Tempo SPAC Presentation Deck

Tempo Automation Investment Highlights

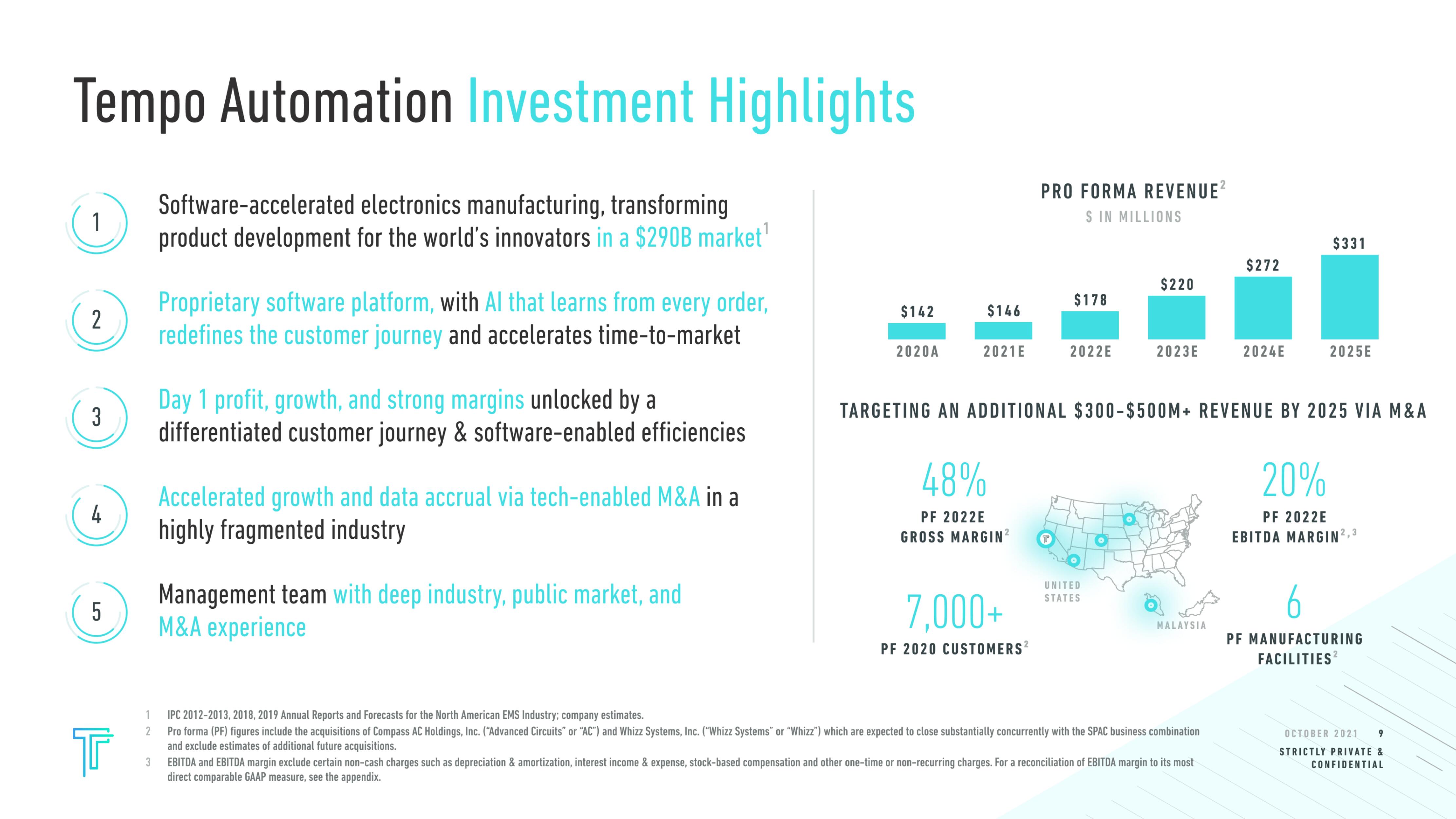

Software-accelerated electronics manufacturing, transforming

product development for the world's innovators in a $290B market¹

1

2

3

4

5

Tr

1

2

3

Proprietary software platform, with Al that learns from every order,

redefines the customer journey and accelerates time-to-market

Day 1 profit, growth, and strong margins unlocked by a

differentiated customer journey & software-enabled efficiencies

Accelerated growth and data accrual via tech-enabled M&A in a

highly fragmented industry

Management team with deep industry, public market, and

M&A experience

$142

2020A

$146

2021E

48%

PF 2022E

GROSS MARGIN²

PRO FORMA REVENUE²

$ IN MILLIONS

7,000+

PF 2020 CUSTOMERS²

$178

2022E

$220

UNITED

STATES

2023E

TARGETING AN ADDITIONAL $300-$500M+ REVENUE BY 2025 VIA M&A

MALAYSIA

IPC 2012-2013, 2018, 2019 Annual Reports and Forecasts for the North American EMS Industry; company estimates.

Pro forma (PF) figures include the acquisitions of Compass AC Holdings, Inc. ("Advanced Circuits" or "AC") and Whizz Systems, Inc. ("Whizz Systems" or "Whizz") which are expected to close substantially concurrently with the SPAC business combination

and exclude estimates of additional future acquisitions.

$272

EBITDA and EBITDA margin exclude certain non-cash charges such as depreciation & amortization, interest income & expense, stock-based compensation and other one-time or non-recurring charges. For a reconciliation of EBITDA margin to its most

direct comparable GAAP measure, see the appendix.

2024E

$331

2025E

20%

PF 2022E

EBITDA MARGIN 2,3

PF MANUFACTURING

FACILITIES²

OCTOBER 2021 9

STRICTLY PRIVATE &

CONFIDENTIALView entire presentation