Sweetheart Brands Acquisition

●

●

●

●

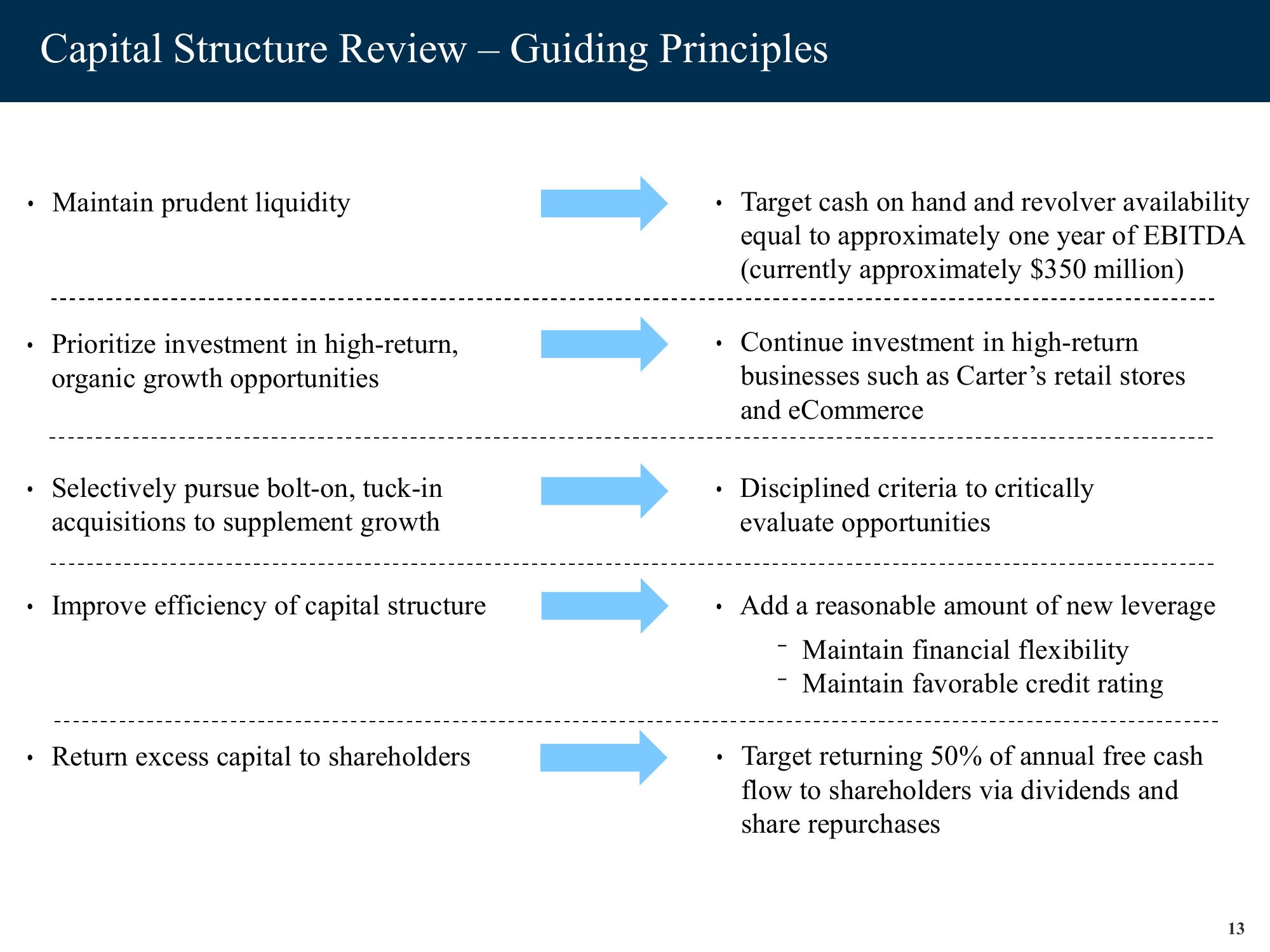

Capital Structure Review – Guiding Principles

Maintain prudent liquidity

Prioritize investment in high-return,

organic growth opportunities

Selectively pursue bolt-on, tuck-in

acquisitions to supplement growth

Improve efficiency of capital structure

Return excess capital to shareholders

●

●

●

●

Target cash on hand and revolver availability

equal to approximately one year of EBITDA

(currently approximately $350 million)

Continue investment in high-return

businesses such as Carter's retail stores

and eCommerce

Disciplined criteria to critically

evaluate opportunities

Add a reasonable amount of new leverage

Maintain financial flexibility

Maintain favorable credit rating

Target returning 50% of annual free cash

flow to shareholders via dividends and

share repurchases

13View entire presentation