November 18, 2016

Targeting 6.0% EPS growth from 2016-2019

▪ Translates to bottom quartile EPS growth vs. peers, based

on consensus estimates for 2016-2019(1)

Compensation plan reflects P&G's insular culture

As of 2017, not a single element of P&G's long-term compensation plan disclosed

in the proxy statement measures performance RELATIVE to peers(²)

Low Targets Weak Performance → Lower Targets

Source: Company proxy statement, Capital IQ.

(1) Consensus estimates from Capital IQ as of June 30, 2016.

(2) According to the Company's 2017 proxy statement, P&G's 2017 long-term incentive plan consisted of a grant of time-vested options, time-vested restricted stock units and

performance stock units that vest based on P&G's achievement of four different absolute targets (regardless of P&G performance versus peers).

- 14 -View entire presentation