Topps SPAC Presentation Deck

5

Transaction Summary

■

2

MDP

3

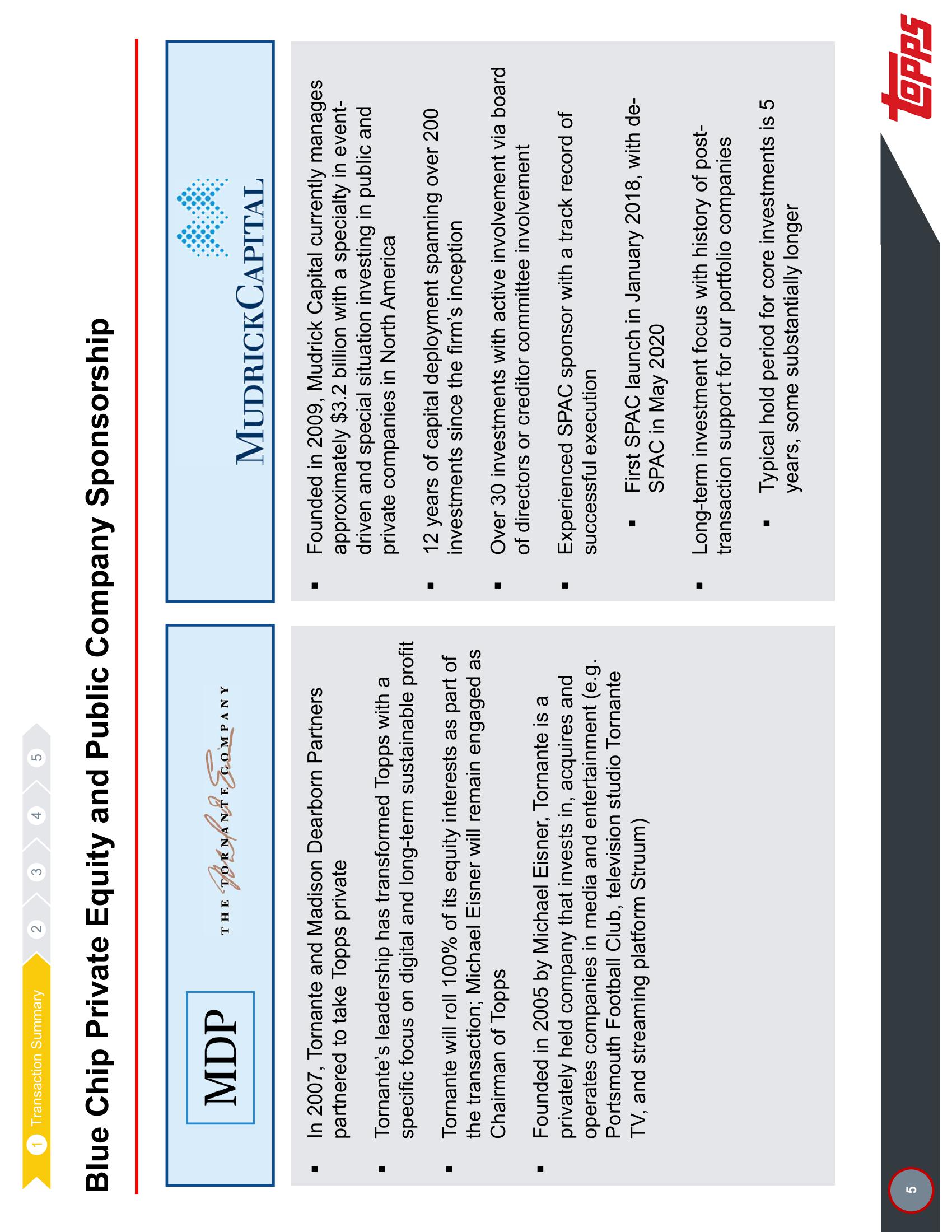

Blue Chip Private Equity and Public Company Sponsorship

4

5

VORNANTE

THE TORNANTE COMPANY

In 2007, Tornante and Madison Dearborn Partners

partnered to take Topps private

Tornante's leadership has transformed Topps with a

specific focus on digital and long-term sustainable profit

Tornante will roll 100% of its equity interests as part of

the transaction; Michael Eisner will remain engaged as

Chairman of Topps

Founded in 2005 by Michael Eisner, Tornante is a

privately held company that invests in, acquires and

operates companies in media and entertainment (e.g.

Portsmouth Football Club, television studio Tornante

TV, and streaming platform Struum)

MUDRICKCAPITAL

Founded in 2009, Mudrick Capital currently manages

approximately $3.2 billion with a specialty in event-

driven and special situation investing in public and

private companies in North America

12 years of capital deployment spanning over 200

investments since the firm's inception

Over 30 investments with active involvement via board

of directors or creditor committee involvement

Experienced SPAC sponsor with a track record of

successful execution

L

First SPAC launch in January 2018, with de-

SPAC in May 2020

Long-term investment focus with history of post-

transaction support for our portfolio companies

Typical hold period for core investments is 5

years, some substantially longer

toppsView entire presentation