J.P.Morgan Results Presentation Deck

JPMORGAN CHASE & CO.

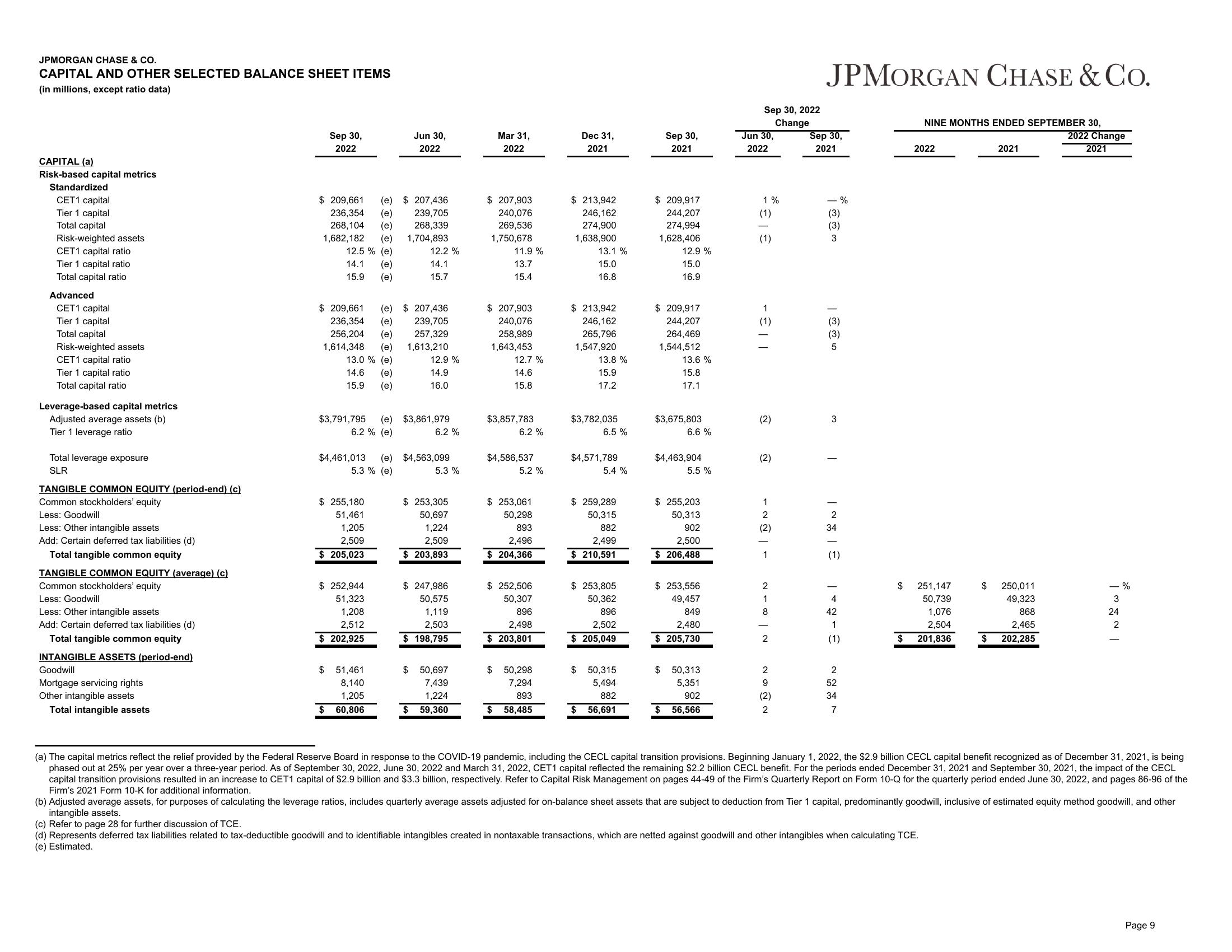

CAPITAL AND OTHER SELECTED BALANCE SHEET ITEMS

(in millions, except ratio data)

CAPITAL (a)

Risk-based capital metrics

Standardized

CET1 capital

Tier 1 capital

Total capital

Risk-weighted assets

CET1 capital ratio

Tier 1 capital ratio

Total capital ratio

Advanced

CET1 capital

Tier 1 capital

Total capital

Risk-weighted assets

CET1 capital ratio

Tier 1 capital ratio

Total capital ratio

Leverage-based capital metrics

Adjusted average assets (b)

Tier 1 leverage ratio

Total leverage exposure

SLR

TANGIBLE COMMON EQUITY (period-end) (c)

Common stockholders' equity

Less: Goodwill

Less: Other intangible assets

Add: Certain deferred tax liabilities (d)

