BenevolentAI Investor Day Presentation Deck

1H 2022 Financial highlights

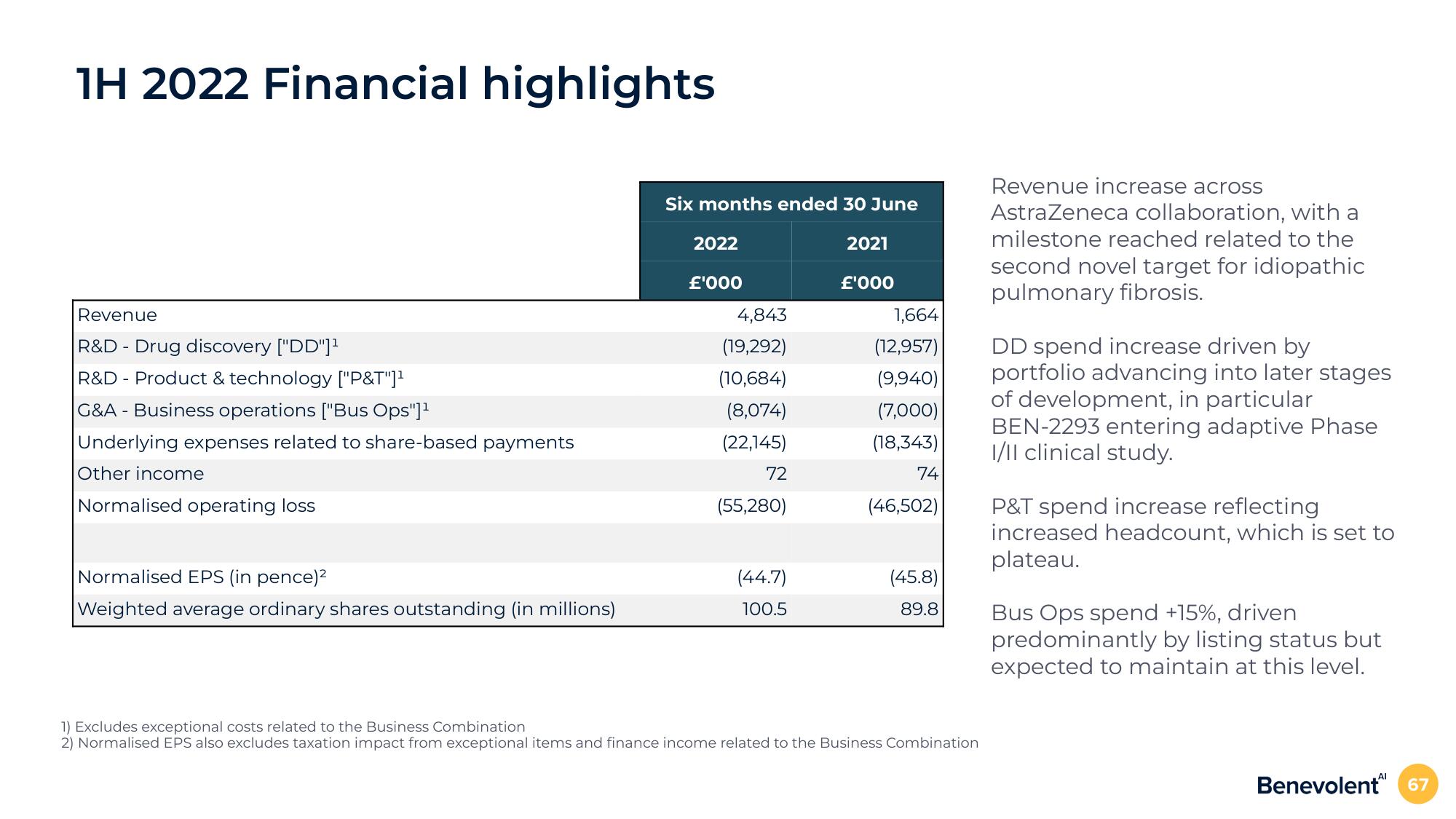

Revenue

R&D - Drug discovery ["DD"]¹

R&D - Product & technology ["P&T"]¹

G&A - Business operations ["Bus Ops"]¹

Underlying expenses related to share-based payments

Other income

Normalised operating loss

Normalised EPS (in pence)²

Weighted average ordinary shares outstanding (in millions)

Six months ended 30 June

2022

£'000

4,843

(19,292)

(10,684)

(8,074)

(22,145)

72

(55,280)

(44.7)

100.5

2021

£'000

1,664

(12,957)

(9,940)

(7,000)

(18,343)

74

(46,502)

(45.8)

89.8

1) Excludes exceptional costs related to the Business Combination

2) Normalised EPS also excludes taxation impact from exceptional items and finance income related to the Business Combination

Revenue increase across

AstraZeneca collaboration, with a

milestone reached related to the

second novel target for idiopathic

pulmonary fibrosis.

DD spend increase driven by

portfolio advancing into later stages

of development, in particular

BEN-2293 entering adaptive Phase

I/II clinical study.

P&T spend increase reflecting

increased headcount, which is set to

plateau.

Bus Ops spend +15%, driven

predominantly by listing status but

expected to maintain at this level.

Benevolent 67View entire presentation