Credit Suisse Investment Banking Pitch Book

Maine GOM exploration update

Excerpts from Maine 11/26/2012 press release

■ Maine updated its ultra-deep exploration and development activities in the

shallow waters of the GOM Shelf and onshore on the Gulf Coast

At Davy Jones No. 1, Maine has recovered to date completion fluids with

weights of approximately 9 and 19 pounds per gallon and is initiating

operations to inject a barite solvent into the formation in order to clean out

the perforations to achieve a measureable flow test

The Lineham Creek exploratory well has encountered hydrocarbon

bearing porous sands above 24,000 feet

■ The Blackbeard West No. 2 ultra-deep exploration well is currently drilling

below 25,200 feet and has encountered additional potential hydrocarbon

bearing sands at approximately 25,000 feet

The Lomond North ultra-deep prospect is currently drilling below 10,700

feet (proposed total depth of 30,000 feet)

Selected press commentary

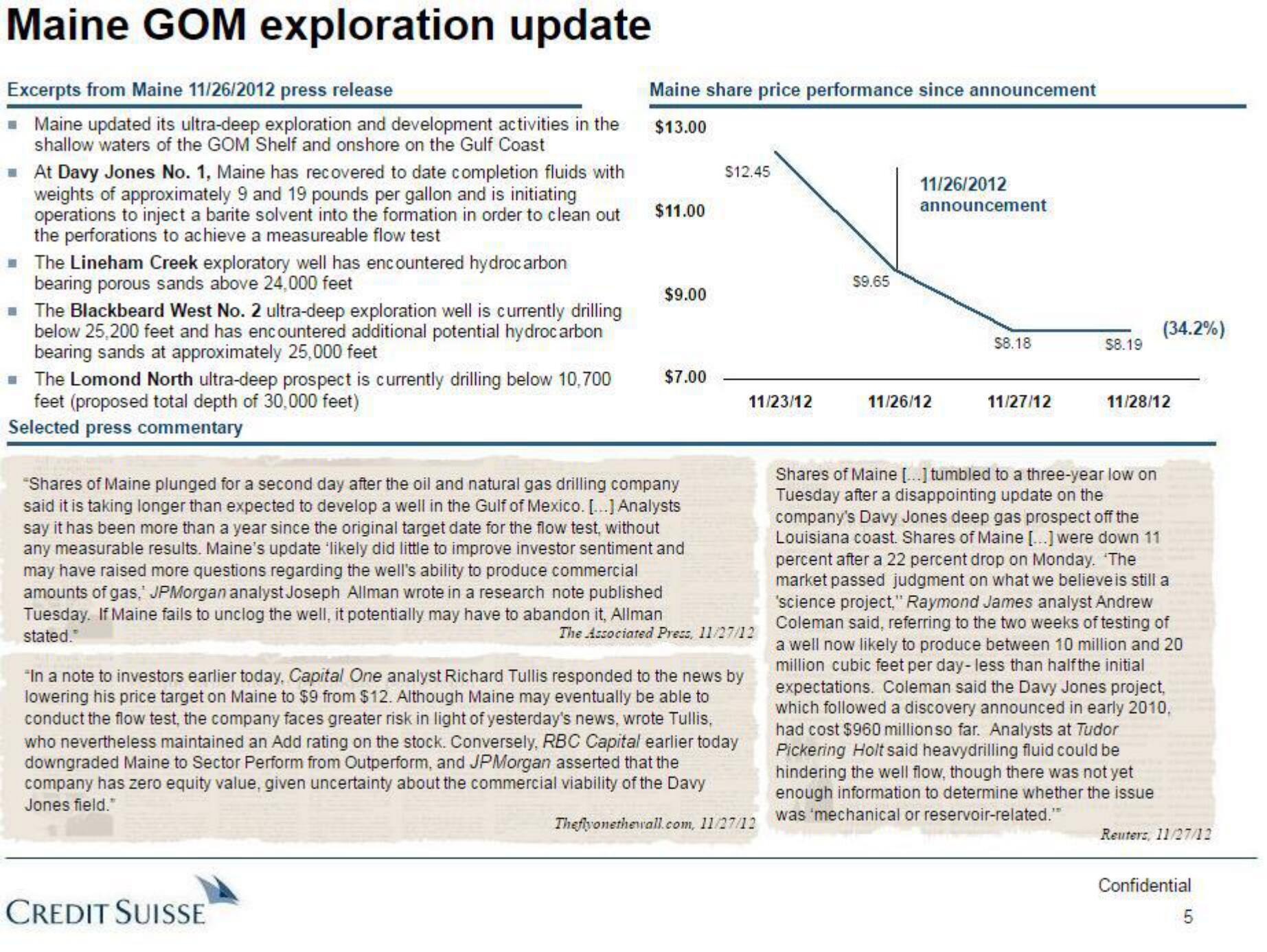

Maine share price performance since announcement

$13.00

$11.00

CREDIT SUISSE

$9.00

$7.00

$12.45

11/23/12

"Shares of Maine plunged for a second day after the oil and natural gas drilling company

said it is taking longer than expected to develop a well in the Gulf of Mexico.[...] Analysts

say it has been more than a year since the original target date for the flow test, without

any measurable results. Maine's update 'likely did little to improve investor sentiment and

may have raised more questions regarding the well's ability to produce commercial

amounts of gas, JPMorgan analyst Joseph Allman wrote in a research note published

Tuesday. If Maine fails to unclog the well, it potentially may have to abandon it, Allman

stated."

The Associated Press, 11/27/12

"In a note to investors earlier today, Capital One analyst Richard Tullis responded to the news by

lowering his price target on Maine to $9 from $12. Although Maine may eventually be able to

conduct the flow test, the company faces greater risk in light of yesterday's news, wrote Tullis,

who nevertheless maintained an Add rating on the stock. Conversely, RBC Capital earlier today

downgraded Maine to Sector Perform from Outperform, and JPMorgan asserted that the

company has zero equity value, given uncertainty about the commercial viability of the Davy

Jones field."

Theflyonethewall.com, 11/27/12

$9.65

11/26/2012

announcement

11/26/12

$8.18

11/27/12

$8.19

(34.2%)

11/28/12

Shares of Maine [...] tumbled to a three-year low on

Tuesday after a disappointing update on the

company's Davy Jones deep gas prospect off the

Louisiana coast. Shares of Maine [...] were down 11

percent after a 22 percent drop on Monday. The

market passed judgment on what we believe is still a

'science project," Raymond James analyst Andrew

Coleman said, referring to the two weeks of testing of

a well now likely to produce between 10 million and 20

million cubic feet per day-less than half the initial

expectations. Coleman said the Davy Jones project,

which followed a discovery announced in early 2010,

had cost $960 million so far. Analysts at Tudor

Pickering Holt said heavydrilling fluid could be

hindering the well flow, though there was not yet

enough information to determine whether the issue

was 'mechanical or reservoir-related."

Reuters, 11/27/12

Confidential

5View entire presentation