J.P.Morgan 4Q23 Earnings Results

JPMORGAN CHASE & CO.

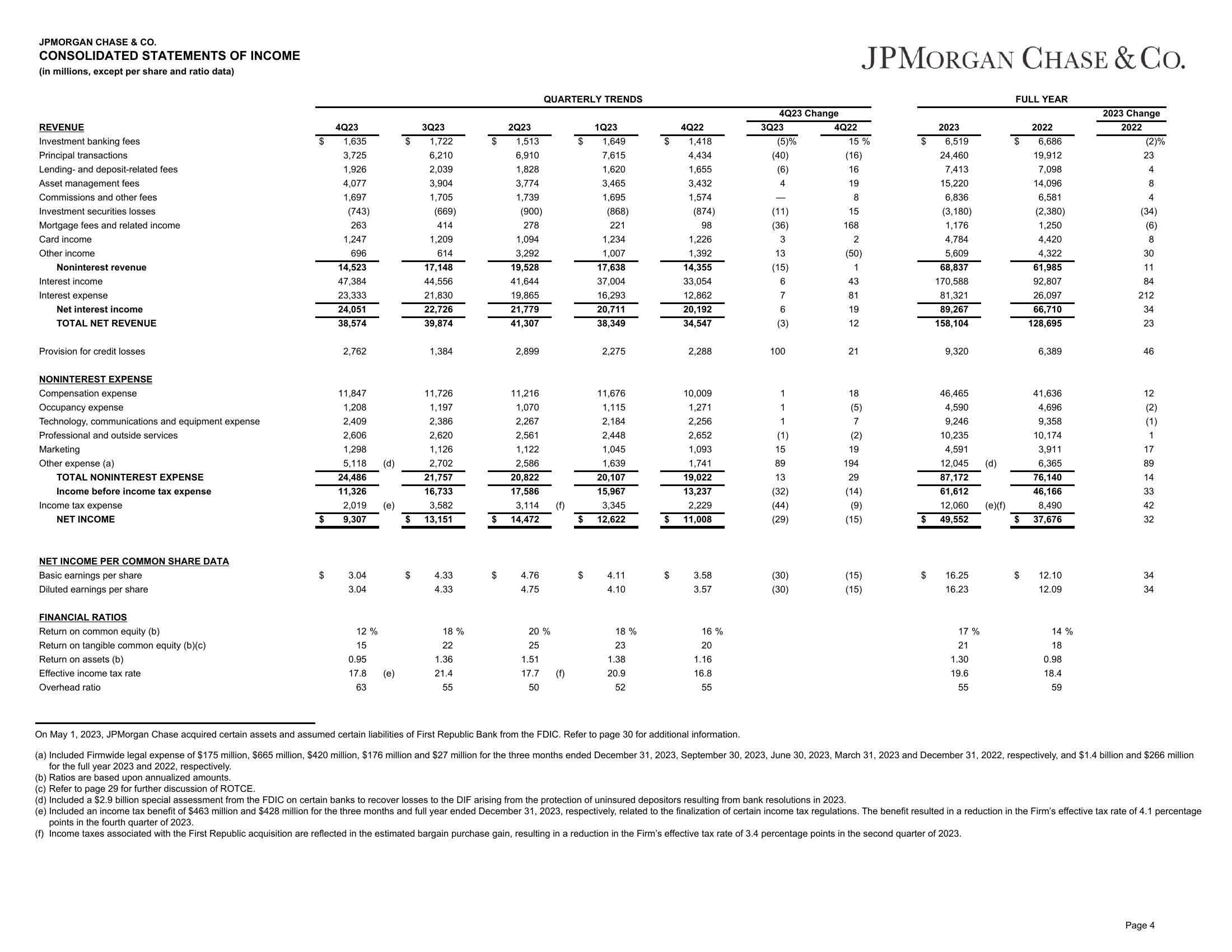

CONSOLIDATED STATEMENTS OF INCOME

(in millions, except per share and ratio data)

REVENUE

Investment banking fees

Principal transactions

Lending- and deposit-related fees

Asset management fees

Commissions and other fees

Investment securities losses

Mortgage fees and related income

Card income

Other income

Noninterest revenue

Interest income

Interest expense

Net interest income

TOTAL NET REVENUE

Provision for credit losses

NONINTEREST EXPENSE

Compensation expense

Occupancy expense

Technology, communications and equipment expense

Professional and outside services

Marketing

Other expense (a)

TOTAL NONINTEREST EXPENSE

Income before income tax expense

Income tax expense

NET INCOME

NET INCOME PER COMMON SHARE DATA

Basic earnings per share

Diluted earnings per share

FINANCIAL RATIOS

Return on common equity (b)

