HHR Investor Presentation Deck

Financial leverage

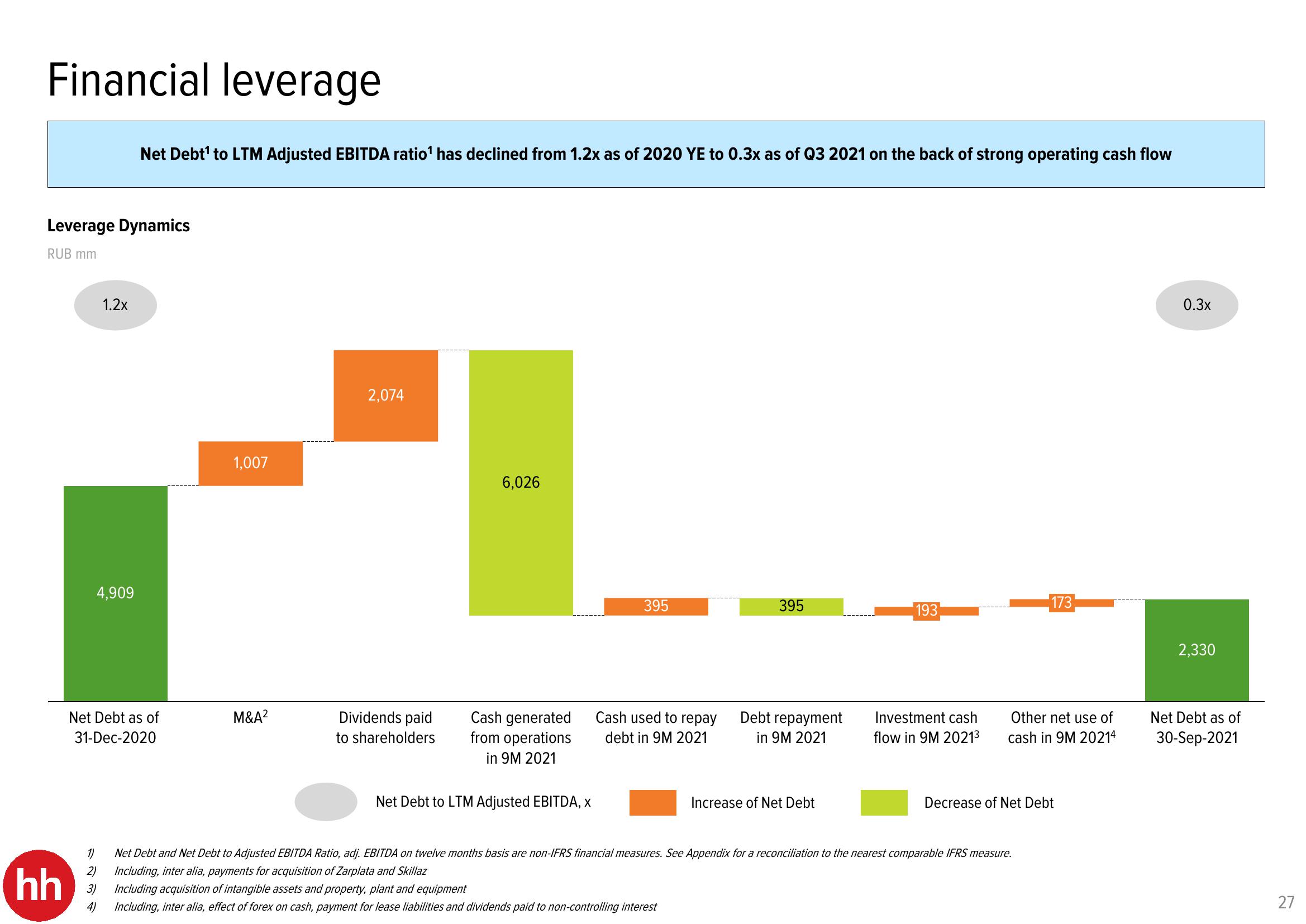

Leverage Dynamics

RUB mm

hh

1.2x

4,909

Net Debt¹ to LTM Adjusted EBITDA ratio¹ has declined from 1.2x as of 2020 YE to 0.3x as of Q3 2021 on the back of strong operating cash flow

1)

2)

3)

4)

Net Debt as of

31-Dec-2020

1,007

M&A²

2,074

Dividends paid

to shareholders

6,026

Cash generated

from operations

in 9M 2021

Net Debt to LTM Adjusted EBITDA, X

395

Cash used to repay

debt in 9M 2021

395

Debt repayment

in 9M 2021

Increase of Net Debt

193

Investment cash

flow in 9M 2021³

173

Other net use of

cash in 9M 20214

Decrease of Net Debt

Net Debt and Net Debt to Adjusted EBITDA Ratio, adj. EBITDA on twelve months basis are non-IFRS financial measures. See Appendix for a reconciliation to the nearest comparable IFRS measure.

Including, inter alia, payments for acquisition of Zarplata and Skillaz

Including acquisition of intangible assets and property, plant and equipment

Including, inter alia, effect of forex on cash, payment for lease liabilities and dividends paid to non-controlling interest

0.3x

2,330

Net Debt as of

30-Sep-2021

27View entire presentation