Origin SPAC Presentation Deck

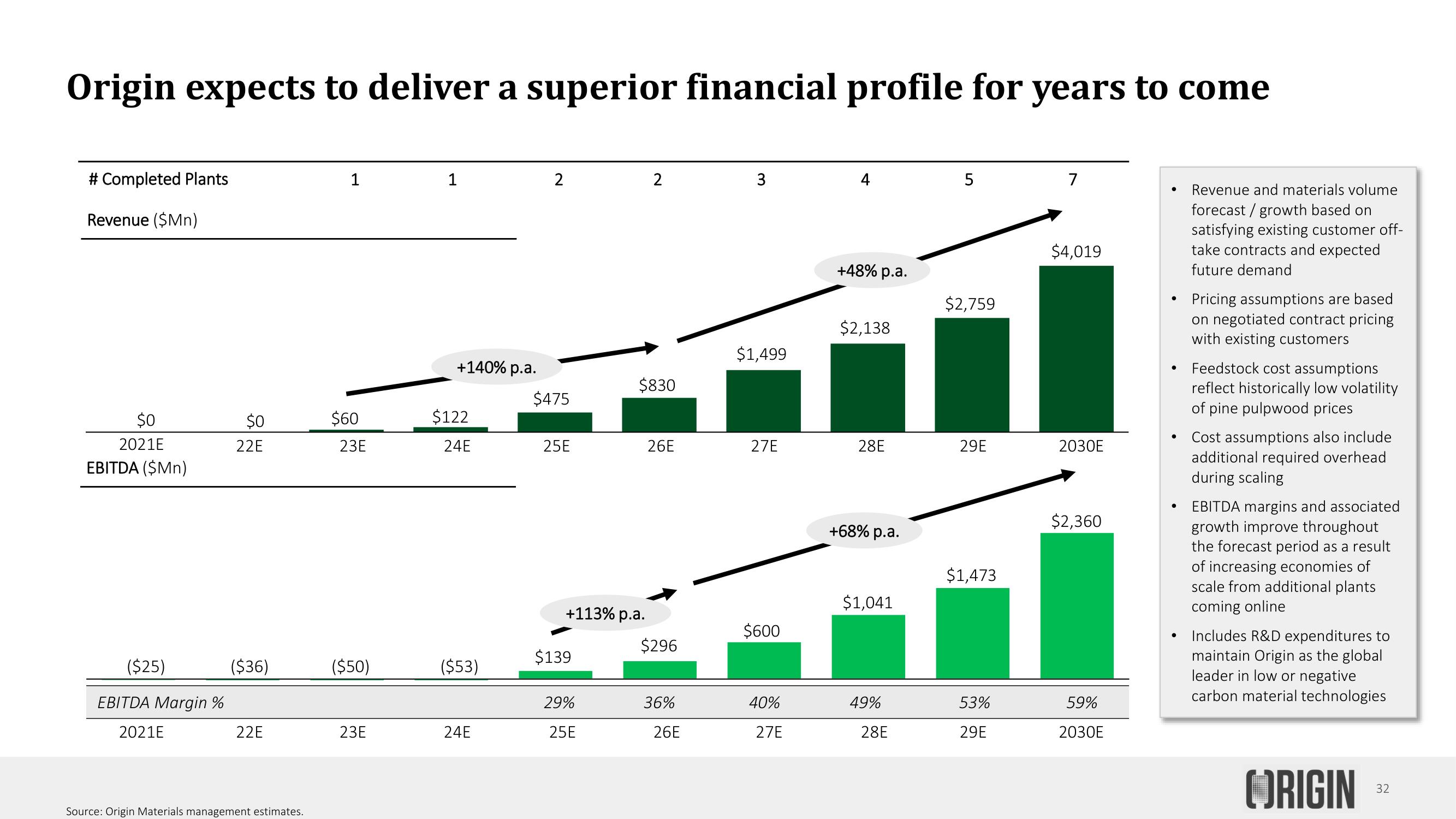

Origin expects to deliver a superior financial profile for years to come

# Completed Plants

Revenue ($Mn)

$0

2021E

EBITDA ($Mn)

EB

($25)

Margin %

2021E

$0

22E

($36)

22E

Source: Origin Materials management estimates.

1

$60

23E

($50)

23E

1

+140% p.a.

$122

24E

($53)

24E

2

$475

25E

+113% p.a.

$139

29%

25E

2

$830

26E

$296

36%

26E

3

$1,499

27E

$600

0%

27E

+48% p.a.

$2,138

28E

+68% p.a.

$1,041

49%

28E

5

$2,759

29E

$1,473

53%

29E

7

$4,019

2030E

$2,360

59%

2030E

●

●

●

●

Revenue and materials volume

forecast / growth based on

satisfying existing customer off-

take contracts and expected

future demand

Pricing assumptions are based

on negotiated contract pricing

with existing customers

Feedstock cost assumptions

reflect historically low volatility

of pine pulpwood prices

Cost assumptions also include

additional required overhead

during scaling

EBITDA margins and associated

growth improve throughout

the forecast period as a result

of increasing economies of

scale from additional plants

coming online

Includes R&D expenditures to

maintain Origin as the global

leader in low or negative

carbon material technologies

ORIGIN

32View entire presentation