Citi Investment Banking Pitch Book

Situation Overview

• Aleris Life Inc. (Nasdaq: "ALR"), f/k/a Five Star Senior

Living Inc., operates an evolving portfolio of residential and

lifestyle services for older adults

2

• Facing financial and operational difficulties, ALR began

restructuring its business in 2019 by reaching an

agreement with its main landlord, Diversified Healthcare

Trust (Nasdaq: "DHC"), f/k/a as Senior Housing Properties

Trust, to restructure the business arrangement between

the parties

- In addition to the replacement of master leases with

management agreements, the agreement provided for

the issuance of ALR stock to DHC (externally

managed by The RMR Group LLC, a subsidiary of

The RMR Group Inc. (collectively, "RMR")), resulting

in DHC becoming a significant shareholder of

AlerisLife (currently owning 32.8% of ALR's common

stock)

• ABP Trust ("ABP"), a private entity owned and controlled

by Adam Portnoy, approached ALR in late 2022 with the

intention to acquire ALR in coordination with DHC in an

all-cash transaction

(2)

(3)

(4)

Separately, ALR has a business management

agreement with RMR

-

Following several weeks of negotiations, ABP

proposed an offer price of $1.31 per share,

representing a premium of approximately 62% over

the closing share price on February 2, 2023

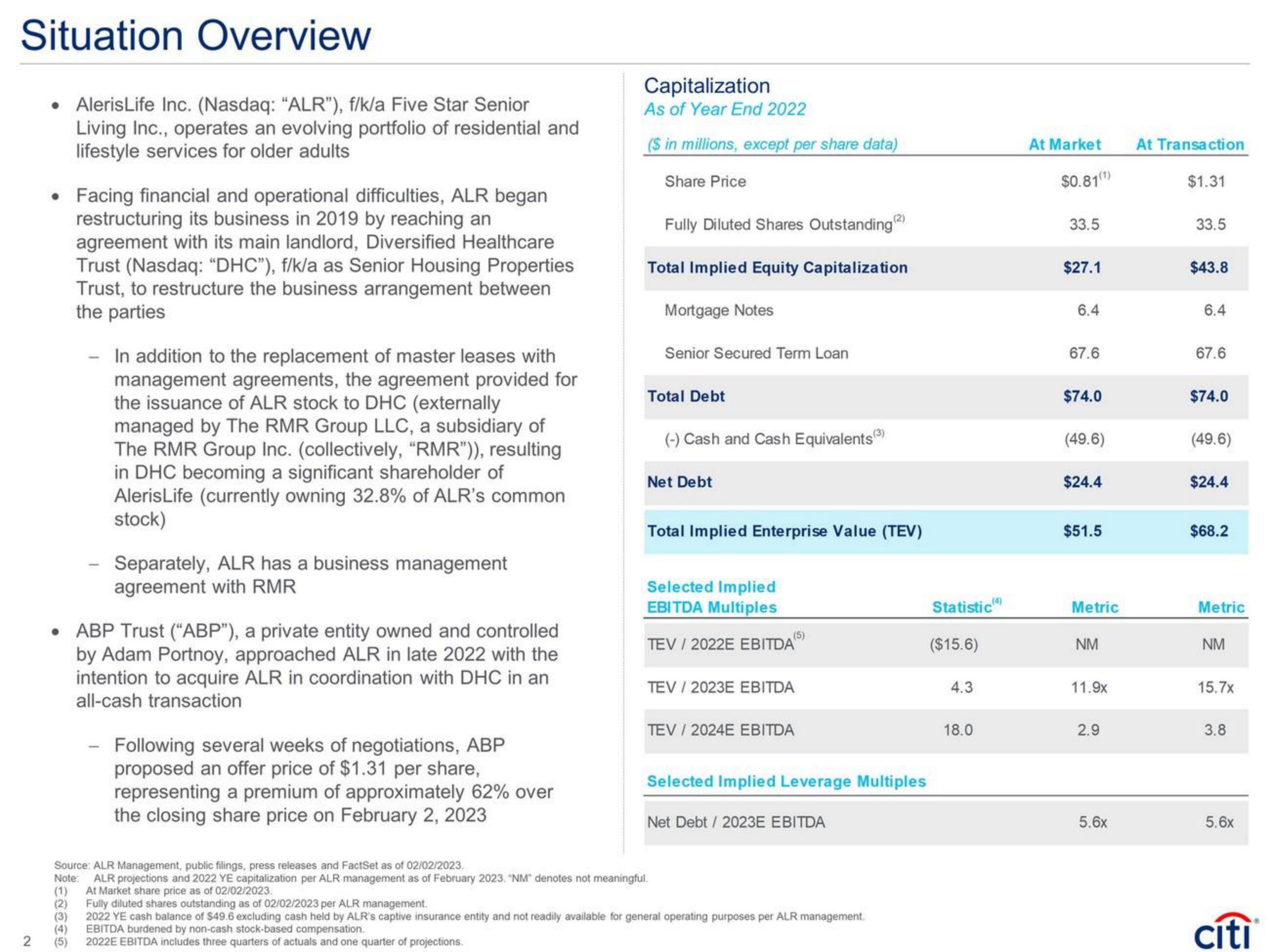

Capitalization

As of Year End 2022

($ in millions, except per share data)

Share Price

Fully Diluted Shares Outstanding (2)

Total Implied Equity Capitalization

Mortgage Notes

Senior Secured Term Loan

Total Debt

(-) Cash and Cash Equivalents(3

Net Debt

Total Implied Enterprise Value (TEV)

Selected Implied

EBITDA Multiples

TEV / 2022E EBITDA

TEV / 2023E EBITDA

Source: ALR Management, public filings, press releases and FactSet as of 02/02/2023.

Note: ALR projections and 2022 YE capitalization per ALR management as of February 2023. "NM denotes not meaningful.

(1) At Market share price as of 02/02/2023.

TEV / 2024E EBITDA

Selected Implied Leverage Multiples

Net Debt / 2023E EBITDA

Fully diluted shares outstanding as of 02/02/2023 per ALR management.

2022 YE cash balance of $49.6 excluding cash held by ALR's captive insurance entity and not readily available for general operating purposes per ALR management.

EBITDA burdened by non-cash stock-based compensation.

2022E EBITDA includes three quarters of actuals and one quarter of projections.

Statistic(4)

($15.6)

4.3

18.0

At Market

$0.81(¹)

33.5

$27.1

6.4

67.6

$74.0

(49.6)

$24.4

$51.5

Metric

NM

11.9x

2.9

5.6x

At Transaction

$1.31

33.5

$43.8

6.4

67.6

$74.0

(49.6)

$24.4

$68.2

Metric

NM

15.7x

3.8

5.6x

cítiView entire presentation