jetBlue Results Presentation Deck

Focused on Maintaining Strong Balance Sheet

jetBlue

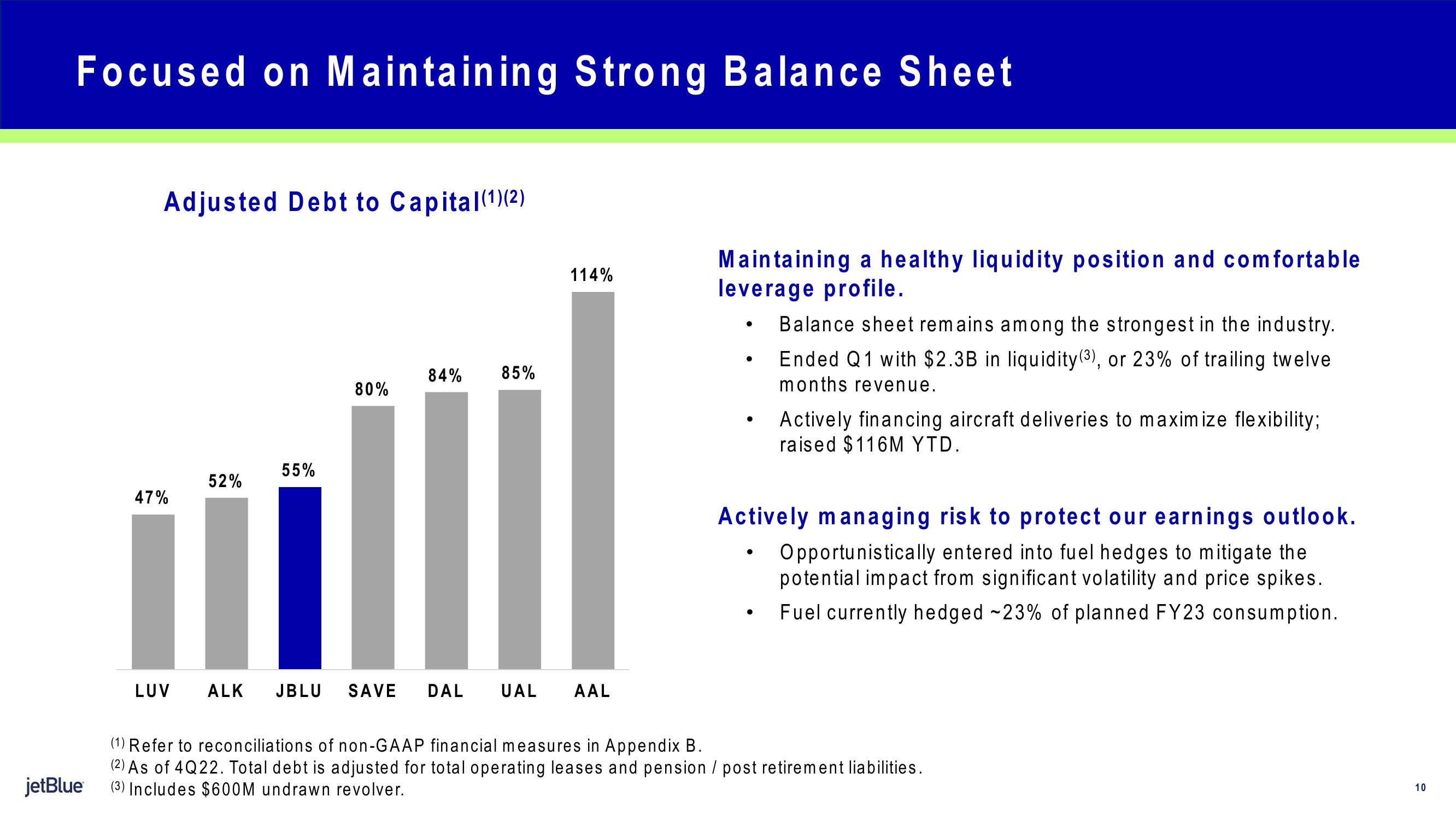

Adjusted Debt to Capital (1)(2)

52%

47%

il

LUV

55%

80%

84%

85%

114%

ALK JBLU SAVE DAL UAL AAL

Maintaining a healthy liquidity position and comfortable.

leverage profile.

●

●

●

●

Balance sheet remains among the strongest in the industry.

Ended Q1 with $2.3B in liquidity (3), or 23% of trailing twelve

months revenue.

Actively managing risk to protect our earnings outlook.

Opportunistically entered into fuel hedges to mitigate the

potential impact from significant volatility and price spikes.

Fuel currently hedged -23% of planned FY23 consumption.

●

Actively financing aircraft deliveries to maximize flexibility;

raised $116M YTD.

(1) Refer to reconciliations of non-GAAP financial measures in Appendix B.

(2) As of 4Q22. Total debt is adjusted for total operating leases and pension / post retirement liabilities.

(3) Includes $600M undrawn revolver.

10View entire presentation