Blackwells Capital Activist Presentation Deck

■

■

I

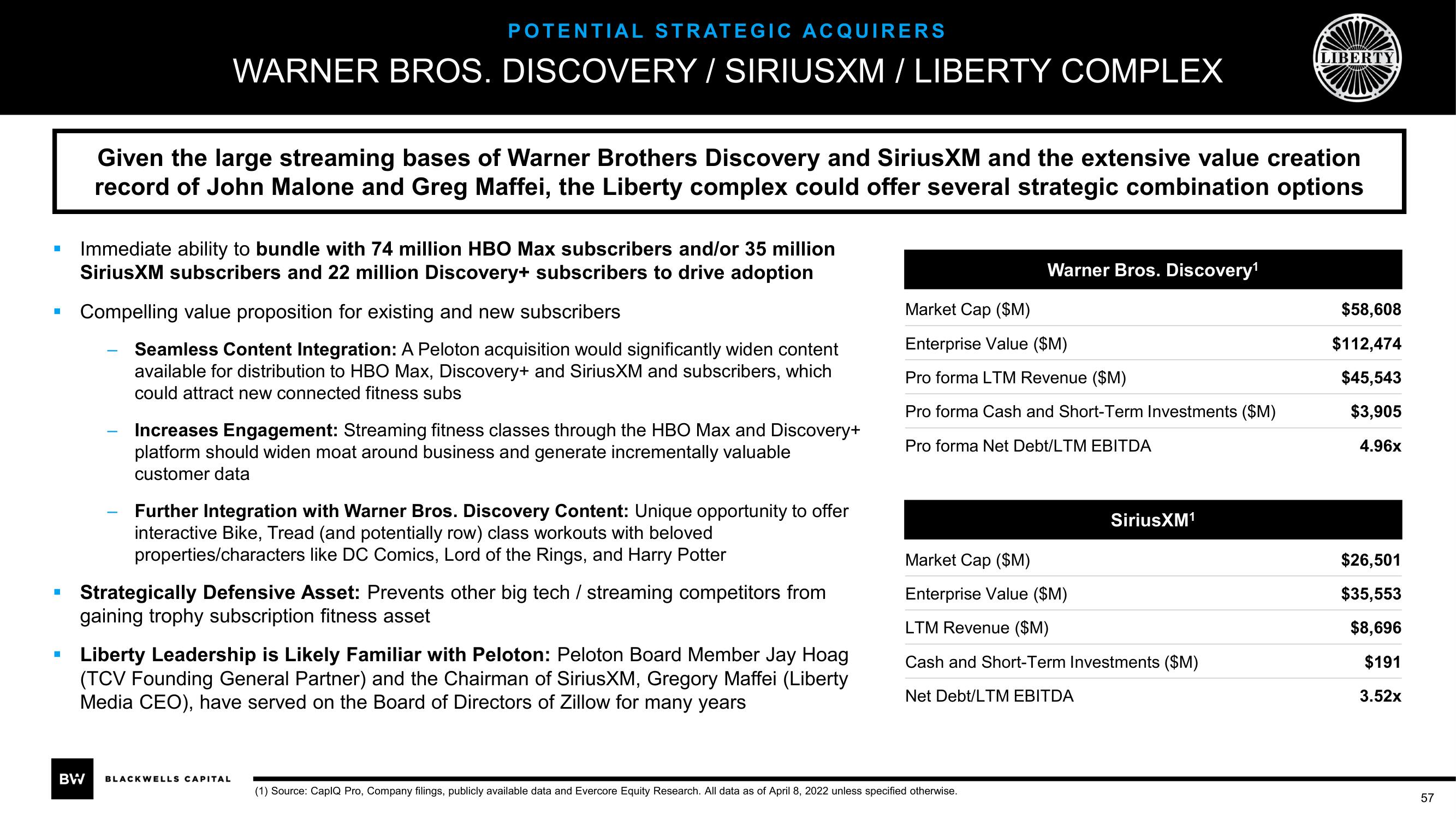

POTENTIAL STRATEGIC ACQUIRERS

WARNER BROS. DISCOVERY / SIRIUSXM/LIBERTY COMPLEX

Given the large streaming bases of Warner Brothers Discovery and SiriusXM and the extensive value creation

record of John Malone and Greg Maffei, the Liberty complex could offer several strategic combination options

Immediate ability to bundle with 74 million HBO Max subscribers and/or 35 million

SiriusXM subscribers and 22 million Discovery+ subscribers to drive adoption

Compelling value proposition for existing and new subscribers

Seamless Content Integration: A Peloton acquisition would significantly widen content

available for distribution to HBO Max, Discovery+ and SiriusXM and subscribers, which

could attract new connected fitness subs

-

Increases Engagement: Streaming fitness classes through the HBO Max and Discovery+

platform should widen moat around business and generate incrementally valuable

customer data

Further Integration with Warner Bros. Discovery Content: Unique opportunity to offer

interactive Bike, Tread (and potentially row) class workouts with beloved

properties/characters like DC Comics, Lord of the Rings, and Harry Potter

Strategically Defensive Asset: Prevents other big tech / streaming competitors from

gaining trophy subscription fitness asset

Liberty Leadership is Likely Familiar with Peloton: Peloton Board Member Jay Hoag

(TCV Founding General Partner) and the Chairman of SiriusXM, Gregory Maffei (Liberty

Media CEO), have served on the Board of Directors of Zillow for many years

BW BLACKWELLS CAPITAL

Warner Bros. Discovery¹

Market Cap ($M)

Enterprise Value ($M)

Pro forma LTM Revenue ($M)

Pro forma Cash and Short-Term Investments ($M)

Pro forma Net Debt/LTM EBITDA

(1) Source: CapIQ Pro, Company filings, publicly available data and Evercore Equity Research. All data as of April 8, 2022 unless specified otherwise.

SiriusXM¹

Market Cap ($M)

Enterprise Value ($M)

LTM Revenue ($M)

Cash and Short-Term Investments ($M)

Net Debt/LTM EBITDA

LIBERTY

$58,608

$112,474

$45,543

$3,905

4.96x

$26,501

$35,553

$8,696

$191

3.52x

57View entire presentation