Evercore Investment Banking Pitch Book

Why Evercore?

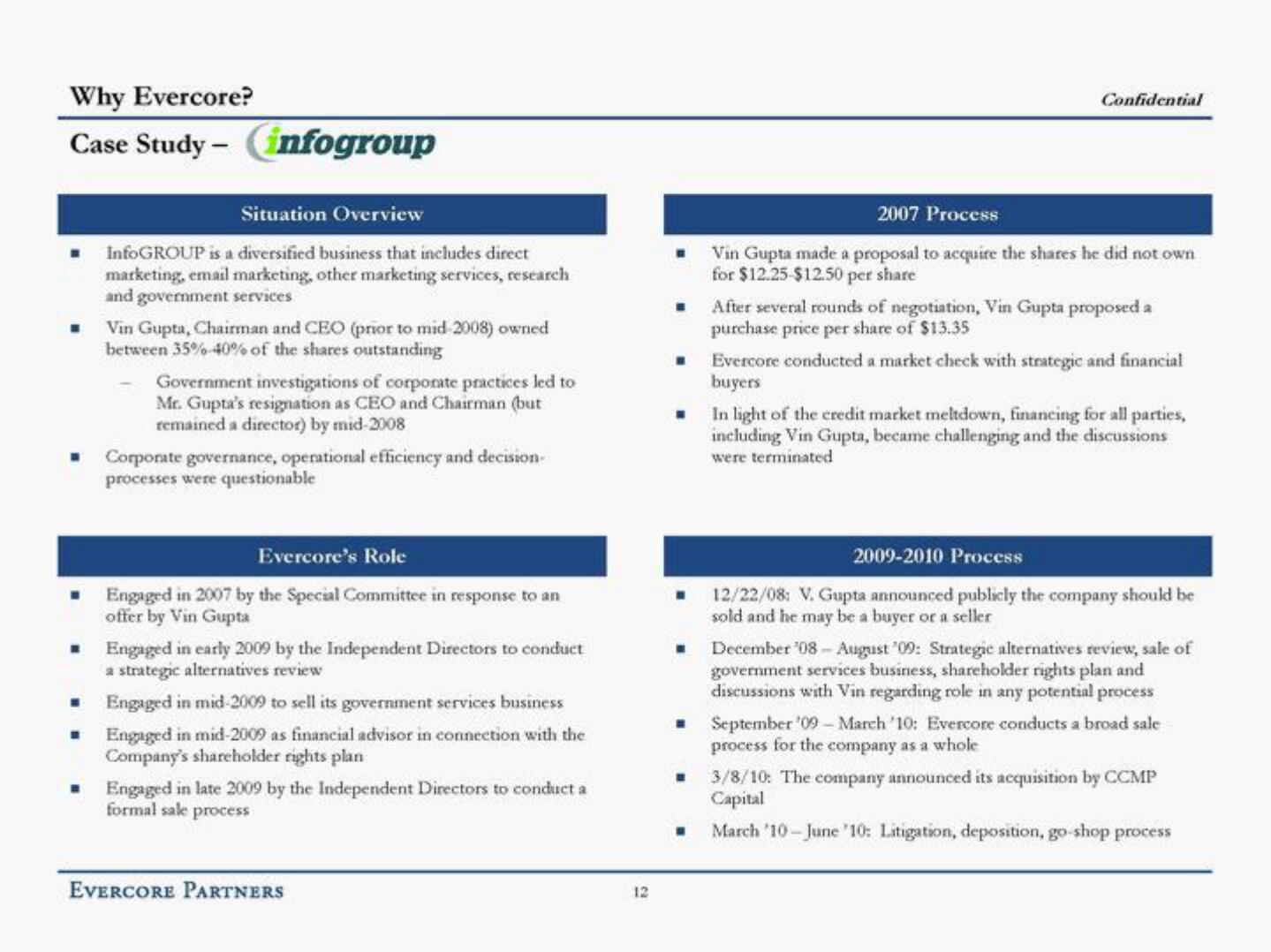

Case Study - infogroup

Situation Overview

InfoGROUP is a diversified business that includes direct

marketing, email marketing, other marketing services, research

and government services

Vin Gupta, Chairman and CEO (prior to mid 2008) owned

between 35%-40% of the shares outstanding

Government investigations of corporate practices led to

Mr. Gupta's resignation as CEO and Chairman (but

remained a director) by mid-2008

Corporate governance, operational efficiency and decision-

processes were questionable

Evercore's Role

Engaged in 2007 by the Special Committee in response to an

offer by Vin Gupta

■

■ Engaged in mid-2009 to sell its government services business

■

Engaged in mid-2009 as financial advisor in connection with the

Company's shareholder rights plan

Engaged in early 2009 by the Independent Directors to conduct

a strategic alternatives review

Engaged in late 2009 by the Independent Directors to conduct a

formal sale process

EVERCORE PARTNERS

12

Confidential

M

2007 Process

Vin Gupta made a proposal to acquire the shares he did not own

for $12.25-$12.50 per share

■ After several rounds of negotiation, Vin Gupta proposed a

purchase price per share of $13.35

Evercore conducted a market check with strategic and financial

buyers

In light of the credit market meltdown, financing for all parties,

including Vin Gupta, became challenging and the discussions

were terminated

2009-2010 Process

12/22/08: V. Gupta announced publicly the company should be

sold and he may be a buyer or a seller

December '08-August '09: Strategic alternatives review, sale of

government services business, shareholder rights plan and

discussions with Vin regarding role in any potential process

September '09 - March '10: Evercore conducts a broad sale

process for the company as a whole

3/8/10: The company announced its acquisition by CCMP

Capital

March '10-June '10: Litigation, deposition, go-shop processView entire presentation