KKR Real Estate Finance Trust Results Presentation Deck

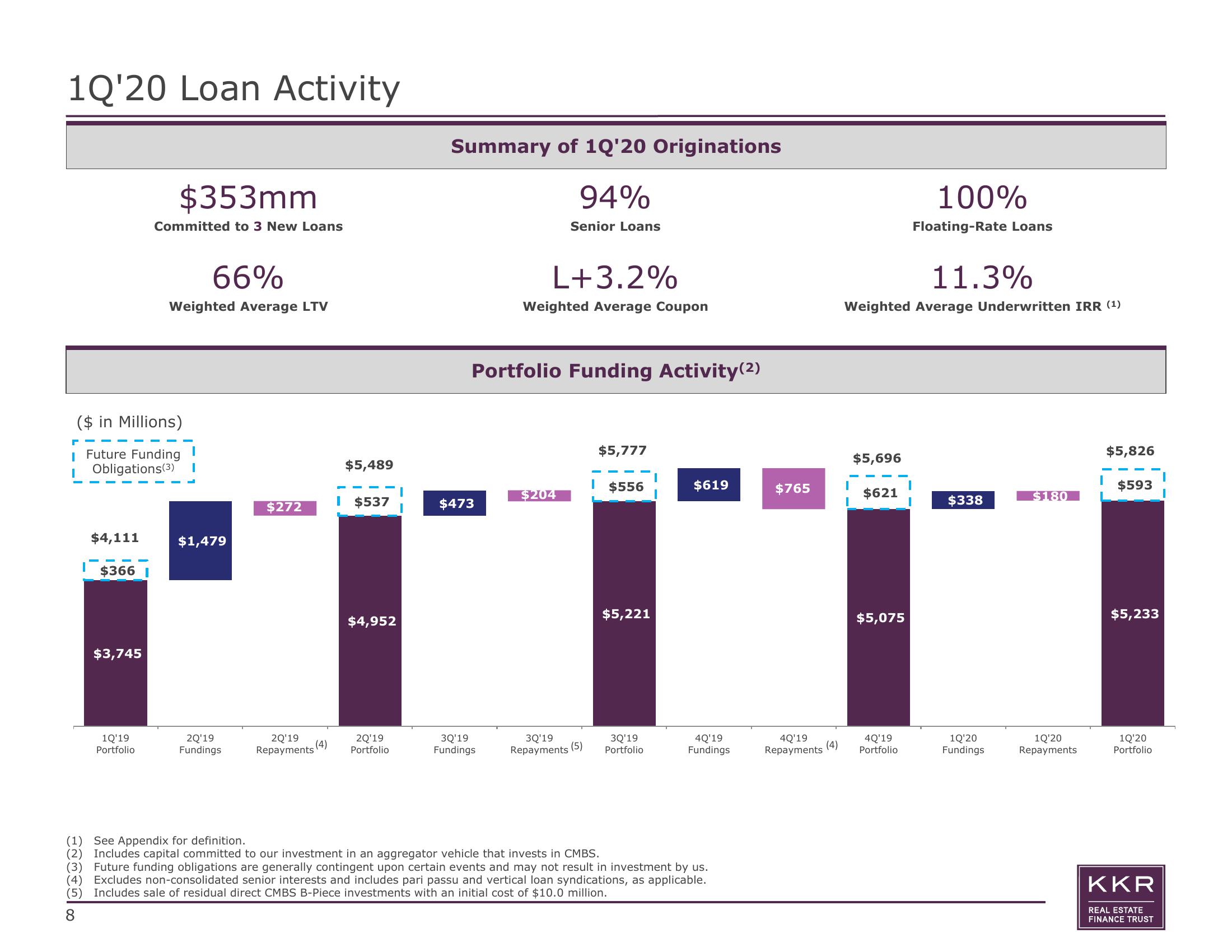

1Q'20 Loan Activity

C

($ in Millions)

$4,111

Future Funding

Obligations (3)

$3661

$353mm

Committed to 3 New Loans

$3,745

66%

Weighted Average LTV

1Q'19

Portfolio

$1,479

2Q'19

Fundings

$272

2Q'19

Repayments

(4)

$5,489

I $537

$4,952

2Q'19

Portfolio

Summary of 1Q'20 Originations

94%

Senior Loans

Portfolio Funding Activity (2)

$473

L+3.2%

Weighted Average Coupon

3Q'19

Fundings

$204

$5,777

$556

$5,221

3Q'19

3Q'19

Repayments (5) Portfolio

$619

4Q'19

Fundings

(1) See Appendix for definition.

(2) Includes capital committed to our investment in an aggregator vehicle that invests in CMBS.

(3) Future funding obligations are generally contingent upon certain events and may not result in investment by us.

(4) Excludes non-consolidated senior interests and includes pari passu and vertical loan syndications, as applicable.

(5) Includes sale of residual direct CMBS B-Piece investments with an initial cost of $10.0 million.

8

$765

4Q'19

Repayments

(4)

$5,696

Weighted Average Underwritten IRR (¹)

$621

$5,075

100%

Floating-Rate Loans

4Q'19

Portfolio

11.3%

$338

1Q'20

Fundings

$180

1Q'20

Repayments

$5,826

$593

$5,233

1Q'20

Portfolio

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation