J.P.Morgan Investment Banking Pitch Book

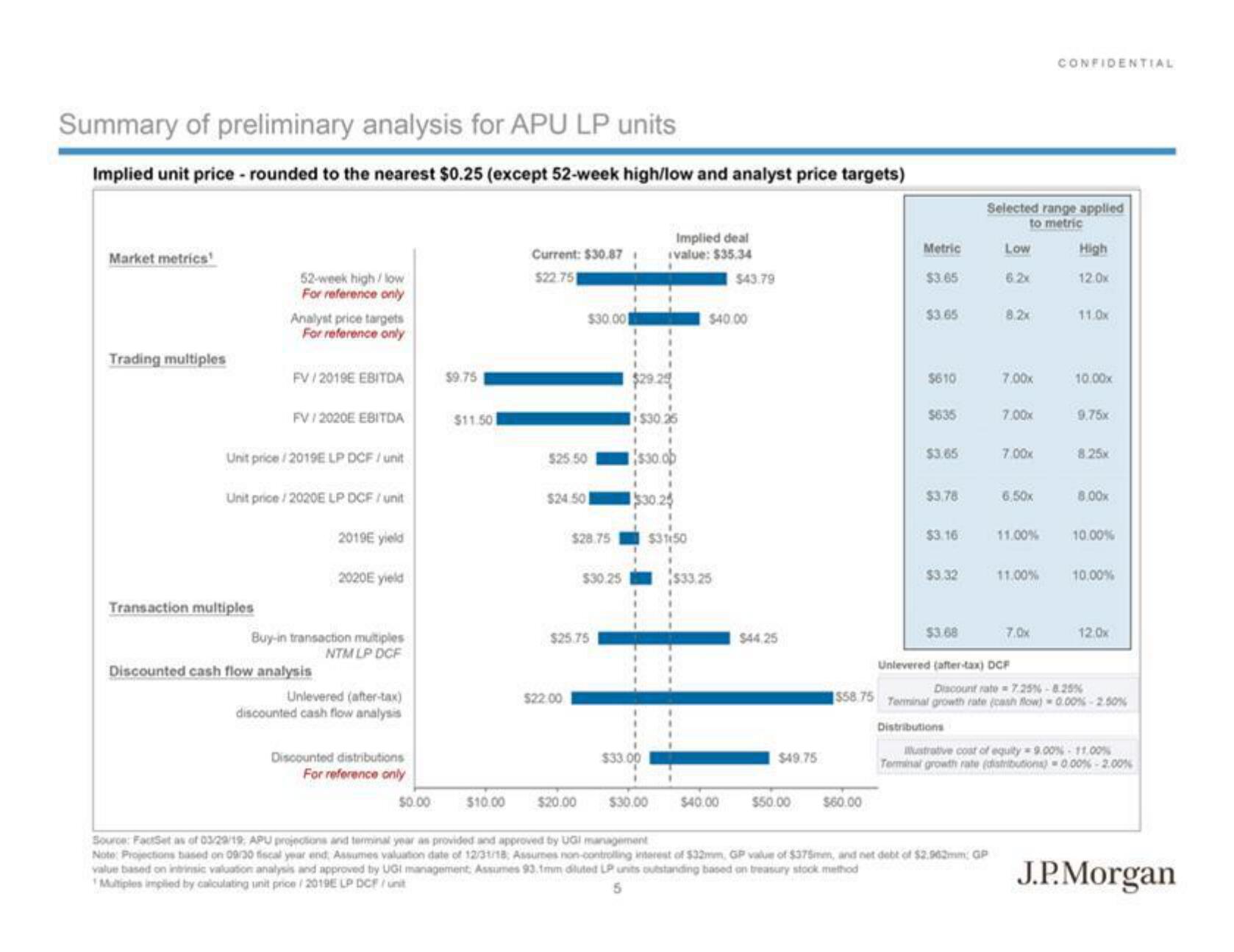

Summary of preliminary analysis for APU LP units

Implied unit price - rounded to the nearest $0.25 (except 52-week high/low and analyst price targets)

Market metrics

Trading multiples

52-week high/low

For reference only

Transaction multiples

Analyst price targets

For reference only

FV/2019E EBITDA

FV/2020E EBITDA

Unit price/2019E LP DCF / unit

Unit price / 2020ELP DCF / unit

2019€ yield

2020E yield

Buy-in transaction multiples

NTM LP DCF

Discounted cash flow analysis

Unlevered (after-tax)

discounted cash flow analysis

Discounted distributions

For reference only

$9.75

$11.50

$0.00 $10.00

Current: $30.87

$22.751

$25.50

$24.50

$30.00

$22.00

$28.75

$25.75

$20.00

$30.25

$30

$30.25

1

$33.00

$30.00

Implied deal

value: $35.34

$31150

$40.00

$33.25

$43.79

$40.00

$44.25

$49.75

$50.00

Metric

$3.65

$60.00

$3.65

$610

$635

$3.65

$3.78

$3.16

$3.32

$3.68

Selected range applied

to metric

Low

6.2x

8.2x

Source: FactSet as of 03/29/19; APU projections and terminal year as provided and approved by UGI management

Note: Projections based on 09/30 fiscal year end, Assumes valuation date of 12/31/18, Assumes non-controlling interest of $32mm, GP value of $375mm, and net debt of $2.962mm; GP

value based on intrinsic valuation analysis and approved by UGI management Assumes 93.1mm diluted LP units outstanding based on treasury stock method

Multiples implied by calculating unit price / 2019E LP DCF / unit

7.00x

7.00x

7.00x

6,50x

11.00%

11.00%

7.0x

Untevered (after-tax) DCF

CONFIDENTIAL

High

12.0x

11.0x

10.00x

9.75x

8.25x

8.00x

10.00%

10,00%

Discount rate=7.25% -8.25%

$58.75 Tenninal growth rate (cash flow) 0.00%-2.50%

Distributions

12.0x

Mustrative coat of equity=9.00% 11.00%

Terminal growth rate (distributions)=0.00%-2.00%

J.P.MorganView entire presentation