Affirm Investor Day Presentation Deck

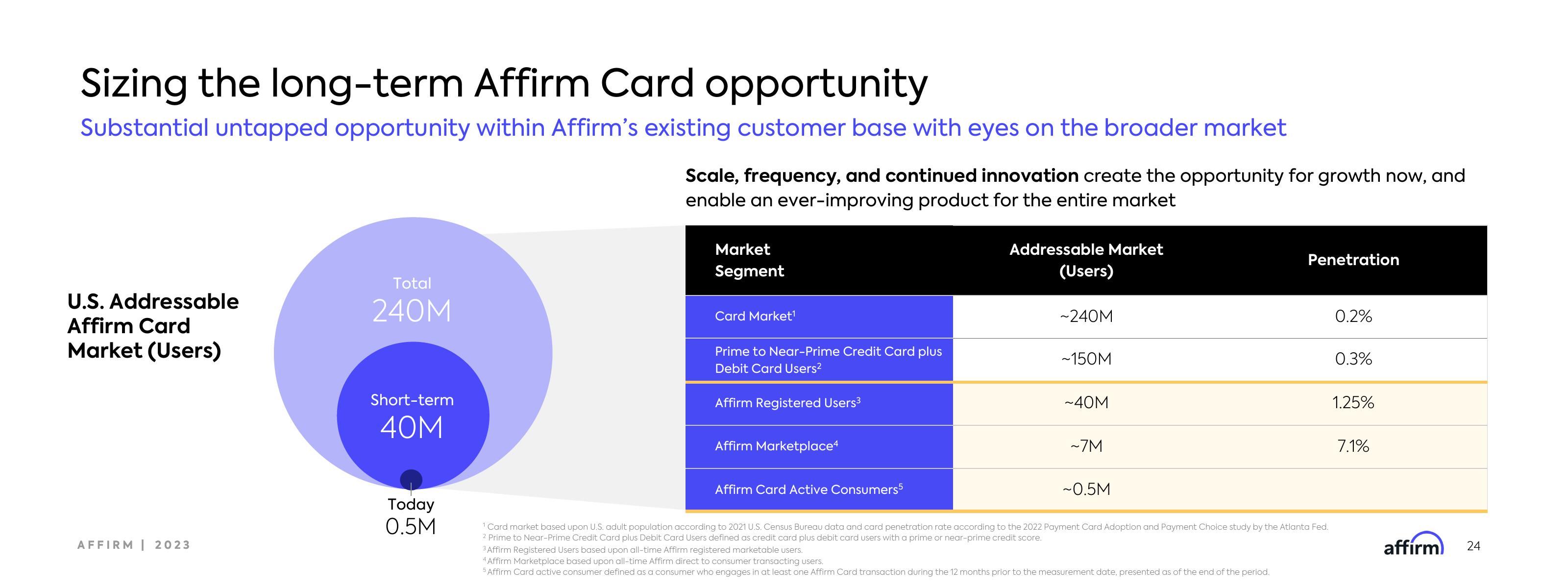

Sizing the long-term Affirm Card opportunity

Substantial untapped opportunity within Affirm's existing customer base with eyes on the broader market

U.S. Addressable

Affirm Card

Market (Users)

AFFIRM | 2023

Total

240M

Short-term

40M

Today

0.5M

Scale, frequency, and continued innovation create the opportunity for growth now, and

enable an ever-improving product for the entire market

Market

Segment

Card Market¹

Prime to Near-Prime Credit Card plus

Debit Card Users²

Affirm Registered Users³

Affirm Marketplace4

Affirm Card Active Consumers5

Addressable Market

(Users)

~240M

~150M

~40M

~7M

~0.5M

Penetration

1 Card market based upon U.S. adult population according to 2021 U.S. Census Bureau data and card penetration rate according to the 2022 Payment Card Adoption and Payment Choice study by the Atlanta Fed.

2 Prime to Near-Prime Credit Card plus Debit Card Users defined as credit card plus debit card users with a prime or near-prime credit score.

3 Affirm Registered Users based upon all-time Affirm registered marketable users.

4 Affirm Marketplace based upon all-time Affirm direct to consumer transacting users.

5 Affirm Card active consumer defined as a consumer who engages in at least one Affirm Card transaction during the 12 months prior to the measurement date, presented as of the end of the period.

0.2%

0.3%

1.25%

7.1%

affirm

24View entire presentation