Kinnevik Results Presentation Deck

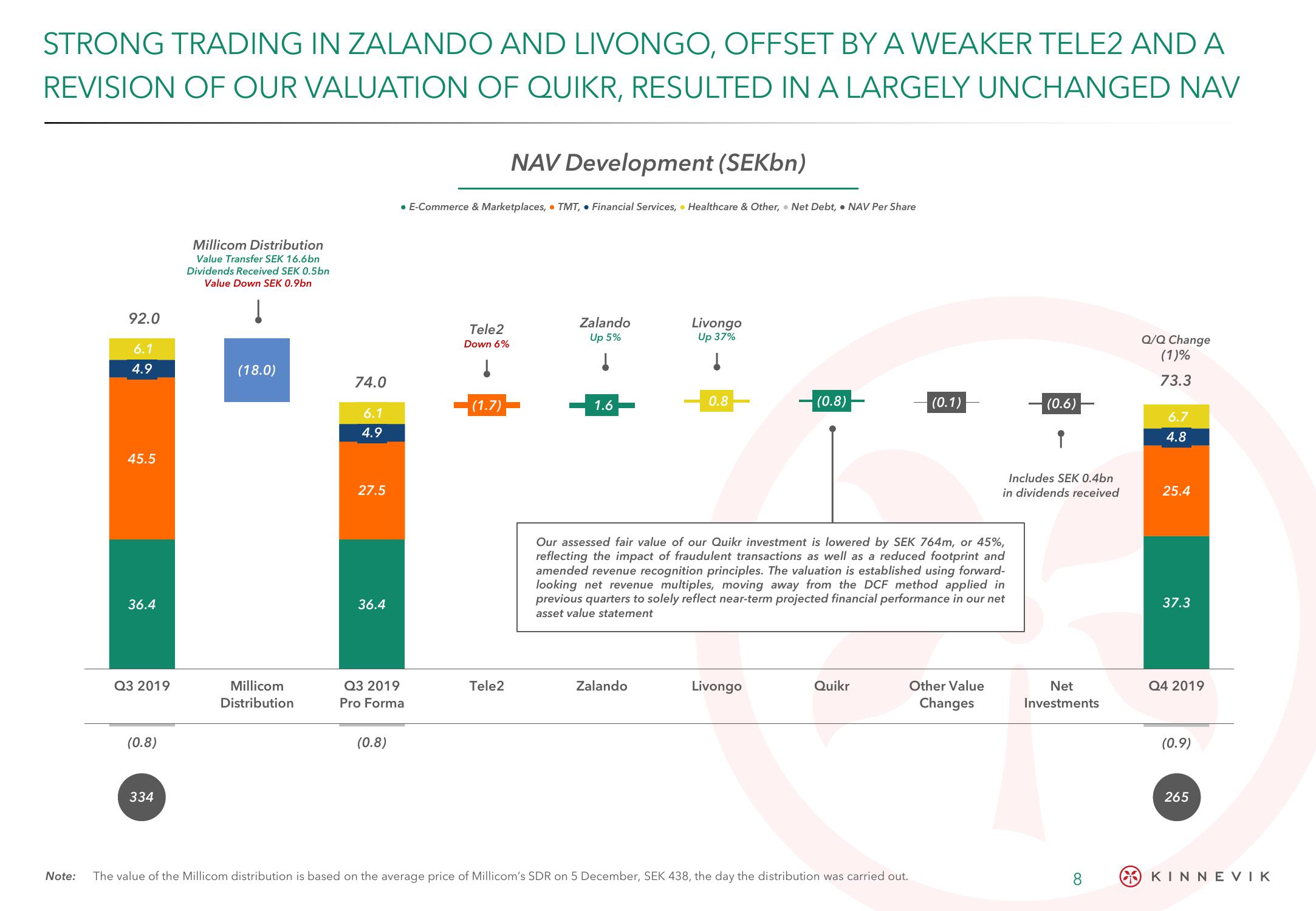

STRONG TRADING IN ZALANDO AND LIVONGO, OFFSET BY A WEAKER TELE2 AND A

REVISION OF OUR VALUATION OF QUIKR, RESULTED IN A LARGELY UNCHANGED NAV

Note:

92.0

6.1

4.9

45.5

36.4

Q3 2019

(0.8)

334

Millicom Distribution

Value Transfer SEK 16.6bn

Dividends Received SEK 0.5bn

Value Down SEK 0.9bn

(18.0)

Millicom

Distribution

74.0

6.1

4.9

27.5

36.4

Q3 2019

Pro Forma

(0.8)

• E-Commerce & Marketplaces, TMT, Financial Services, Healthcare & Other, Net Debt, NAV Per Share

Tele2

Down 6%

Į

(1.7)

NAV Development (SEKbn)

Tele2

Zalando

Up 5%

1.6

Livongo

Up 37%

Zalando

0.8

(0.8)

Livongo

Our assessed fair value of our Quikr investment is lowered by SEK 764m, or 45%,

reflecting the impact of fraudulent transactions as well as a reduced footprint and

amended revenue recognition principles. The valuation is established using forward-

looking net revenue multiples, moving away from the DCF method applied in

previous quarters to solely reflect near-term projected financial performance in our net

asset value statement

Quikr

(0.1)

Other Value

Changes

The value of the Millicom distribution is based on the average price of Millicom's SDR on 5 December, SEK 438, the day the distribution was carried out.

(0.6)

Includes SEK 0.4bn

in dividends received

Net

Investments

8

Q/Q Change

(1)%

73.3

6.7

4.8

25.4

37.3

Q4 2019

(0.9)

265

KINNEVIKView entire presentation