Total tangible common equity

TANGIBLE COMMON EQUITY (average) (c)

Common stockholders' equity

Less: Goodwill

Less: Other intangible assets

Add: Certain deferred tax liabilities (d)

Total tangible common equity

INTANGIBLE ASSETS (period-end)

Goodwill

Mortgage servicing rights

Other intangible assets

Total intangible assets

Sep 30,

2022

$ 209,661 (e) $ 207,436

236,354 (e) 239,705

268,104 (e) 268,339

1,682,182 (e) 1,704,893

12.5% (e)

14.1 (e)

15.9 (e)

$209,661 (e)

236,354 (e)

256,204 (e)

1,614,348 (e)

13.0 % (e)

14.6 (e)

15.9 (e)

$4,461,013 (e)

5.3% (e)

$ 255,180

51,461

1,205

2,509

$ 205,023

$ 252,944

51,323

1,208

2,512

$ 202,925

Jun 30,

2022

$3,791,795 (e) $3,861,979

6.2 % (e)

6.2 %

$ 51,461

8,140

1,205

60,806

$

12.2 %

14.1

15.7

$207,436

239,705

257,329

1,613,210

12.9 %

14.9

16.0

$4,563,099

5.3%

$253,305

50,697

1,224

2,509

$ 203,893

$247,986

50,575

1,119

2,503

$ 198,795

$ 50,697

7,439

1,224

$ 59,360

Mar 31,

2022

$207,903

240,076

269,536

1,750,678

11.9 %

13.7

15.4

$207,903

240,076

258,989

1,643,453

12.7 %

14.6

15.8

$3,857,783

6.2 %

$4,586,537

5.2 %

$ 253,061

50,298

893

2,496

$ 204,366

$ 252,506

50,307

896

2,498

$ 203,801

$ 50,298

7,294

893

$ 58,485

Dec 31,

2021

$213,942

246,162

274,900

1,638,900

13.1 %

15.0

16.8

$213,942

246,162

265,796

1,547,920

13.8 %

15.9

17.2

$3,782,035

6.5 %

$4,571,789

5.4 %

$259,289

50,315

882

2,499

$ 210,591

$ 253,805

50,362

896

2,502

$ 205,049

$ 50,315

5,494

882

$ 56,691

Sep 30,

2021

$ 209,917

244,207

274,994

1,628,406

12.9 %

15.0

16.9

$209,917

244,207

264,469

1,544,512

13.6 %

15.8

17.1

$3,675,803

6.6 %

$4,463,904

5.5 %

$ 255,203

50,313

902

2,500

$206,488

$ 253,556

49,457

849

2,480

$ 205,730

$ 50,313

5,351

902

$ 56,566

Sep 30, 2022

Change

Jun 30,

2022

1%

(1)

(1)

- €11

(2)

(2)

1

2

(2)

1

N 100 N

2

9

(2)

2

JPMORGAN CHASE & CO.

Sep 30,

2021

(3)

3

2

34

(1)

|

4

42

1

%

(1)

2

52

34

7

NINE MONTHS ENDED SEPTEMBER 30,

2022

$ 251,147

50,739

1,076

2,504

$ 201,836

2021

$ 250,011

49,323

868

2,465

$ 202,285

2022 Change

2021

%

| NEW !

(a) The capital metrics reflect the relief provided by the Federal Reserve Board in response to the COVID-19 pandemic, including the CECL capital transition provisions. Beginning January 1, 2022, the $2.9 billion CECL capital benefit recognized as of December 31, 2021, is being

phased out at 25% per year over a three-year period. As of September 30, 2022, June 30, 2022 and March 31, 2022, CET1 capital reflected the remaining $2.2 billion CECL benefit. For the periods ended December 31, 2021 and September 30, 2021, the impact of the CECL

capital transition provisions resulted in an increase to CET1 capital of $2.9 billion and $3.3 billion, respectively. Refer to Capital Risk Management on pages 44-49 of the Firm's Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2022, and pages 86-96 of the

Firm's 2021 Form 10-K for additional information.

(b) Adjusted average assets, for purposes of calculating the leverage ratios, includes quarterly average assets adjusted for on-balance sheet assets that are subject to deduction from Tier 1 capital, predominantly goodwill, inclusive of estimated equity method goodwill, and other

intangible assets.

(c) Refer to page 28 for further discussion of TCE.

(d) Represents deferred tax liabilities related to tax-deductible goodwill and to identifiable intangibles created in nontaxable transactions, which are netted against goodwill and other intangibles when calculating TCE.

(e) Estimated.

Page 9View entire presentation