Ford Investor Conference Presentation Deck

U.S. FLOORPLAN SECURITIZATION

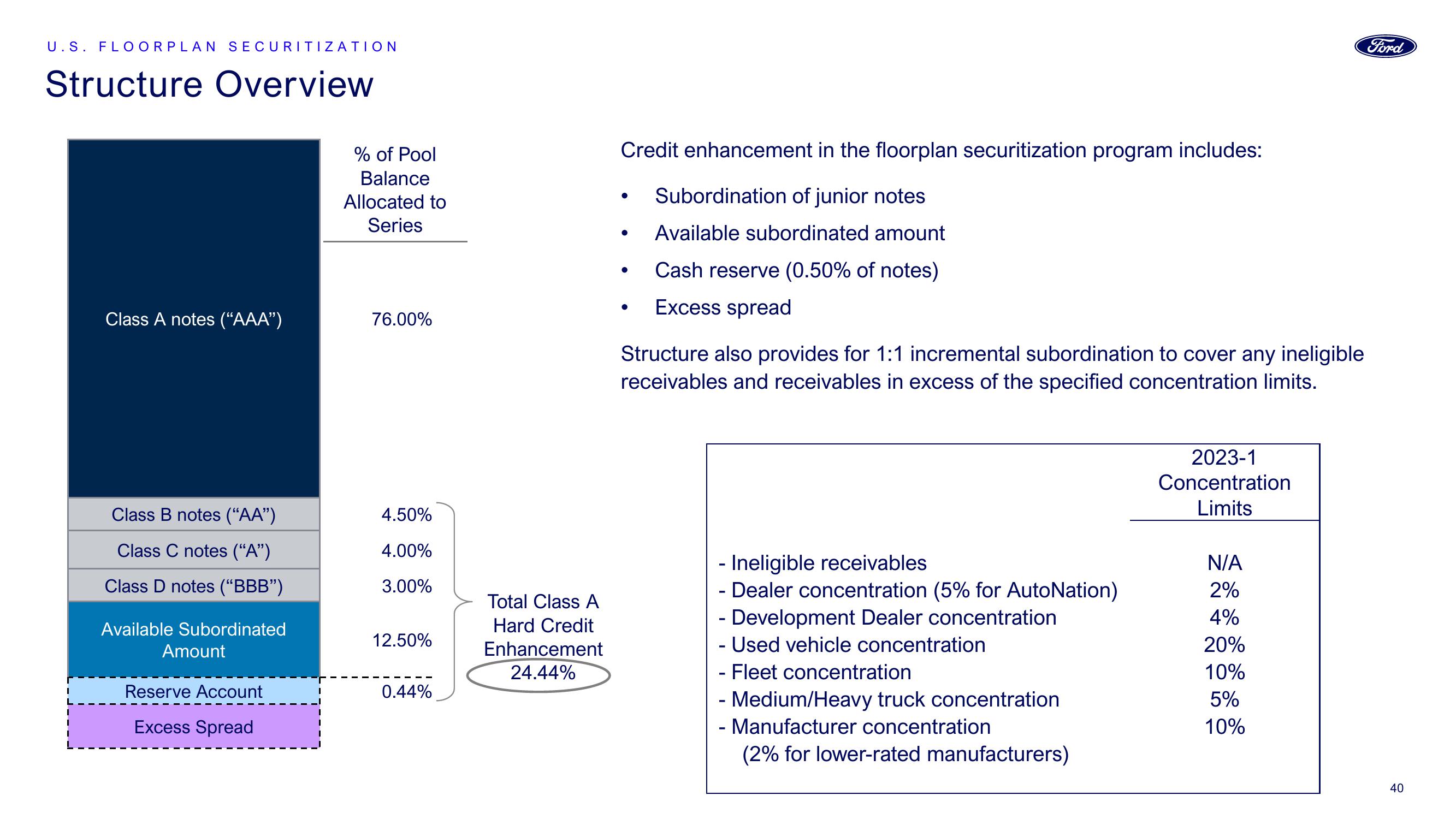

Structure Overview

Class A notes ("AAA")

Class B notes (“AA”)

Class C notes ("A")

Class D notes ("BBB")

Available Subordinated

Amount

Reserve Account

Excess Spread

% of Pool

Balance

Allocated to

Series

76.00%

4.50%

4.00%

3.00%

12.50%

0.44%

Total Class A

Hard Credit

Enhancement

24.44%

Credit enhancement in the floorplan securitization program includes:

Subordination of junior notes

Available subordinated amount

●

●

Cash reserve (0.50% of notes)

Excess spread

Structure also provides for 1:1 incremental subordination to cover any ineligible

receivables and receivables in excess of the specified concentration limits.

- Ineligible receivables

- Dealer concentration (5% for AutoNation)

- Development Dealer concentration

- Used vehicle concentration

- Fleet concentration

- Medium/Heavy truck concentration

- Manufacturer concentration

(2% for lower-rated manufacturers)

2023-1

Concentration

Limits

N/A

2%

4%

20%

10%

5%

10%

Ford

40View entire presentation