Centessa IPO Presentation Deck

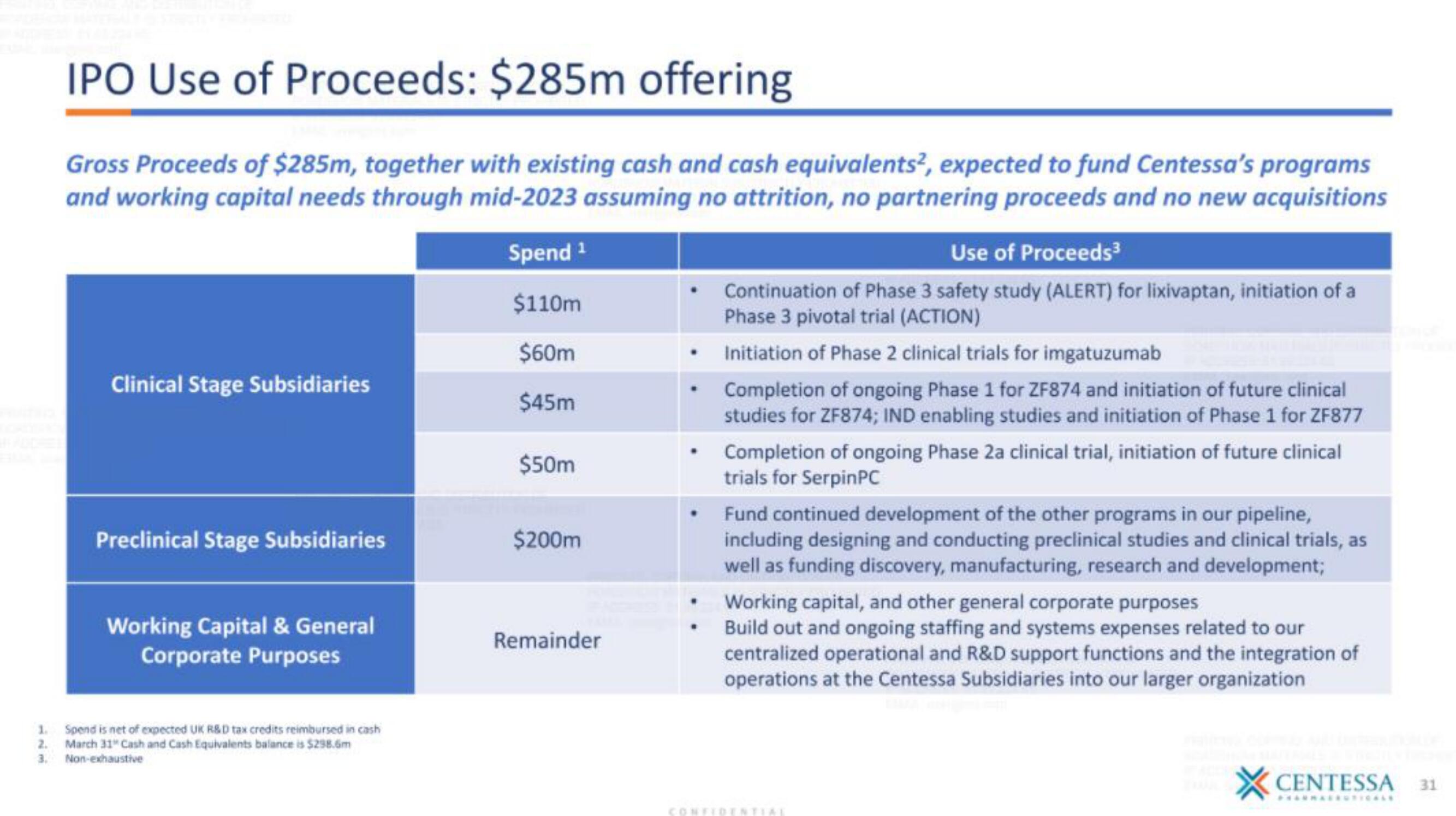

IPO Use of Proceeds: $285m offering

Gross Proceeds of $285m, together with existing cash and cash equivalents², expected to fund Centessa's programs

and working capital needs through mid-2023 assuming no attrition, no partnering proceeds and no new acquisitions

1.

2.

Clinical Stage Subsidiaries

Preclinical Stage Subsidiaries

Working Capital & General

Corporate Purposes

Spend is net of expected UK R&D tax credits reimbursed in cash

March 31" Cash and Cash Equivalents balance is $298.6m

3. Non-exhaustive

Spend ¹

$110m

$60m

$45m

$50m

$200m

Remainder

.

Use of Proceeds³

Continuation of Phase 3 safety study (ALERT) for lixivaptan, initiation of a

Phase 3 pivotal trial (ACTION)

Initiation of Phase 2 clinical trials for imgatuzumab

Completion of ongoing Phase 1 for ZF874 and initiation of future clinical

studies for ZF874; IND enabling studies and initiation of Phase 1 for ZF877

Completion of ongoing Phase 2a clinical trial, initiation of future clinical

trials for SerpinPC

Fund continued development of the other programs in our pipeline,

including designing and conducting preclinical studies and clinical trials, as

well as funding discovery, manufacturing, research and development;

Working capital, and other general corporate purposes

Build out and ongoing staffing and systems expenses related to our

centralized operational and R&D support functions and the integration of

operations at the Centessa Subsidiaries into our larger organization

CENTESSA

31View entire presentation