Ashtead Group Results Presentation Deck

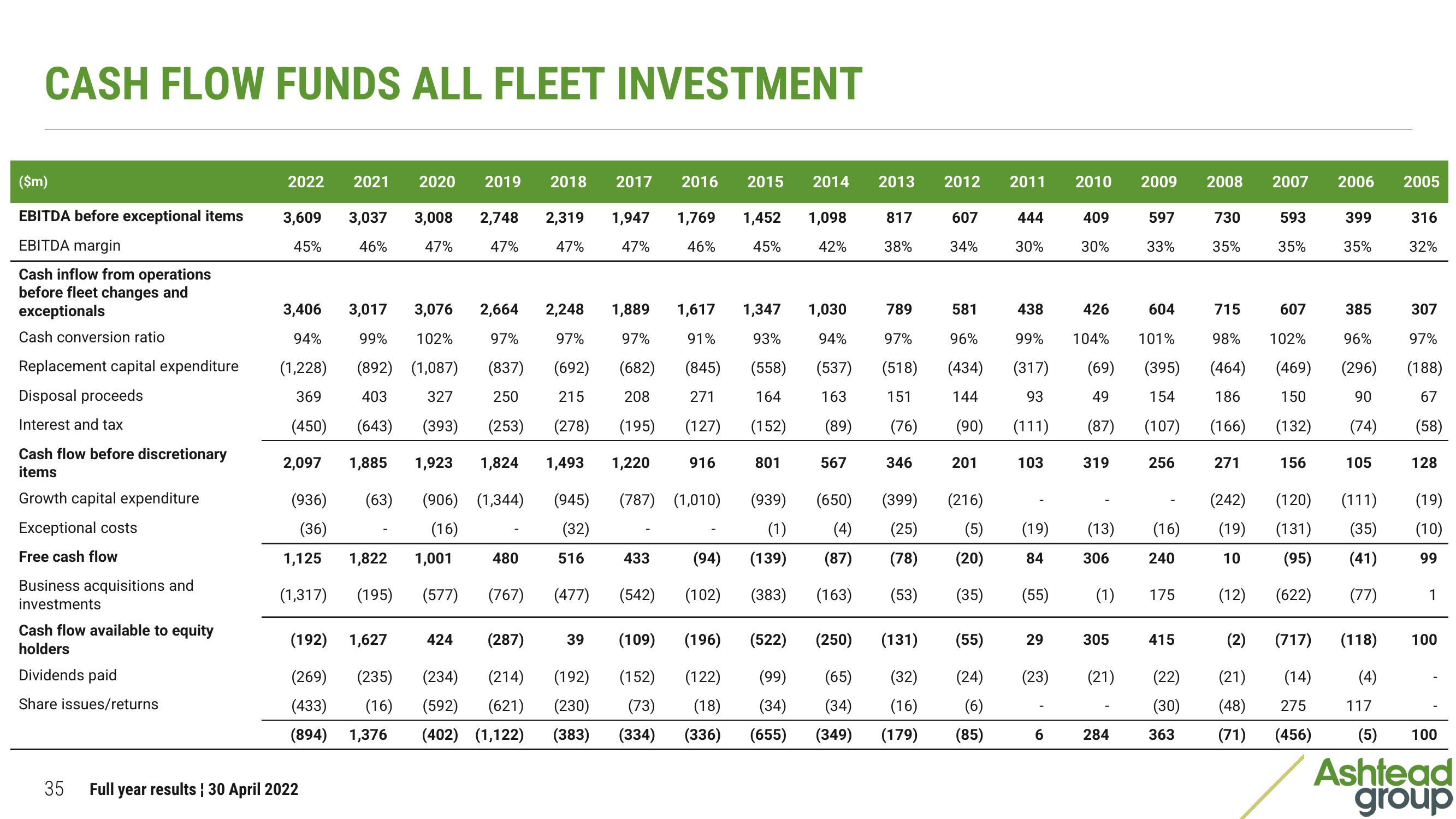

CASH FLOW FUNDS ALL FLEET INVESTMENT

($m)

EBITDA before exceptional items

EBITDA margin

Cash inflow from operations

before fleet changes and

exceptionals

Cash conversion ratio

Replacement capital expenditure

Disposal proceeds

Interest and tax

Cash flow before discretionary

items

Growth capital expenditure

Exceptional costs

Free cash flow

Business acquisitions and

investments

Cash flow available to equity

holders

Dividends paid

Share issues/returns

2022

3,609 3,037 3,008 2,748 2,319 1,947

45% 46% 47% 47% 47% 47%

3,406

94%

(1,228)

369

(450)

2,097

3,017 3,076 2,664 2,248 1,889

99% 102%

(892) (1,087)

403 327

(643) (393)

97%

(837)

250 215

(253) (278)

1,885 1,923 1,824 1,493 1,220

(63) (906) (1,344) (945) (787) (1,010)

(16)

(32)

1,125

1,822 1,001

(1,317) (195) (577)

2021 2020 2019 2018 2017

(936)

(36)

1,627

(192)

(269) (235) (234)

(433)

(16)

(894)

35 Full year results | 30 April 2022

1,376

480

424

(767)

1,617 1,347 1,030

93%

91%

(845)

271

94%

(537)

97% 97%

(692) (682)

208

(195) (127)

(558)

163

164

(152)

(89)

516

(477)

2016 2015

1,769 1,452 1,098

46% 45% 42%

433

39

(542)

916

801

(939)

(1)

(94)

(139)

(102) (383)

(287)

(214)

(192)

(592) (621) (230) (73) (18)

(402) (1,122) (383) (334)

(109)

(196) (522)

(152) (122) (99)

2014

567

(650)

(4)

(87)

(163)

2013

817

38%

346

(250) (131)

(65)

(32)

(34)

(16)

(34)

(336) (655) (349) (179)

(399)

(25)

(78)

(53)

2012

607

34%

789

581 438

97% 96% 99%

(518) (434) (317)

151

144

93

(90) (111)

(76)

201

(216)

(5)

(20)

(35)

2011 2010

(55)

(24)

(6)

(85)

444

30%

103

(55)

29

(19) (13)

84

306

(23)

409

30%

6

426

104%

(69)

49

(87)

319

(1)

305

(21)

284

2009 2008

597

33%

730

35%

604

101%

(395)

154

(107)

256

(16)

240

175

415

(22)

(30)

363

271

607

715

98% 102%

(464) (469)

186 150

(166) (132)

156

(242)

(19)

10

(12)

2007

(2)

(21)

(48)

(71)

593

35%

2006

399

35%

275

(456)

385

96%

(296)

90

(74)

105

(120) (111)

(131)

(95)

(622)

2005

316

32%

117

307

97%

(188)

67

(58)

(19)

(35) (10)

(41)

99

(77)

128

(717) (118) 100

(14)

(4)

1

(5) 100

Ashtead

groupView entire presentation