Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

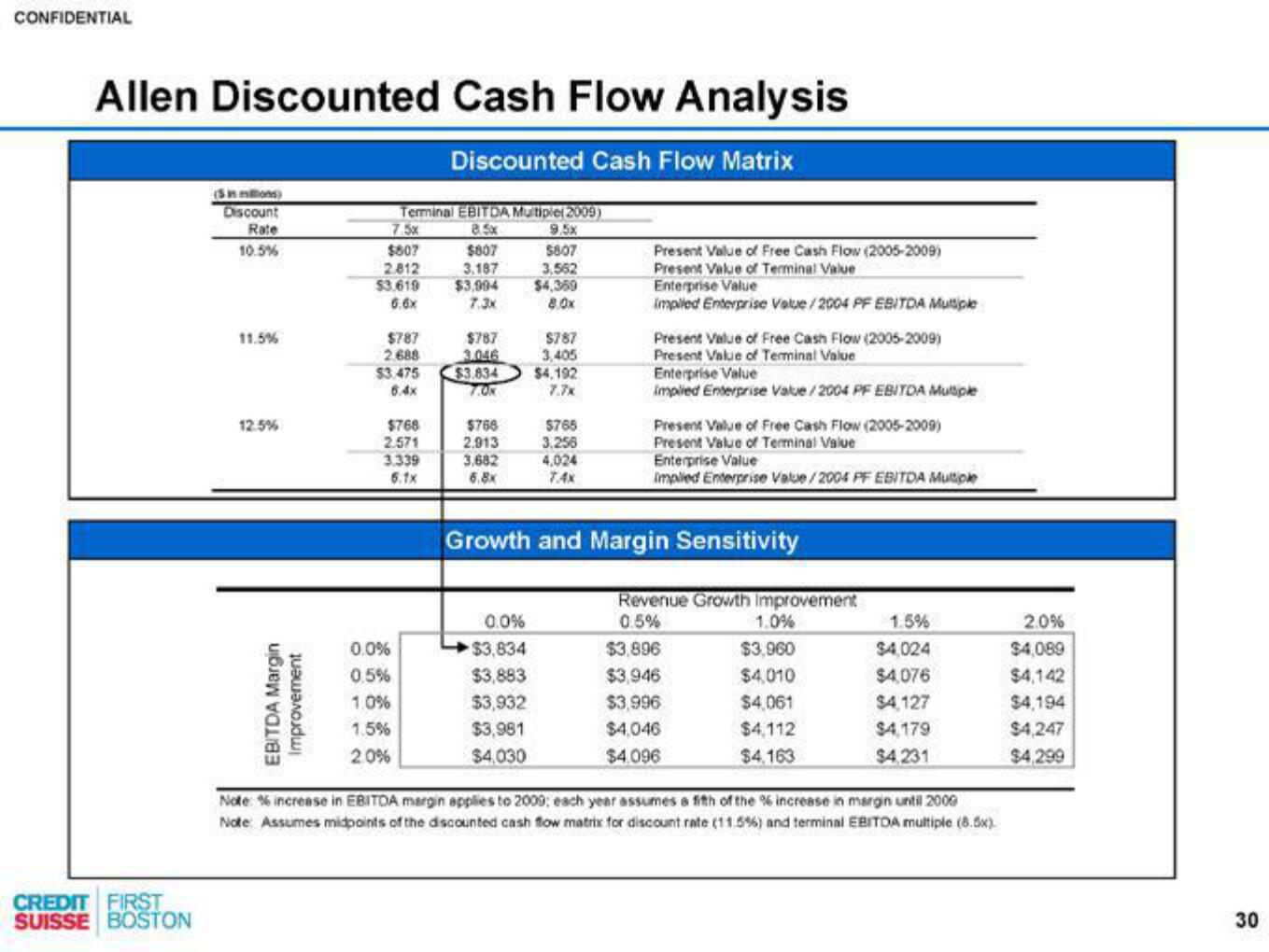

Allen Discounted Cash Flow Analysis

Discounted Cash Flow Matrix

CREDIT FIRST

SUISSE BOSTON

(Sin millions)

Discount

Rate

10.5%

11.5%

12.5%

EBITDA Margin

Improvement

Terminal EBITDA Multiple(2009)

8.5x

9.5x

7.5x

$807

2.812

$3.619

6.6x

$787

2.688

$3.475

6.4x

$768

2.571

3.339

6.1x

0.0%

0,5%

1.0%

1.5%

2.0%

$807

3.187

$3,994

7.3x

$787

3.046

$768

2.913

3,682

6.8x

$807

3.562

$4,369

8.0x

$3.834 $4.192

7.0k

7.7x

$787

3,405

0.0%

$3,834

$3,883

$3,932

$3,981

$4,030

$765

3.256

4,024

7.4x

Present Value of Free Cash Flow (2005-2009)

Present Value of Terminal Value

Enterprise Value

impiled Enterprise Value/2004 PF EBITDA Multiple

Present Value of Free Cash Flow (2005-2009)

Present Value of Terminal Value

Enterprise Value

implied Enterprise Valbue/2004 PF EBITDA Multiple

Present Value of Free Cash Flow (2005-2009)

Present Value of Terminal Value

Enterprise Value

Implied Enterprise Value/2004 PF EBITDA Multiple

Growth and Margin Sensitivity

Revenue Growth Improvement

0.5%

$3,896

$3,946

$3,996

$4,046

$4.096

1.0%

$3,960

$4,010

$4,061

$4,112

$4,163

1.5%

$4,024

$4,076

$4,127

$4,179

$4,231

Note: % increase in EBITDA margin applies to 2009; each year assumes a fifth of the % increase in margin until 2009

Note: Assumes midpoints of the discounted cash flow matrix for discount rate (11.5%) and terminal EBITDA multiple (8.5x).

2.0%

$4,089

$4,142

$4,194

$4,247

$4,299

30View entire presentation