Bakkt SPAC Presentation Deck

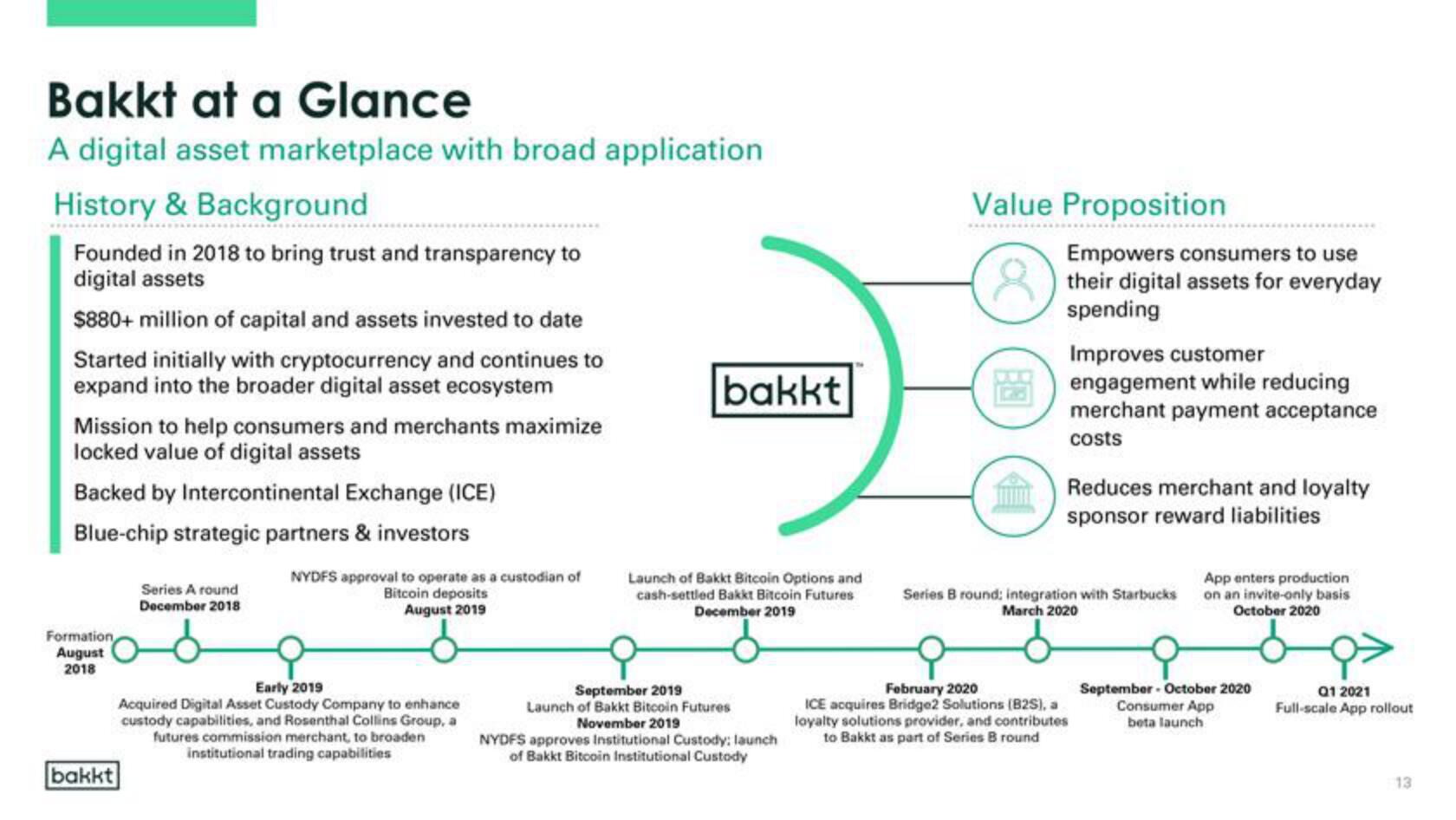

Bakkt at a Glance

A digital asset marketplace with broad application

History & Background

Founded in 2018 to bring trust and transparency to

digital assets

$880+ million of capital and assets invested to date

Started initially with cryptocurrency and continues to

expand into the broader digital asset ecosystem

Mission to help consumers and merchants maximize

locked value of digital assets

Backed by Intercontinental Exchange (ICE)

Blue-chip strategic partners & investors

Formation

August

2018

bakkt

Series Around

December 2018

NYDFS approval to operate as a custodian of

Bitcoin deposits

August 2019

Early 2019

Acquired Digital Asset Custody Company to enhance

custody capabilities, and Rosenthal Collins Group, a

futures commission merchant, to broaden

institutional trading capabilities

bakkt

Launch of Bakkt Bitcoin Options and

cash-settled Bakkt Bitcoin Futures

December 2019

September 2019

Launch of Bakkt Bitcoin Futures

November 2019

NYDFS approves Institutional Custody: launch

of Bakkt Bitcoin Institutional Custody

Value Proposition

Empowers consumers to use

their digital assets for everyday

spending

Improves customer

engagement while reducing

merchant payment acceptance

costs

Reduces merchant and loyalty

sponsor reward liabilities

Series B round: integration with Starbucks

March 2020

February 2020

ICE acquires Bridge2 Solutions (B2S), a

loyalty solutions provider, and contributes

to Bakkt as part of Series B round

App enters production

on an invite-only basis

October 2020

September October 2020

Consumer App

beta launch

Q1 2021

Full-scale App rollout

13View entire presentation