Maersk Investor Presentation Deck

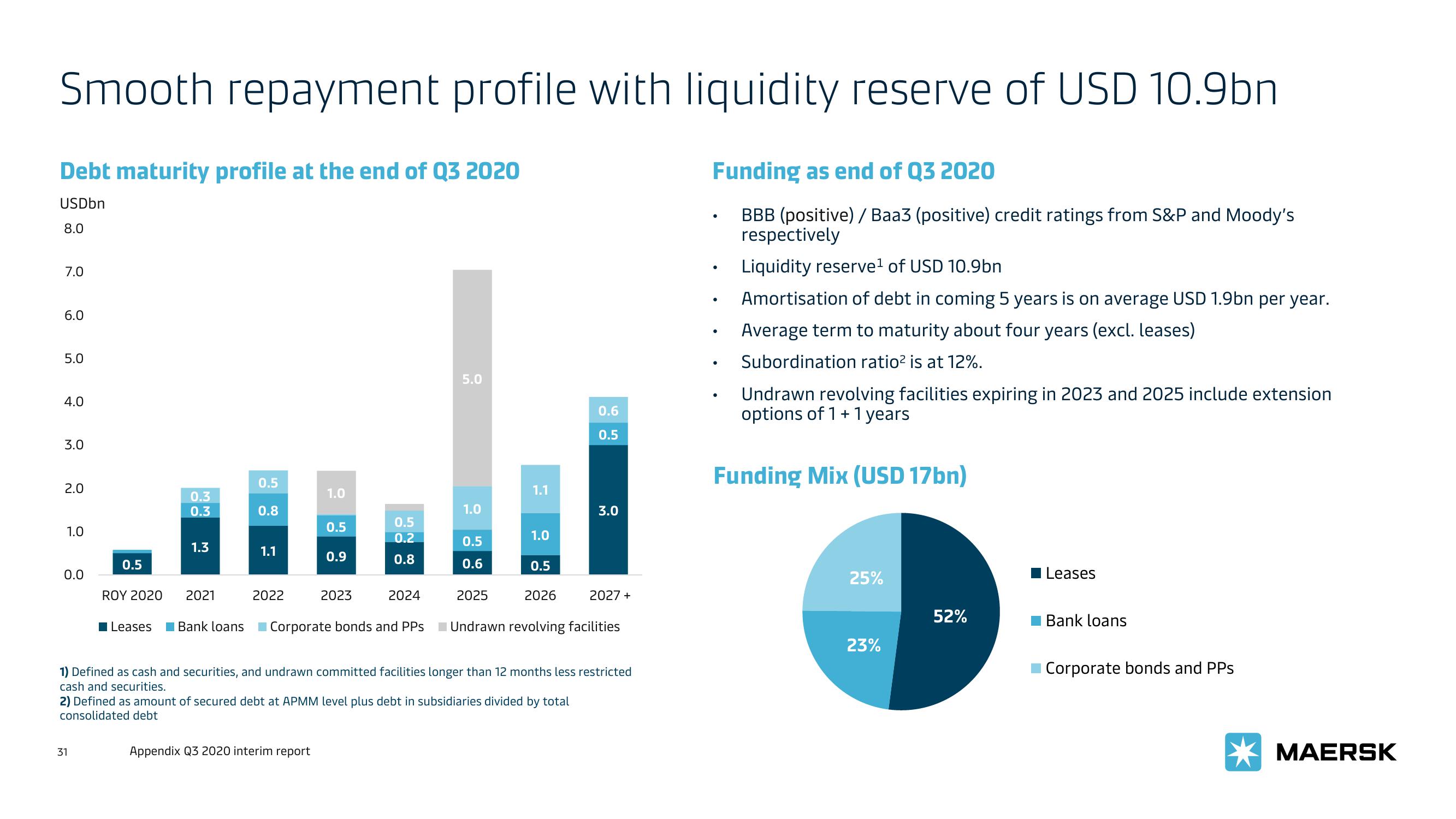

Smooth repayment profile with liquidity reserve of USD 10.9bn

Debt maturity profile at the end of Q3 2020

USDbn

8.0

7.0

6.0

5.0

4.0

3.0

2.0

1.0

0.0

0.5

31

0.3

0.3

Leases

1.3

ROY 2020 2021

0.5

0.8

1.1

2022

1.0

0.5

0.9

Appendix Q3 2020 interim report

2023

0.5

0.2

0.8

2024

Bank loans Corporate bonds and PPs

5.0

1.0

0.5

0.6

2025

1.1

1.0

0.5

2026

2) Defined as amount of secured debt at APMM level plus debt in subsidiaries divided by total

consolidated debt

0.6

0.5

3.0

1) Defined as cash and securities, and undrawn committed facilities longer than 12 months less restricted

cash and securities.

2027 +

Undrawn revolving facilities

Funding as end of Q3 2020

BBB (positive) / Baa3 (positive) credit ratings from S&P and Moody's

respectively

●

●

●

●

Liquidity reserve¹ of USD 10.9bn

Amortisation of debt in coming 5 years is on average USD 1.9bn per year.

Average term to maturity about four years (excl. leases)

Subordination ratio² is at 12%.

Undrawn revolving facilities expiring in 2023 and 2025 include extension

options of 1 + 1 years

Funding Mix (USD 17bn)

25%

23%

52%

Leases

Bank loans

Corporate bonds and PPs

MAERSKView entire presentation