Allwyn Results Presentation Deck

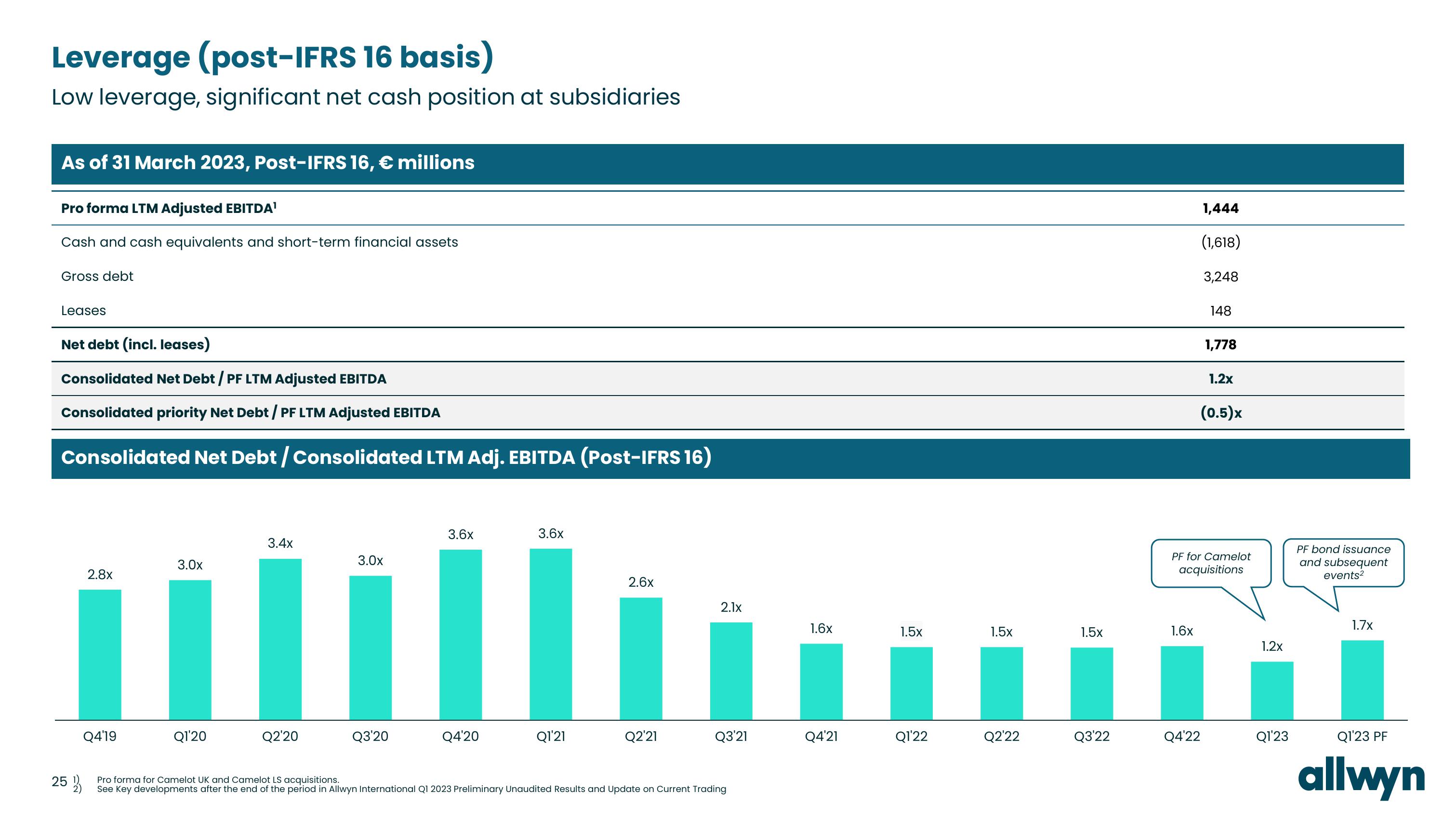

Leverage (post-IFRS 16 basis)

Low leverage, significant net cash position at subsidiaries

As of 31 March 2023, Post-IFRS 16, € millions

Pro forma LTM Adjusted EBITDA¹

Cash and cash equivalents and short-term financial assets

Gross debt

Leases

Net debt (incl. leases)

Consolidated Net Debt / PF LTM Adjusted EBITDA

Consolidated priority Net Debt / PF LTM Adjusted EBITDA

Consolidated Net Debt / Consolidated LTM Adj. EBITDA (Post-IFRS 16)

25

23

2.8x

Q4'19

3.0x

Q1'20

3.4x

Q2'20

3.0x

Q3'20

3.6x

Q4'20

3.6x

Q1'21

2.6x

Q2'21

2.1x

Q3'21

Pro forma for Camelot UK and Camelot LS acquisitions.

See Key developments after the end of the period in Allwyn International Q1 2023 Preliminary Unaudited Results and Update on Current Trading

1.6x

Q4'21

1.5x

Q1'22

1.5x

Q2'22

1.5x

Q3'22

1.6x

1,444

(1,618)

3,248

Q4'22

148

1,778

1.2x

(0.5)x

PF for Camelot

acquisitions

1.2x

Q1'23

PF bond issuance

and subsequent

events²

1.7x

Q1'23 PF

allwynView entire presentation