Grindr Investor Presentation Deck

3

Market

Positioning

Monthly

Active Users(1)

Daily Time Spent

Per User(2)

# Of Countries (3)

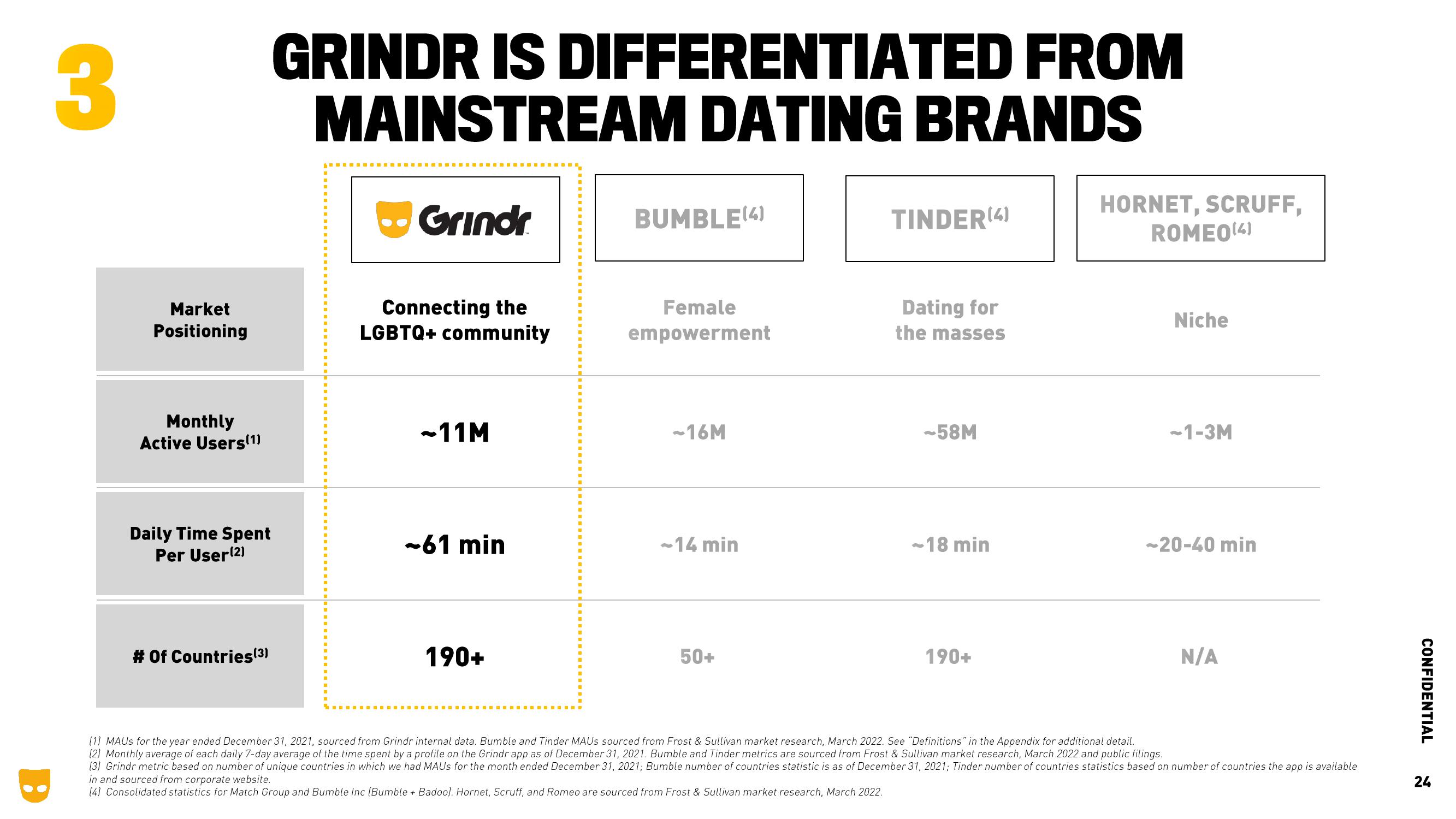

GRINDR IS DIFFERENTIATED FROM

MAINSTREAM DATING BRANDS

‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒

■

Grindr

Connecting the

LGBTQ+ community

-11M

-61 min

190+

‒‒‒‒‒‒‒‒‒

"

B

■

1

1

■

H

■

"

·

U

"

■

■

■

H

■

"

■

■

B

M

■

1

-

D

"

■

‒‒‒‒‒D

BUMBLE(4)

Female

empowerment

-16M

~14 min

50+

TINDER (4)

Dating for

the masses

-58M

-18 min

190+

HORNET, SCRUFF,

ROMEO (4)

Niche

-1-3M

-20-40 min

N/A

(1) MAUs for the year ended December 31, 2021, sourced from Grindr internal data. Bumble and Tinder MAUS sourced from Frost & Sullivan market research, March 2022. See "Definitions" in the Appendix for additional detail.

(2) Monthly average of each daily 7-day average of the time spent by a profile on the Grindr app as of December 31, 2021. Bumble and Tinder metrics are sourced from Frost & Sullivan market research, March 2022 and public filings.

(3) Grindr metric based on number of unique countries in which we had MAUS for the month ended December 31, 2021; Bumble number of countries statistic is as of December 31, 2021; Tinder number of countries statistics based on number of countries the app is available

in and sourced from corporate website.

(4) Consolidated statistics for Match Group and Bumble Inc (Bumble + Badoo). Hornet, Scruff, and Romeo are sourced from Frost & Sullivan market research, March 2022.

CONFIDENTIAL

24View entire presentation