Terran Orbital SPAC Presentation Deck

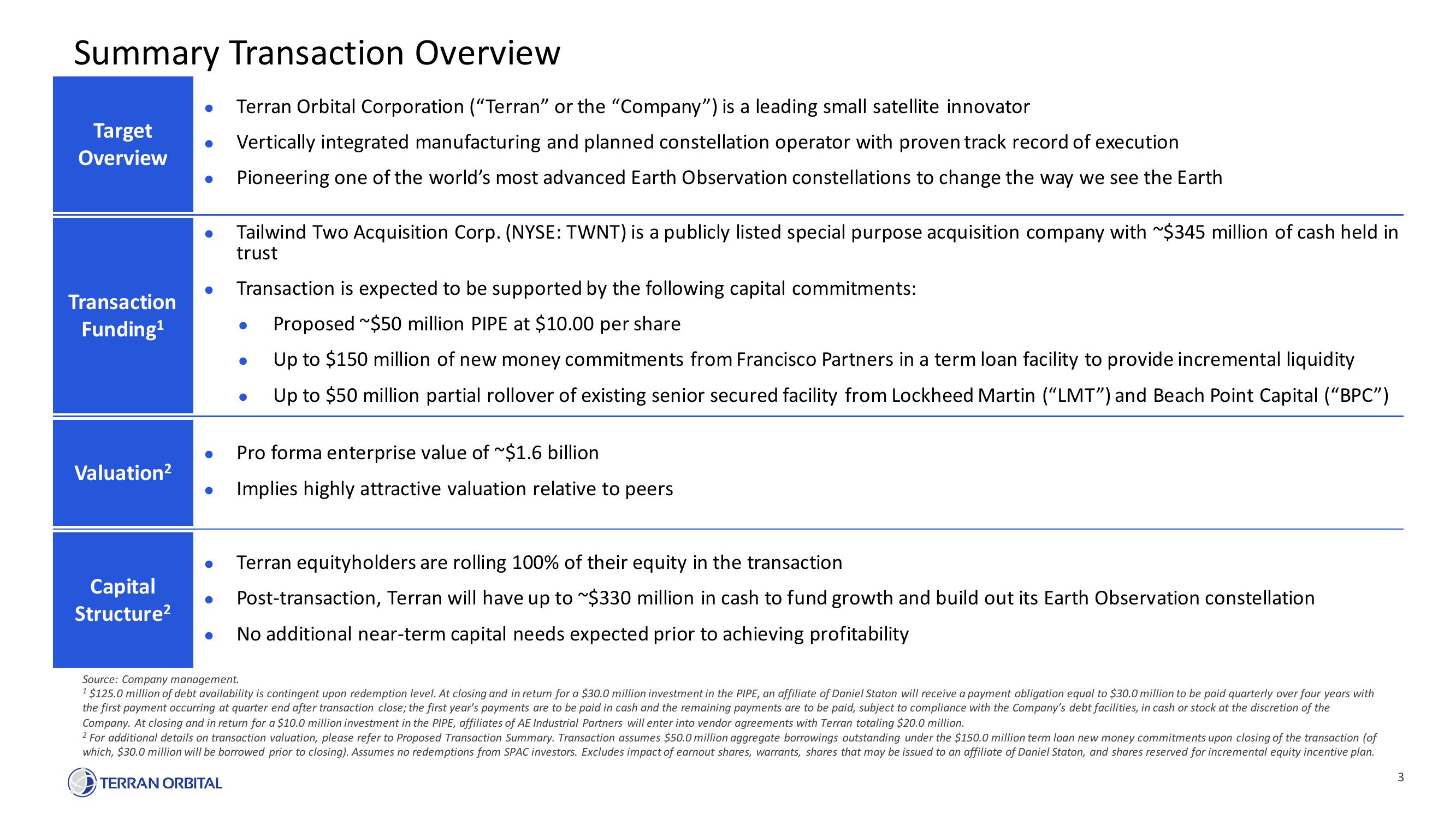

Summary Transaction Overview

Target

Overview

Transaction

Funding¹

Valuation²

Capital

Structure²

●

●

Terran Orbital Corporation ("Terran" or the "Company") is a leading small satellite innovator

Vertically integrated manufacturing and planned constellation operator with proven track record of execution

Pioneering one of the world's most advanced Earth Observation constellations to change the way we see the Earth

Tailwind Two Acquisition Corp. (NYSE: TWNT) is a publicly listed special purpose acquisition company with ~$345 million of cash held in

trust

Transaction is expected to be supported by the following capital commitments:

Proposed ~$50 million PIPE at $10.00 per share

Up to $150 million of new money commitments from Francisco Partners in a term loan facility to provide incremental liquidity

Up to $50 million partial rollover of existing senior secured facility from Lockheed Martin ("LMT") and Beach Point Capital ("BPC")

●

Pro forma enterprise value of ~$1.6 billion

Implies highly attractive valuation relative to peers

Terran equityholders are rolling 100% of their equity in the transaction

Post-transaction, Terran will have up to ~$330 million in cash to fund growth and build out its Earth Observation constellation

No additional near-term capital needs expected prior to achieving profitability

Source: Company management.

¹ $125.0 million of debt availability is contingent upon redemption level. At closing and in return for a $30.0 million investment in the PIPE, an affiliate of Daniel Staton will receive a payment obligation equal to $30.0 million to be paid quarterly over four years with

the first payment occurring at quarter end after transaction close; the first year's payments are to be paid in cash and the remaining payments are to be paid, subject to compliance with the Company's debt facilities, in cash or stock at the discretion of the

Company. At closing and in return for a $10.0 million investment in the PIPE, affiliates of AE Industrial Partners will enter into vendor agreements with Terran totaling $20.0 million.

2 For additional details on transaction valuation, please refer to Proposed Transaction Summary. Transaction assumes $50.0 million aggregate borrowings outstanding under the $150.0 million term loan new money commitments upon closing of the transaction (of

which, $30.0 million will be borrowed prior to closing). Assumes no redemptions from SPAC investors. Excludes impact of earnout shares, warrants, shares that may be issued to an affiliate of Daniel Staton, and shares reserved for incremental equity incentive plan.

TERRAN ORBITAL

3View entire presentation