Nexters Results Presentation Deck

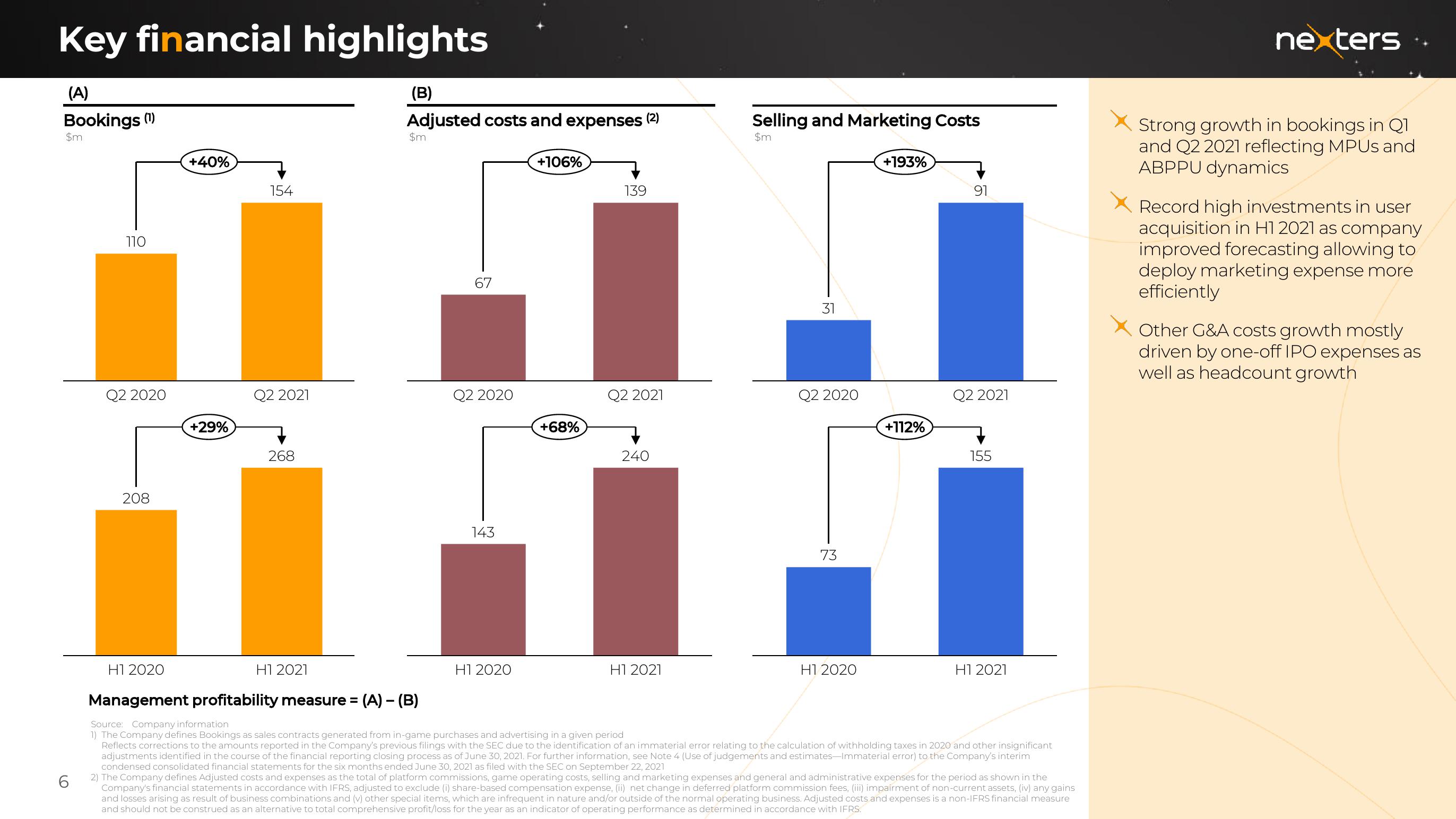

Key financial highlights

(A)

Bookings (¹)

$m

LO

6

110

Q2 2020

208

+40%

+29%

154

Q2 2021

268

H1 2021

(B)

Adjusted costs and expenses (2)

$m

67

Q2 2020

143

H1 2020

+106%

+68%

139

Q2 2021

240

H1 2021

Selling and Marketing Costs

$m

31

Q2 2020

73

H1 2020

+193%

+112%

91

HT 2020

Management profitability measure = (A) - (B)

Source: Company information

1) The Company defines Bookings as sales contracts generated from in-game purchases and advertising in a given period

Reflects corrections to the amounts reported in the Company's previous filings with the SEC due to the identification of an immaterial error relating to the calculation of withholding taxes in 2020 and other insignificant

adjustments identified in the course of the financial reporting closing process as of June 30, 2021. For further information, see Note 4 (Use of judgements and estimates-Immaterial error) to the Company's interim

condensed consolidated financial statements for the six months ended June 30, 2021 as filed with the SEC on September 22, 2021

Q2 2021

155

H1 2021

2) The Company defines Adjusted costs and expenses as the total of platform commissions, game operating costs, selling and marketing expenses and general and administrative expenses for the period as shown in the

Company's financial statements in accordance with IFRS, adjusted to exclude (i) share-based compensation expense, (ii) net change in deferred platform commission fees, (iii) impairment of non-current assets, (iv) any gains

and losses arising as result of business combinations and (v) other special items, which are infrequent in nature and/or outside of the normal operating business. Adjusted costs and expenses is a non-IFRS financial measure

and should not be construed as an alternative to total comprehensive profit/loss for the year as an indicator of operating performance as determined in accordance with IFRS.

nexters

Strong growth in bookings in Q1

and Q2 2021 reflecting MPUs and

ABPPU dynamics

Record high investments in user

acquisition in H1 2021 as company

improved forecasting allowing to

deploy marketing expense more

efficiently

Other G&A costs growth mostly

driven by one-off IPO expenses as

well as headcount growthView entire presentation