Zegna Results Presentation Deck

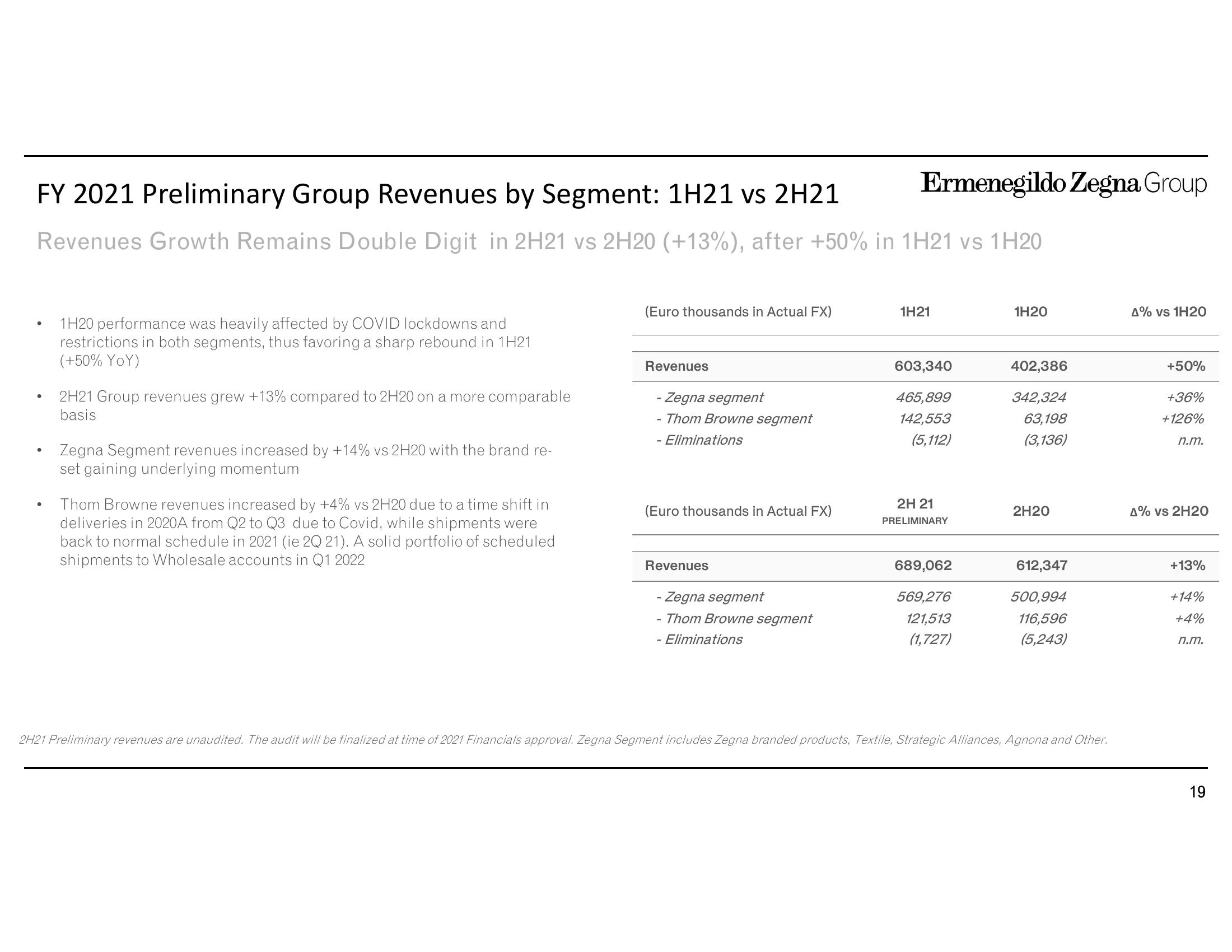

FY 2021 Preliminary Group Revenues by Segment: 1H21 vs 2H21

Revenues Growth Remains Double Digit in 2H21 vs 2H20 (+13%), after +50% in 1H21 vs 1H20

●

●

1H20 performance was heavily affected by COVID lockdowns and

restrictions in both segments, thus favoring a sharp rebound in 1H21

(+50% YoY)

2H21 Group revenues grew +13% compared to 2H20 on a more comparable

basis.

Zegna Segment revenues increased by +14% vs 2H20 with the brand re-

set gaining underlying momentum

Thom Browne revenues increased by +4% vs 2H20 due to a time shift in

deliveries in 2020A from Q2 to Q3 due to Covid, while shipments were

back to normal schedule in 2021 (ie 2Q 21). A solid portfolio of scheduled

shipments to Wholesale accounts in Q1 2022

(Euro thousands in Actual FX)

Revenues

- Zegna segment

- Thom Browne segment

- Eliminations

(Euro thousands in Actual FX)

Revenues

Ermenegildo Zegna Group

- Zegna segment

- Thom Browne segment

- Eliminations

1H21

603,340

465,899

142,553

(5,112)

2H 21

PRELIMINARY

689,062

569,276

121,513

(1,727)

1H20

402,386

342,324

63,198

(3,136)

2H20

612,347

500,994

116,596

(5,243)

2H21 Preliminary revenues are unaudited. The audit will be finalized at time of 2021 Financials approval. Zegna Segment includes Zegna branded products, Textile, Strategic Alliances, Agnona and Other.

A% vs 1H20

+50%

+36%

+126%

n.m.

4% vs 2H20

+13%

+14%

+4%

n.m.

19View entire presentation