DraftKings SPAC Presentation Deck

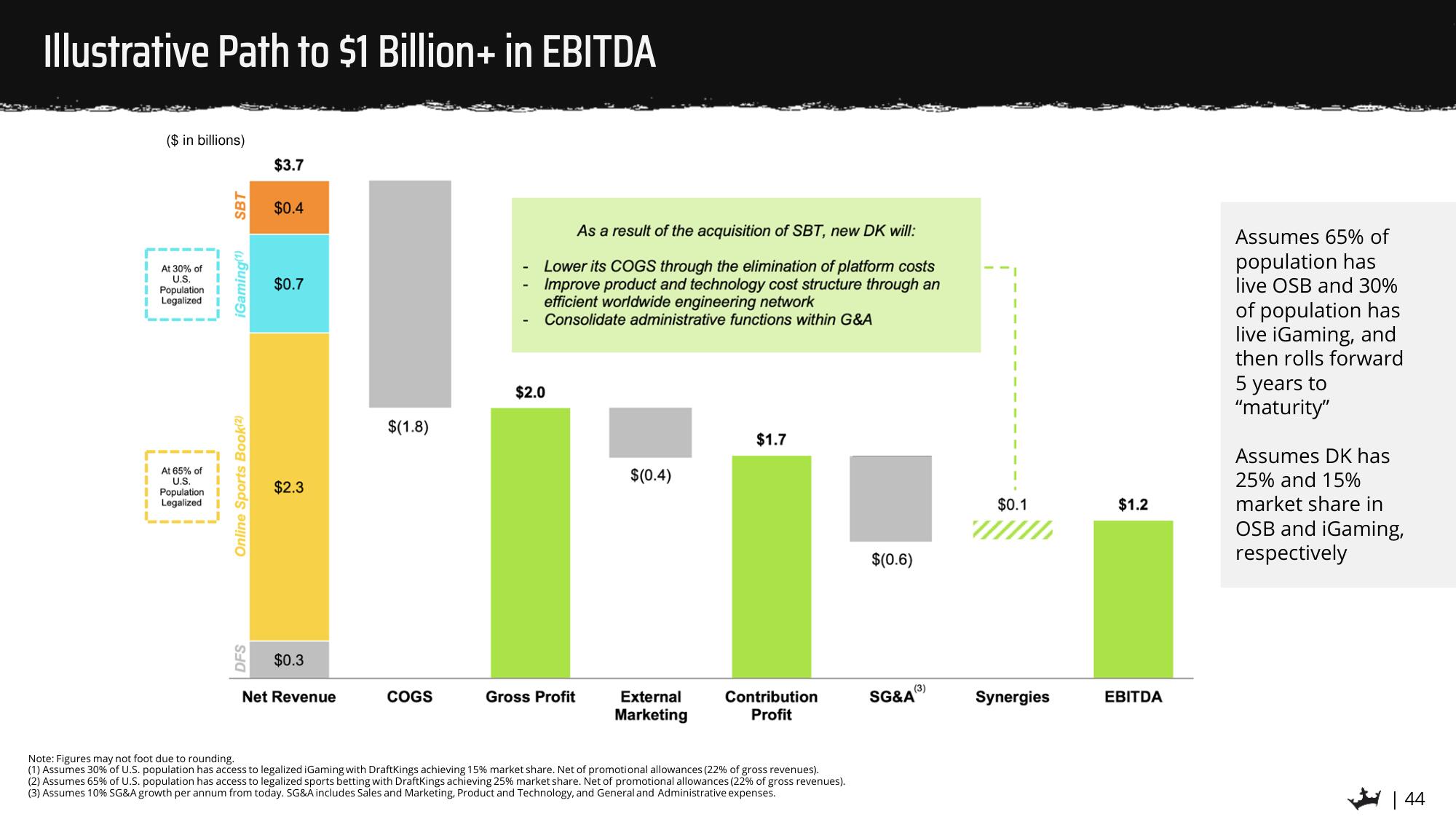

Illustrative Path to $1 Billion+ in EBITDA

($ in billions)

At 30% of

U.S.

Population

Legalized

At 65% of

U.S.

Population

Legalized

SBT

iGaming(¹)

Online Sports Book(2)

DFS

$3.7

$0.4

$0.7

$2.3

$0.3

Net Revenue

$(1.8)

COGS

As a result of the acquisition of SBT, new DK will:

Lower its COGS through the elimination of platform costs

Improve product and technology cost structure through an

efficient worldwide engineering network

Consolidate administrative functions within G&A

$2.0

Gross Profit

$(0.4)

External

Marketing

$1.7

Contribution

Profit

Note: Figures may not foot due to rounding.

(1) Assumes 30% of U.S. population has access to legalized iGaming with DraftKings achieving 15% market share. Net of promotional allowances (22% of gross revenues).

(2) Assumes 65% of U.S. population has access to legalized sports betting with DraftKings achieving 25 % market share. Net of promotional allowances (22% of gross revenues).

(3) Assumes 10% SG&A growth per annum from today. SG&A includes Sales and Marketing, Product and Technology, and General and Administrative expenses.

$(0.6)

(3)

SG&A

$0.1

Synergies

$1.2

EBITDA

Assumes 65% of

population has

live OSB and 30%

of population has

live iGaming, and

then rolls forward

5 years to

"maturity"

Assumes DK has

25% and 15%

market share in

OSB and iGaming,

respectively

| 44View entire presentation