OpenText Investor Presentation Deck

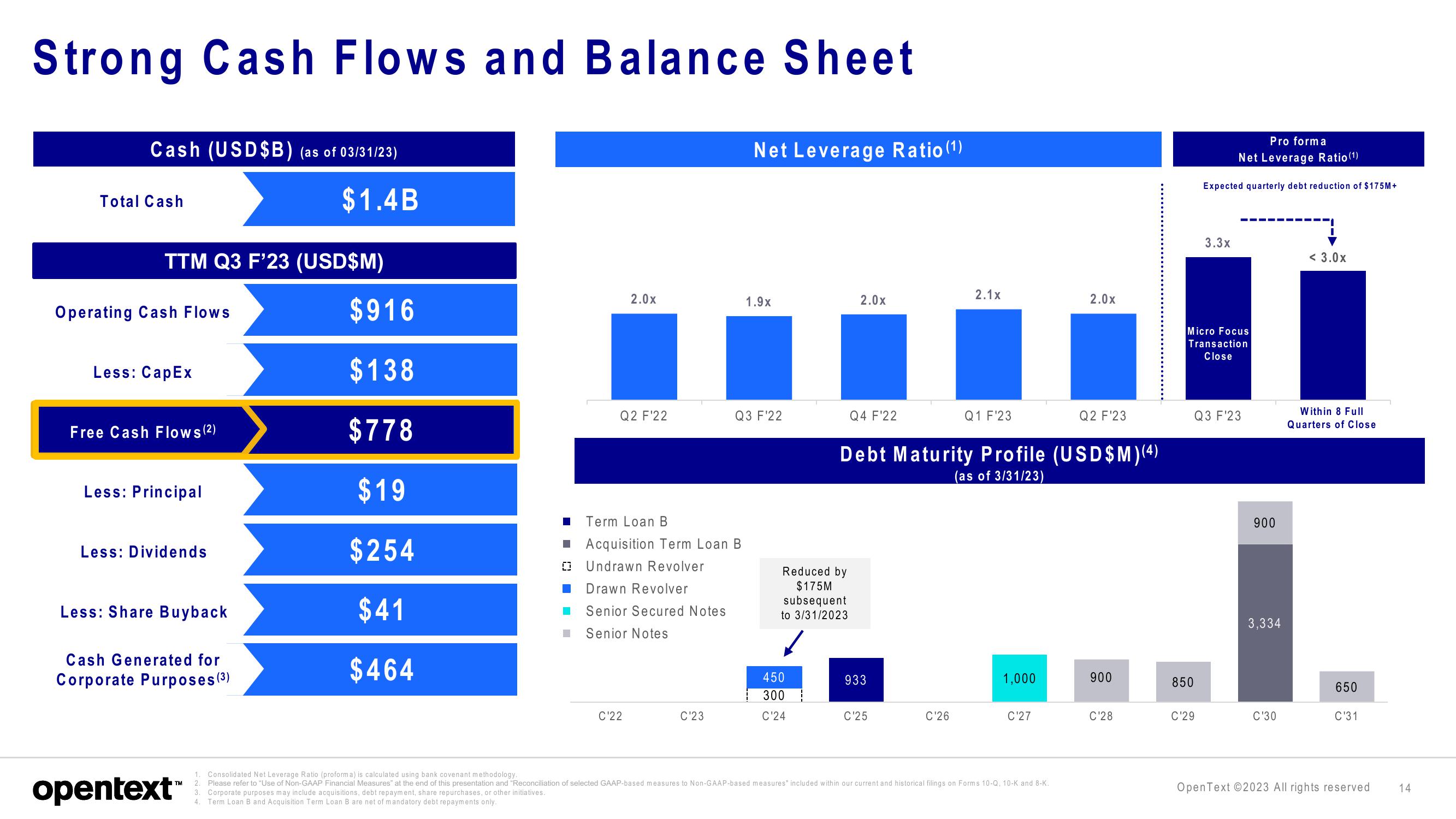

Strong Cash Flows and Balance Sheet

Cash (USD$B) (as of 03/31/23)

$1.4B

Total Cash

TTM Q3 F'23 (USD$M)

Operating Cash Flows

Less: CapEx

Free Cash Flows (²)

Less: Principal

Less: Dividends

Less: Share Buyback

Cash Generated for

Corporate Purposes (³)

opentext™

$916

$138

$778

$19

$254

$41

$464

2.0x

Q2 F¹22

I Term Loan B

Acquisition Term Loan B

0 Undrawn Revolver

Drawn Revolver

Senior Secured Notes

Senior Notes

C'22

C'23

Net Leverage Ratio (¹)

1.9x

Q3 F'22

Reduced by

$175M

subsequent

to 3/31/2023

450

300

C'24

2.0x

Q4 F¹22

933

C'25

2.1x

Debt Maturity Profile (USD$M)(4)

(as of 3/31/23)

C'26

Q1 F¹23

1,000

C'27

2.0x

1. Consolidated Net Leverage Ratio (proforma) is calculated using bank covenant methodology.

2. Please refer to "Use of Non-GAAP Financial Measures" at the end of this presentation and "Reconciliation of selected GAAP-based measures to Non-GAAP-based measures" included within our current and historical filings on Forms 10-Q, 10-K and 8-K.

3. Corporate purposes may include acquisitions, debt repayment, share repurchases, or other initiatives.

4. Term Loan B and Acquisition Term Loan B are net of mandatory debt repayments only.

Q2 F¹23

900

C'28

850

Pro forma

Net Leverage Ratio (¹)

Expected quarterly debt reduction of $175M+

3.3x

Micro Focus

Transaction

Close

C'29

Q3 F¹23

900

3,334

C'30

< 3.0x

Within 8 Full

Quarters of Close

650

C'31

OpenText ©2023 All rights reserved

14View entire presentation