FY 2017 Second Quarter Earnings Call

Non-GAAP reconciliations

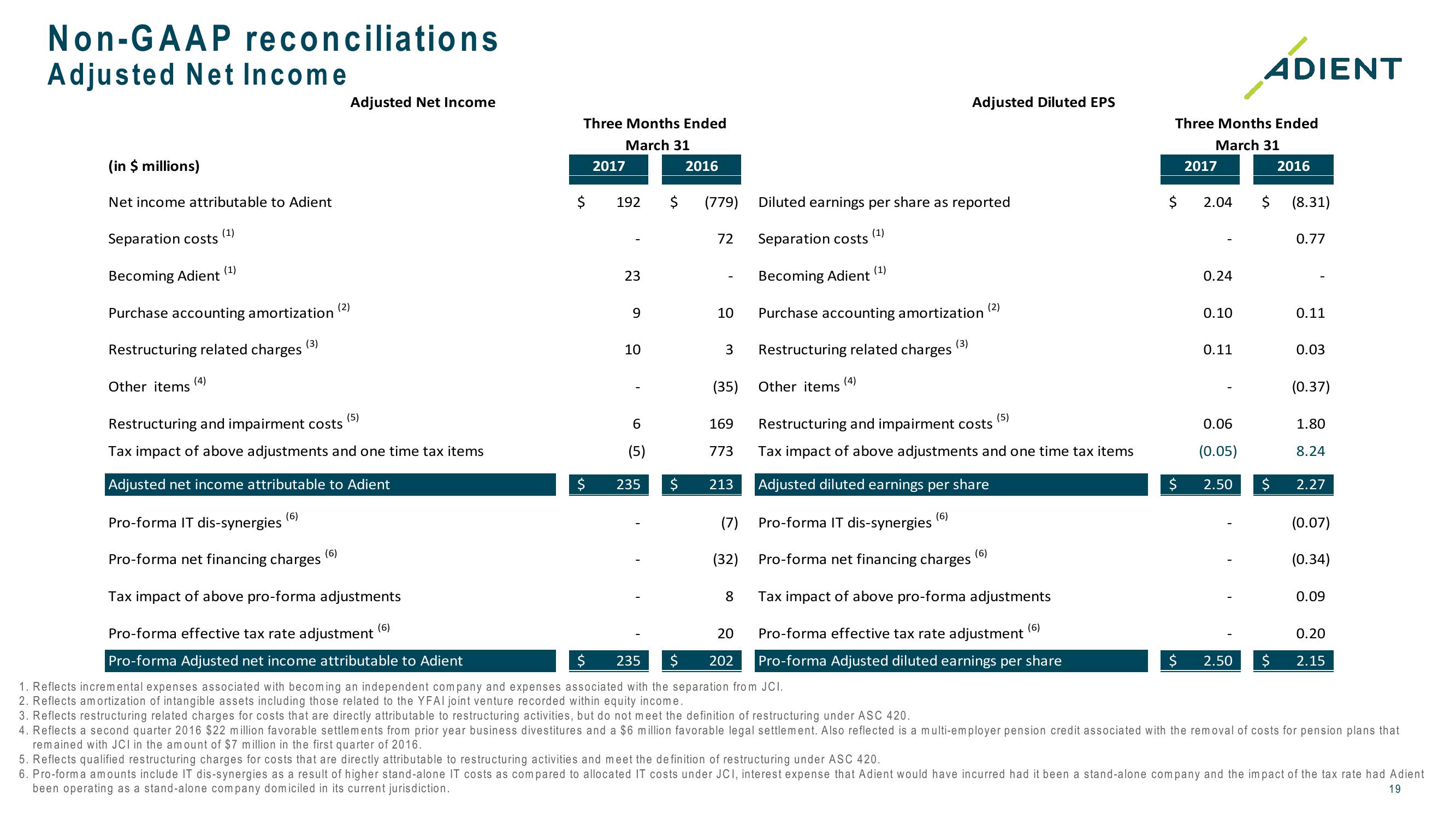

Adjusted Net Income

(in $ millions)

Net income attributable to Adient

Separation costs

(1)

Becoming Adient

(1)

Purchase accounting amortization

(2)

(3)

Restructuring related charges

Other items

(4)

Adjusted Net Income

Restructuring and impairment costs

(5)

Tax impact of above adjustments and one time tax items

Adjusted net income attributable to Adient

(6)

Pro-forma IT dis-synergies

Pro-forma net financing charges

(6)

Tax impact of above pro-forma adjustments

(6)

Pro-forma effective tax rate adjustment

Pro-forma Adjusted net income attributable to Adient

Adjusted Diluted EPS

ADIENT

Three Months Ended

March 31

Three Months Ended

March 31

2017

2016

2017

2016

$ 192 $ (779)

Diluted earnings per share as reported

$ 2.04 $ (8.31)

72

Separation costs

(1)

0.77

23

Becoming Adient

(1)

0.24

(2)

9

10

Purchase accounting amortization

0.10

0.11

(3)

10

3

Restructuring related charges

0.11

0.03

(4)

(35)

Other items

(0.37)

(5)

9

169

Restructuring and impairment costs

0.06

1.80

(5)

773

Tax impact of above adjustments and one time tax items

(0.05)

8.24

St

$

235

$

213

Adjusted diluted earnings per share

$

2.50 $

2.27

(6)

(7)

Pro-forma IT dis-synergies

(0.07)

(32)

Pro-forma net financing charges

(6)

(0.34)

8

Tax impact of above pro-forma adjustments

0.09

(6)

20

$

235

$

202

Pro-forma effective tax rate adjustment

Pro-forma Adjusted diluted earnings per share

0.20

$

2.50 $

2.15

1. Reflects incremental expenses associated with becoming an independent company and expenses associated with the separation from JCI.

2. Reflects amortization of intangible assets including those related to the YFAI joint venture recorded within equity income.

3. Reflects restructuring related charges for costs that are directly attributable to restructuring activities, but do not meet the definition of restructuring under ASC 420.

4. Reflects a second quarter 2016 $22 million favorable settlements from prior year business divestitures and a $6 million favorable legal settlement. Also reflected is a multi-employer pension credit associated with the removal of costs for pension plans that

remained with JCI in the amount of $7 million in the first quarter of 2016.

5. Reflects qualified restructuring charges for costs that are directly attributable to restructuring activities and meet the definition of restructuring under ASC 420.

6. Pro-forma amounts include IT dis-synergies as a result of higher stand-alone IT costs as compared to allocated IT costs under JCI, interest expense that Adient would have incurred had it been a stand-alone company and the impact of the tax rate had Adient

been operating as a stand-alone company domiciled in its current jurisdiction.

19View entire presentation