Investor Presentation

INTRO

ENERGY EVOLUTION

NATURAL RESOURCES

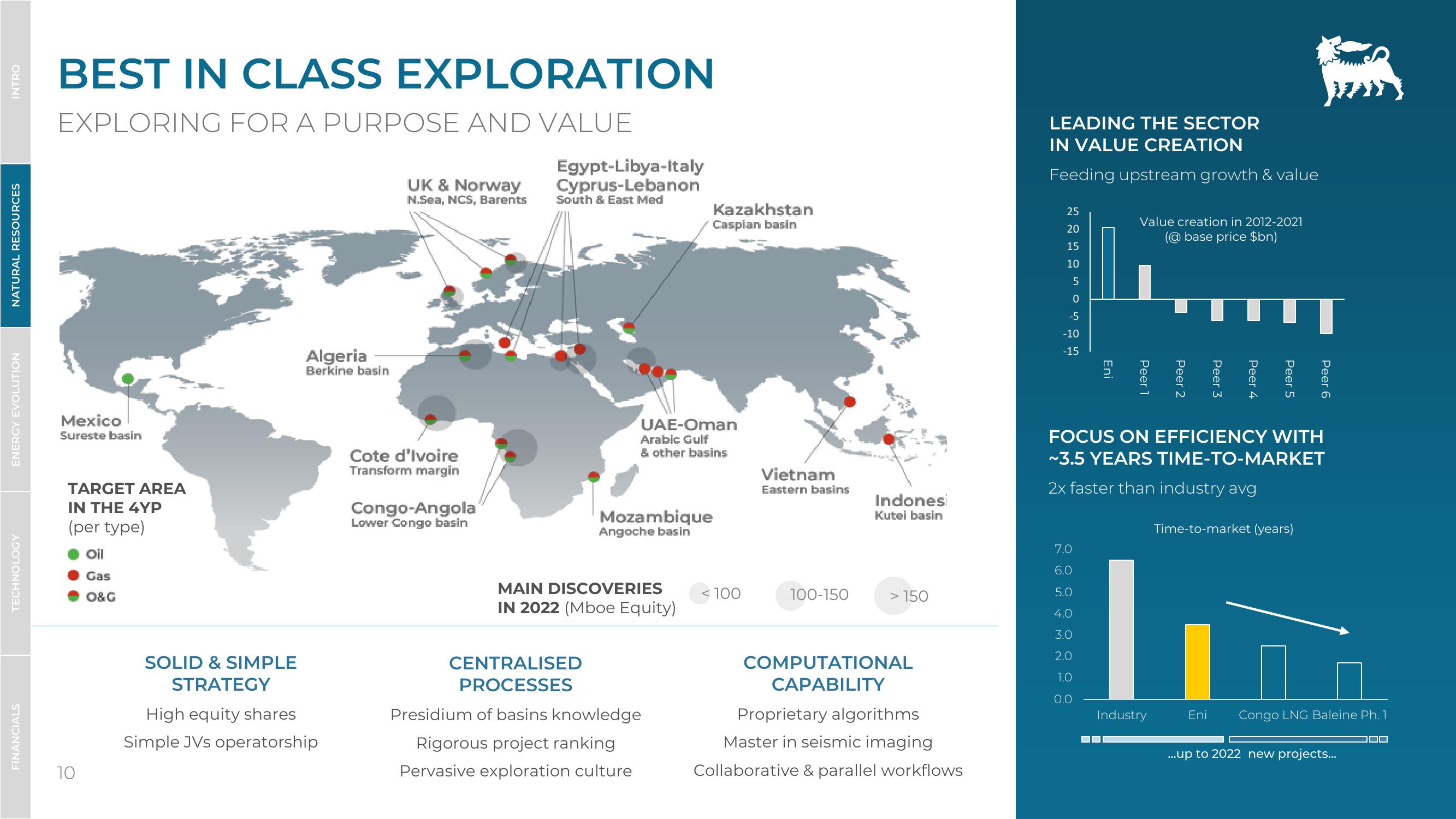

BEST IN CLASS EXPLORATION

EXPLORING FOR A PURPOSE AND VALUE

UK & Norway

N.Sea, NCS, Barents

Egypt-Libya-Italy

Cyprus-Lebanon

South & East Med

Kazakhstan

Caspian basin

FINANCIALS

TECHNOLOGY

Algeria

Berkine basin

Mexico

Sureste basin

TARGET AREA

IN THE 4YP

(per type)

Oil

Gas

Cote d'Ivoire

Transform margin

Congo-Angola

Lower Congo basin

UAE-Oman

Arabic Gulf

& other basins

Mozambique

Angoche basin

10

O&G

Vietnam

Eastern basins

LEADING THE SECTOR

IN VALUE CREATION

Feeding upstream growth & value

15

10

225250524

-5

-10

-15

Eni

Value creation in 2012-2021

(@base price $bn)

Peer 1

Peer 2

Peer 6

Peer 5

Peer 4

Peer 3

FOCUS ON EFFICIENCY WITH

~3.5 YEARS TIME-TO-MARKET

2x faster than industry avg

Time-to-market (years)

Indones

Kutel basin

7.0

6.0

MAIN DISCOVERIES

IN 2022 (Mboe Equity)

< 100

100-150

> 150

5.0

4.0

SOLID & SIMPLE

STRATEGY

High equity shares

Simple JVs operatorship

CENTRALISED

PROCESSES

Presidium of basins knowledge

Rigorous project ranking

Pervasive exploration culture

COMPUTATIONAL

CAPABILITY

Proprietary algorithms

Master in seismic imaging

Collaborative & parallel workflows

3.0

2.0

ON WA UO2

0.0

Industry

Eni

Congo LNG Baleine Ph. 1

...up to 2022 new projects...View entire presentation