MSR Value Growth & Market Trends

14 |

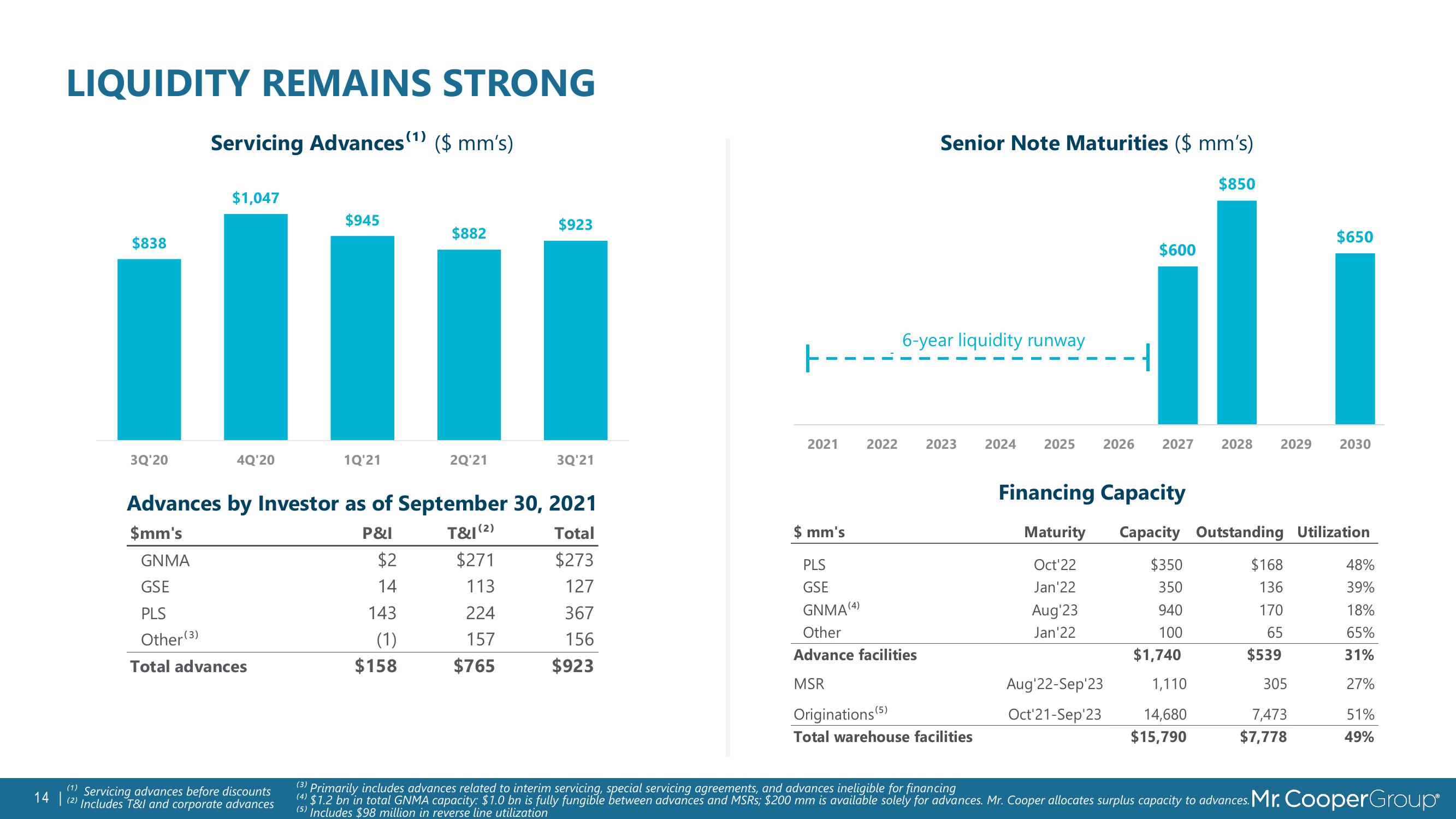

LIQUIDITY REMAINS STRONG

Servicing Advances (1) ($ mm's)

$838

3Q'20

$1,047

4Q'20

GNMA

GSE

PLS

Other (3)

Total advances

(1) Servicing advances before discounts

$945

(2) Includes T&I and corporate advances

1Q'21

Advances by Investor as of September 30, 2021

$mm's

P&I

T&I (2)

Total

$273

127

367

156

$923

$2

14

$882

143

(1)

$158

2Q¹21

$271

113

$923

224

157

$765

3Q'21

Senior Note Maturities ($ mm's)

6-year liquidity runway

2021 2022 2023 2024 2025

$ mm's

PLS

GSE

GNMA (4)

Other

Advance facilities

MSR

Originations (5)

Total warehouse facilities

$850

$650

$600

ili

Aug 22-Sep¹23

Oct¹21-Sep'23

2026 2027

Financing Capacity

Maturity

Oct¹22

Jan 22

Aug 23

Jan'22

Capacity Outstanding Utilization

$350

350

940

100

$1,740

2028 2029 2030

1,110

14,680

$15,790

$168

136

170

65

$539

305

7,473

$7,778

48%

39%

18%

65%

31%

27%

51%

49%

(3) Primarily includes advances related to interim servicing, special servicing agreements, and advances ineligible for financing

(4) $1.2 bn in total GNMA capacity: $1.0 bn is fully fungible between advances and MSRs; $200 mm is available solely for advances. Mr. Cooper allocates surplus capacity to advances. Mr. CooperGroup

(5) Includes $98 million in reverse line utilizationView entire presentation