Babylon Investor Day Presentation Deck

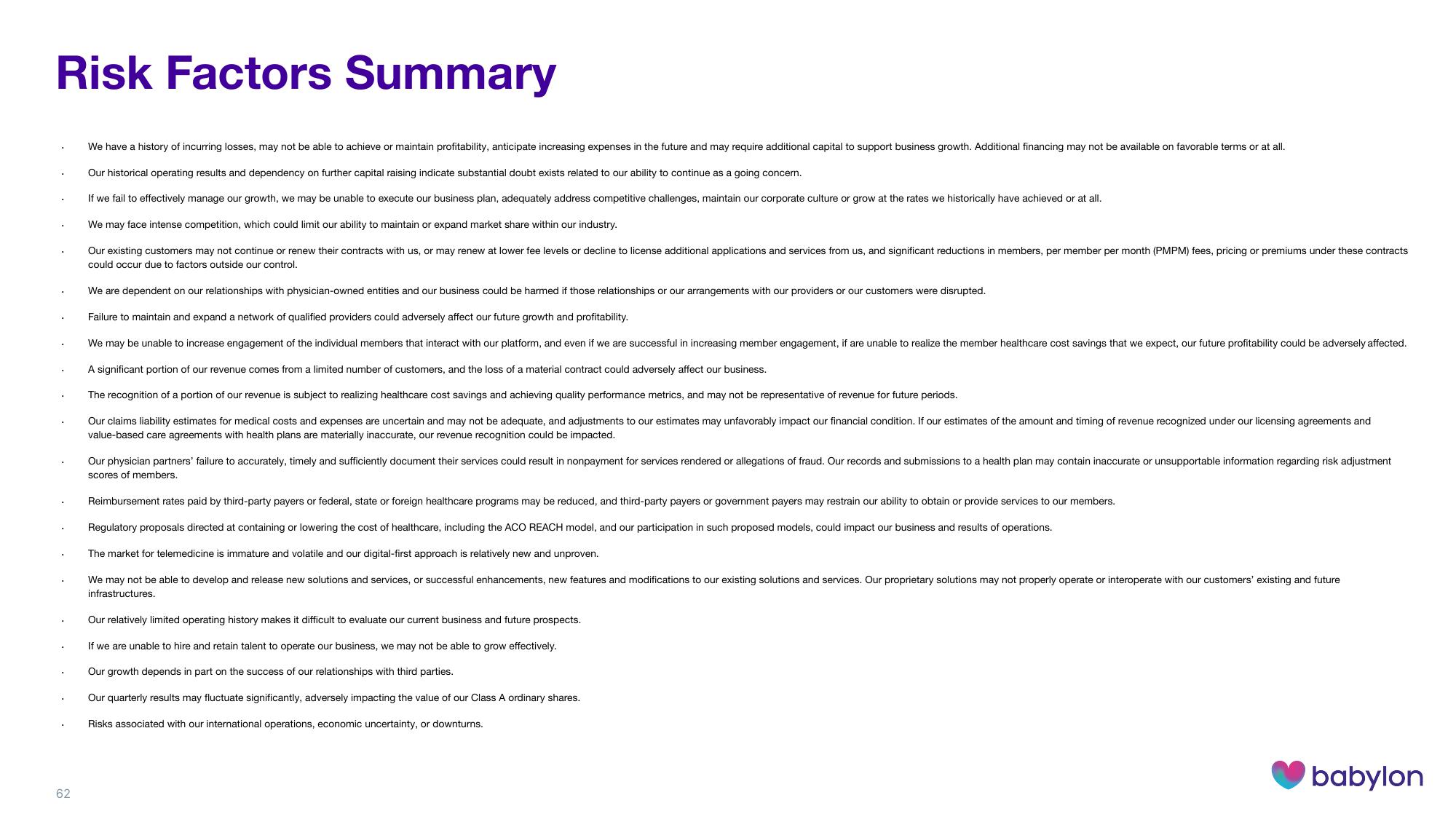

Risk Factors Summary

We have a history of incurring losses, may not be able to achieve or maintain profitability, anticipate increasing expenses in the future and may require additional capital to support business growth. Additional financing may not be available on favorable terms or at all.

Our historical operating results and dependency on further capital raising indicate substantial doubt exists related to our ability to continue as a going concern.

If we fail to effectively manage our growth, we may be unable to execute our business plan, adequately address competitive challenges, maintain our corporate culture or grow at the rates we historically have achieved or at all.

We may face intense competition, which could limit our ability to maintain or expand market share within our industry.

Our existing customers may not continue or renew their contracts with us, or may renew at lower fee levels or decline to license additional applications and services from us, and significant reductions in members, per member per month (PMPM) fees, pricing or premiums under these contracts

could occur due to factors outside our control.

62

We are dependent on our relationships with physician-owned entities and our business could be harmed if those relationships or our arrangements with our providers or our customers were disrupted.

Failure to maintain and expand a network of qualified providers could adversely affect our future growth and profitability.

We may be unable to increase engagement of the individual members that interact with our platform, and even if we are successful in increasing member engagement, if are unable to realize the member healthcare cost savings that we expect, our future profitability could be adversely affected.

A significant portion of our revenue comes from a limited number of customers, and the loss of a material contract could adversely affect our business.

The recognition of a portion of our revenue is subject to realizing healthcare cost savings and achieving quality performance metrics, and may not be representative of revenue for future periods.

Our claims liability estimates for medical costs and expenses are uncertain and may not be adequate, and adjustments to our estimates may unfavorably impact our financial condition. If our estimates of the amount and timing of revenue recognized under our licensing agreements and

value-based care agreements with health plans are materially inaccurate, our revenue recognition could be impacted.

Our physician partners' failure to accurately, timely and sufficiently document their services could result in nonpayment for services rendered or allegations of fraud. Our records and submissions to a health plan may contain inaccurate or unsupportable information regarding risk adjustment

scores of members.

Reimbursement rates paid by third-party payers or federal, state or foreign healthcare programs may be reduced, and third-party payers or government payers may restrain our ability to obtain or provide services to our members.

Regulatory proposals directed at containing or lowering the cost of healthcare, including the ACO REACH model, and our participation in such proposed models, could impact our business and results of operations.

The market for telemedicine is immature and volatile and our digital-first approach is relatively new and unproven.

We may not be able to develop and release new solutions and services, or successful enhancements, new features and modifications to our existing solutions and services. Our proprietary solutions may not properly operate or interoperate with our customers' existing and future

infrastructures.

Our relatively limited operating history makes it difficult to evaluate our current business and future prospects.

If we are unable to hire and retain talent to operate our business, we may not be able to grow effectively.

Our growth depends in part on the success of our relationships with third parties.

Our quarterly results may fluctuate significantly, adversely impacting the value of our Class A ordinary shares.

Risks associated with our international operations, economic uncertainty, or downturns.

babylonView entire presentation