Hanmi Financial Results Presentation Deck

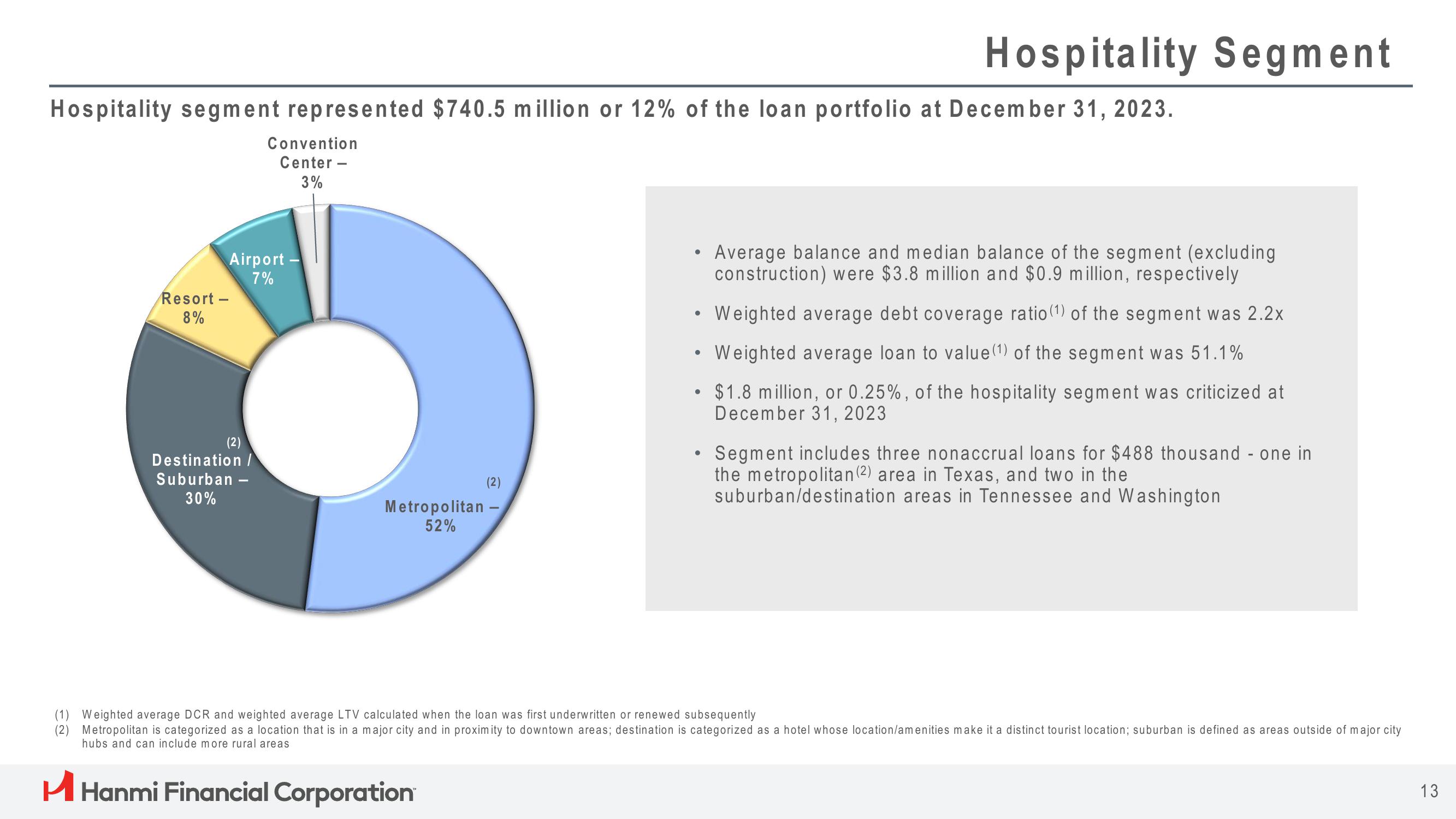

Hospitality segment represented $740.5 million or 12% of the loan portfolio at December 31, 2023.

Resort -

8%

Convention

Center -

3%

Airport

7%

(2)

Destination /

Suburban -

30%

(2)

Metropolitan -

52%

●

Hospitality Segment

●

Average balance and median balance of the segment (excluding

construction) were $3.8 million and $0.9 million, respectively

Weighted average debt coverage ratio (1) of the segment was 2.2x

Weighted average loan to value (1) of the segment was 51.1%

$1.8 million, or 0.25%, of the hospitality segment was criticized at

December 31, 2023

• Segment includes three nonaccrual loans for $488 thousand - one in

the metropolitan (2) area in Texas, and two in the

suburban/destination areas in Tennessee and Washington

(1) Weighted average DCR and weighted average LTV calculated when the loan was first underwritten or renewed subsequently

(2) Metropolitan is categorized as a location that is in a major city and in proximity to downtown areas; destination is categorized as a hotel whose location/amenities make it a distinct tourist location; suburban is defined as areas outside of major city

hubs and can include more rural areas

H Hanmi Financial Corporation

13View entire presentation