Return on tangible common equity (b)(c)

Return on assets (b)

Effective income tax rate

Overhead ratio

$

$

4Q23

1,635

3,725

1,926

4,077

1,697

(743)

263

1,247

696

14,523

47,384

23,333

24,051

38,574

2,762

11,847

1,208

2,409

2,606

1,298

5,118 (d)

24,486

11,326

2,019 (e)

9,307

3.04

3.04

12 %

15

0.95

17.8

63

(e)

$

3Q23

$

1,722

6,210

2,039

3,904

1,705

(669)

414

1,209

614

17,148

44,556

21,830

22,726

39,874

1,384

11,726

1,197

2,386

2,620

1,126

2,702

21,757

16,733

3,582

$ 13,151

4.33

4.33

18 %

22

1.36

21.4

55

$

2Q23

1,513

6,910

1,828

3,774

1,739

(900)

278

1,094

3,292

19,528

41,644

19,865

21,779

41,307

2,899

11,216

1,070

2,267

2,561

1,122

2,586

20,822

17,586

3,114

14,472

4.76

4.75

QUARTERLY TRENDS

20 %

25

1.51

17.7

50

(f)

(f)

$

$

$

1Q23

1,649

7,615

1,620

3,465

1,695

(868)

221

1,234

1,007

17,638

37,004

16,293

20,711

38,349

2,275

11,676

1,115

2,184

2,448

1,045

1,639

20,107

15,967

3,345

12,622

4.11

4.10

18 %

23

1.38

20.9

52

$

$

$

4Q22

1,418

4,434

1,655

3,432

1,574

(874)

98

1,226

1,392

14,355

33,054

12,862

20,192

34,547

2,288

10,009

1,271

2,256

2,652

1,093

1,741

19,022

13,237

2,229

11,008

3.58

3.57

16 %

20

1.16

16.8

55

4Q23 Change

3Q23

(5)%

(40)

(6)

4

(11)

(36)

3

13

(15)

6

7

6

(3)

100

1

1

1

(1)

15

89

13

(32)

(44)

(29)

(30)

(30)

4Q22

15%

(16)

16

19

8

15

168

2

(50)

1

43

81

19

12

21

JPMORGAN CHASE & CO.

18

(5)

7

(2)

19

194

29

(14)

(9)

(15)

(15)

(15)

$

$

$

2023

6,519

24,460

7,413

15,220

6,836

(3,180)

1,176

4,784

5,609

68,837

170,588

81,321

89,267

158,104

9,320

46,465

4,590

9,246

10,235

4,591

12,045

87,172

61,612

12,060

49,552

16.25

16.23

17%

21

1.30

19.6

55

(d)

(e)(f)

FULL YEAR

$

$

2022

6,686

19,912

7,098

14,096

6,581

(2,380)

1,250

4,420

4,322

61,985

92,807

26,097

66,710

128,695

6,389

41,636

4,696

9,358

10,174

3,911

6,365

76,140

46,166

8,490

37,676

12.10

12.09

14 %

18

0.98

18.4

59

2023 Change

2022

(2)%

23

4

8

4

(34)

(6)

8

30

11

84

212

34

23

46

12

(2)

(1)

1

17

89

14

33

42

32

34

34

On May 1, 2023, JPMorgan Chase acquired certain assets and assumed certain liabilities of First Republic Bank from the FDIC. Refer to page 30 for additional information.

(a) Included Firmwide legal expense of $175 million, $665 million, $420 million, $176 million and $27 million for the three months ended December 31, 2023, September 30, 2023, June 30, 2023, March 31, 2023 and December 31, 2022, respectively, and $1.4 billion and $266 million

for the full year 2023 and 2022, respectively.

(b) Ratios are based upon annualized amounts.

(c) Refer to page 29 for further discussion of ROTCE.

(d) Included a $2.9 billion special assessment from the FDIC on certain banks to recover losses to the DIF arising from the protection of uninsured depositors resulting from bank resolutions in 2023.

(e) Included an income tax benefit of $463 million and $428 million for the three months and full year ended December 31, 2023, respectively, related to the finalization of certain income tax regulations. The benefit resulted in a reduction in the Firm's effective tax rate of 4.1 percentage

points in the fourth quarter of 2023.

(f) Income taxes associated with the First Republic acquisition are reflected in the estimated bargain purchase gain, resulting in a reduction in the Firm's effective tax rate of 3.4 percentage points in the second quarter of 2023.

Page 4View entire presentation