Antero Midstream Partners Investor Presentation Deck

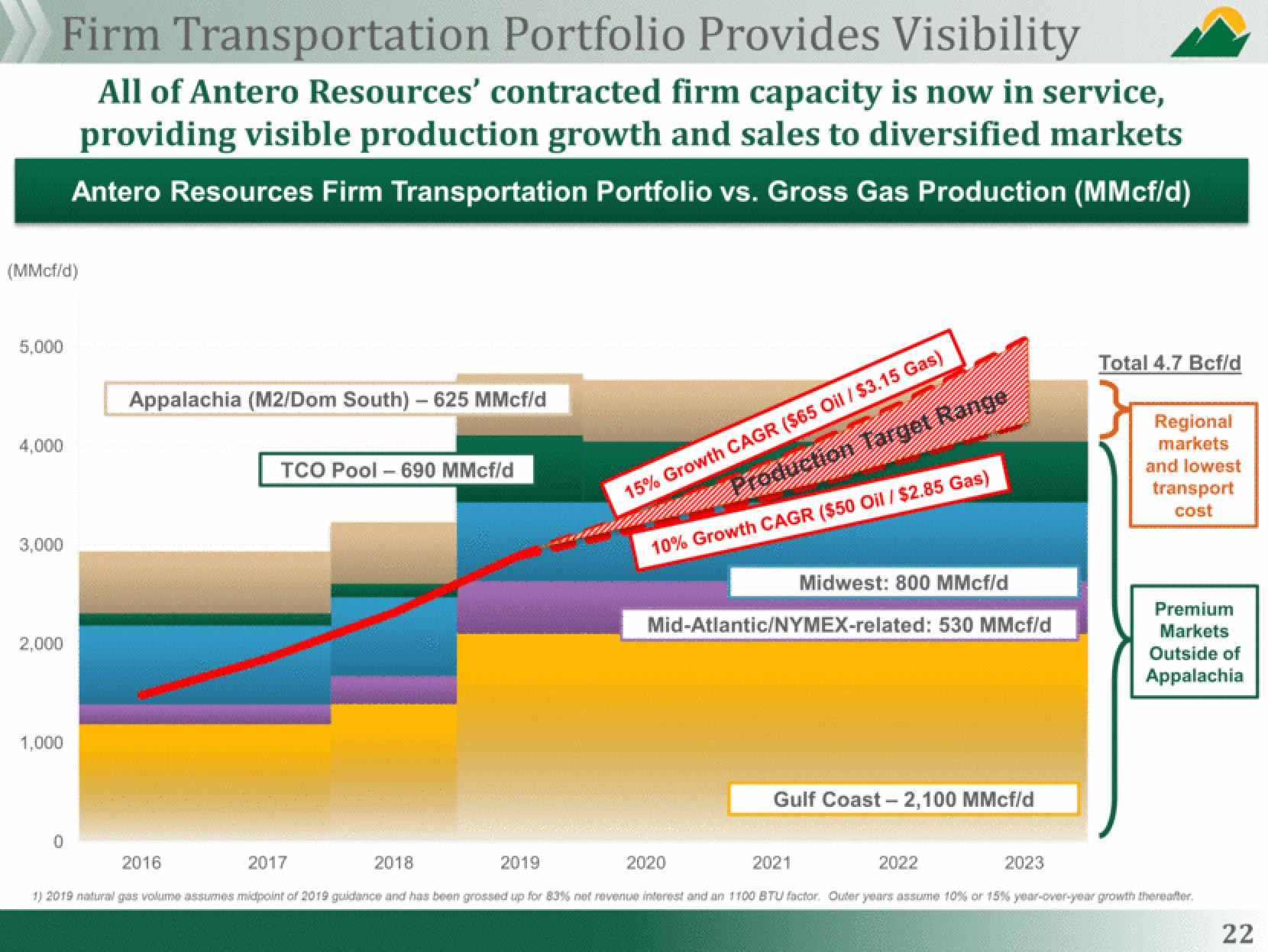

Firm Transportation Portfolio Provides Visibility

All of Antero Resources' contracted firm capacity is now in service,

providing visible production growth and sales to diversified markets

Antero Resources Firm Transportation Portfolio vs. Gross Gas Production (MMcf/d)

(MMcf/d)

5,000

4,000

3,000

2,000

1,000

0

Appalachia (M2/Dom South) - 625 MMcf/d

2016

TCO Pool - 690 MMcf/d

2017

2018

2019

15% Growth CAGR ($65 Oil / $3.15 Gas)

Production Target Range

10% Growth CAGR ($50 Oil / $2.85 Gas)

Midwest: 800 MMcf/d

Mid-Atlantic/NYMEX-related: 530 MMcf/d

2020

Gulf Coast - 2,100 MMcf/d

2021

2022

2023

Total 4.7 Bcf/d

Regional

markets

and lowest

transport

cost

Premium

Markets

Outside of

Appalachia

1) 2019 natural gas volume assumes midpoint of 2019 guidance and has been grossed up for 83% net revenue interest and an 1100 BTU factor. Outer years assume 10% or 15% year-over-year growth thereafter.

22View entire presentation