Nikola SPAC Presentation Deck

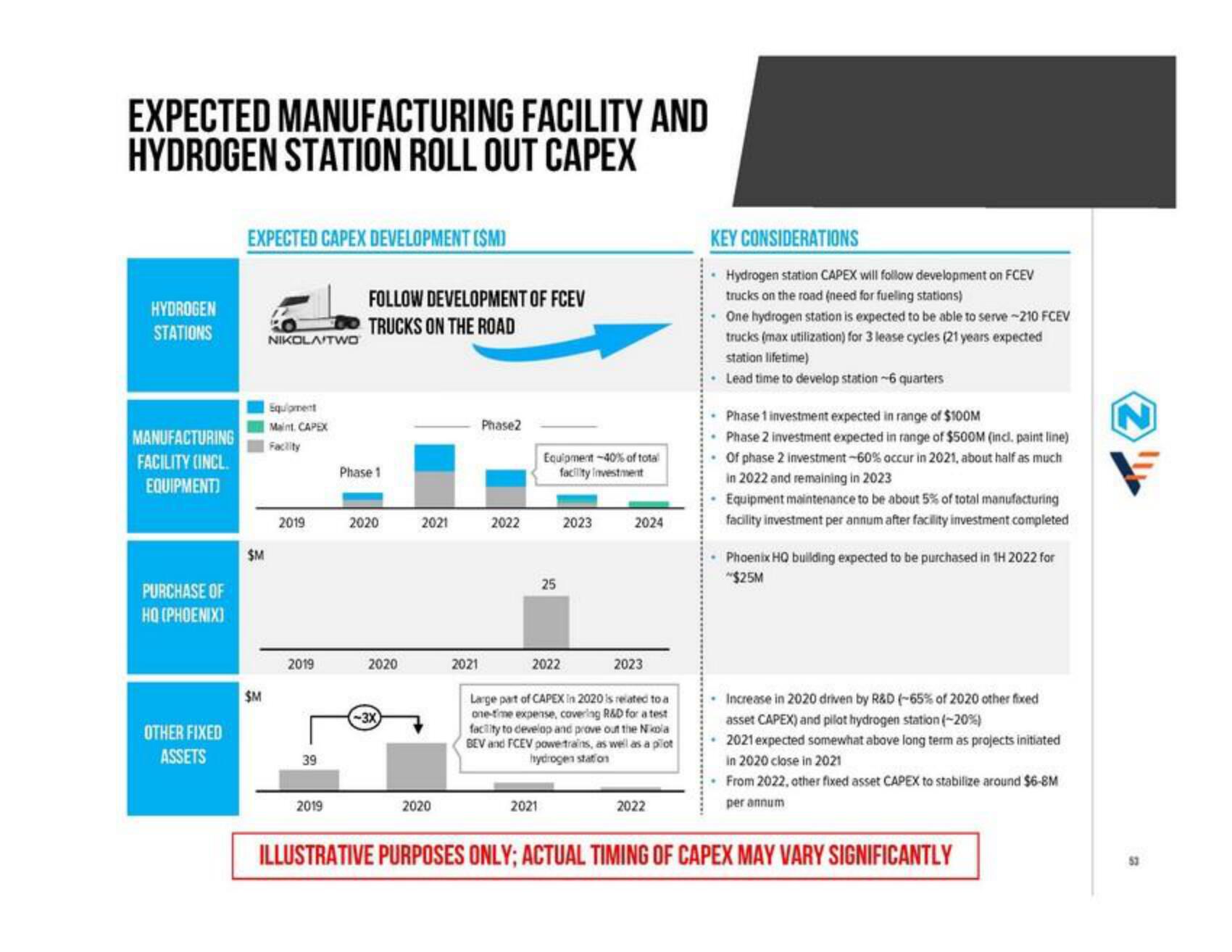

EXPECTED MANUFACTURING FACILITY AND

HYDROGEN STATION ROLL OUT CAPEX

HYDROGEN

STATIONS

MANUFACTURING

FACILITY (INCL.

EQUIPMENT)

PURCHASE OF

HQ (PHOENIX)

OTHER FIXED

ASSETS

EXPECTED CAPEX DEVELOPMENT (SM)

$M

$M

NIKOLA TWO

Equipment

Maint. CAPEX

Facility

2019

2019

39

2019

FOLLOW DEVELOPMENT OF FCEV

TRUCKS ON THE ROAD

Phase 1

2020

2020

-3X

2021

2020

2021

Phase2

2022

Equipment -40% of total

facility Investment

25

2022

2021

2023

2024

2023

Large part of CAPEX in 2020 is related to a

one-time expense, covering R&D for a test

facility to develop and prove out the Nikola

BEV and FCEV powertrains, as well as a plot

hydrogen station

2022

KEY CONSIDERATIONS

Hydrogen station CAPEX will follow development on FCEV

trucks on the road (need for fuelling stations)

One hydrogen station is expected to be able to serve -210 FCEV

trucks (max utilization) for 3 lease cycles (21 years expected

station lifetime)

Lead time to develop station -6 quarters

Phase 1 investment expected in range of $100M

Phase 2 investment expected in range of $500M (incl. paint line)

• Of phase 2 investment-60% accur in 2021, about half as much

in 2022 and remaining in 2023

Equipment maintenance to be about 5% of total manufacturing

facility investment per annum after facility investment completed

Phoenix HQ building expected to be purchased in 1H 2022 for

$25M

• Increase in 2020 driven by R&D (-65% of 2020 other fixed

asset CAPEX) and pilot hydrogen station (-20%)

2021 expected somewhat above long term as projects initiated

in 2020 close in 2021

From 2022, other fixed asset CAPEX to stabilize around $6-8M

per annum

ILLUSTRATIVE PURPOSES ONLY; ACTUAL TIMING OF CAPEX MAY VARY SIGNIFICANTLY

53View entire presentation