Bank of America Investment Banking Pitch Book

Appendix

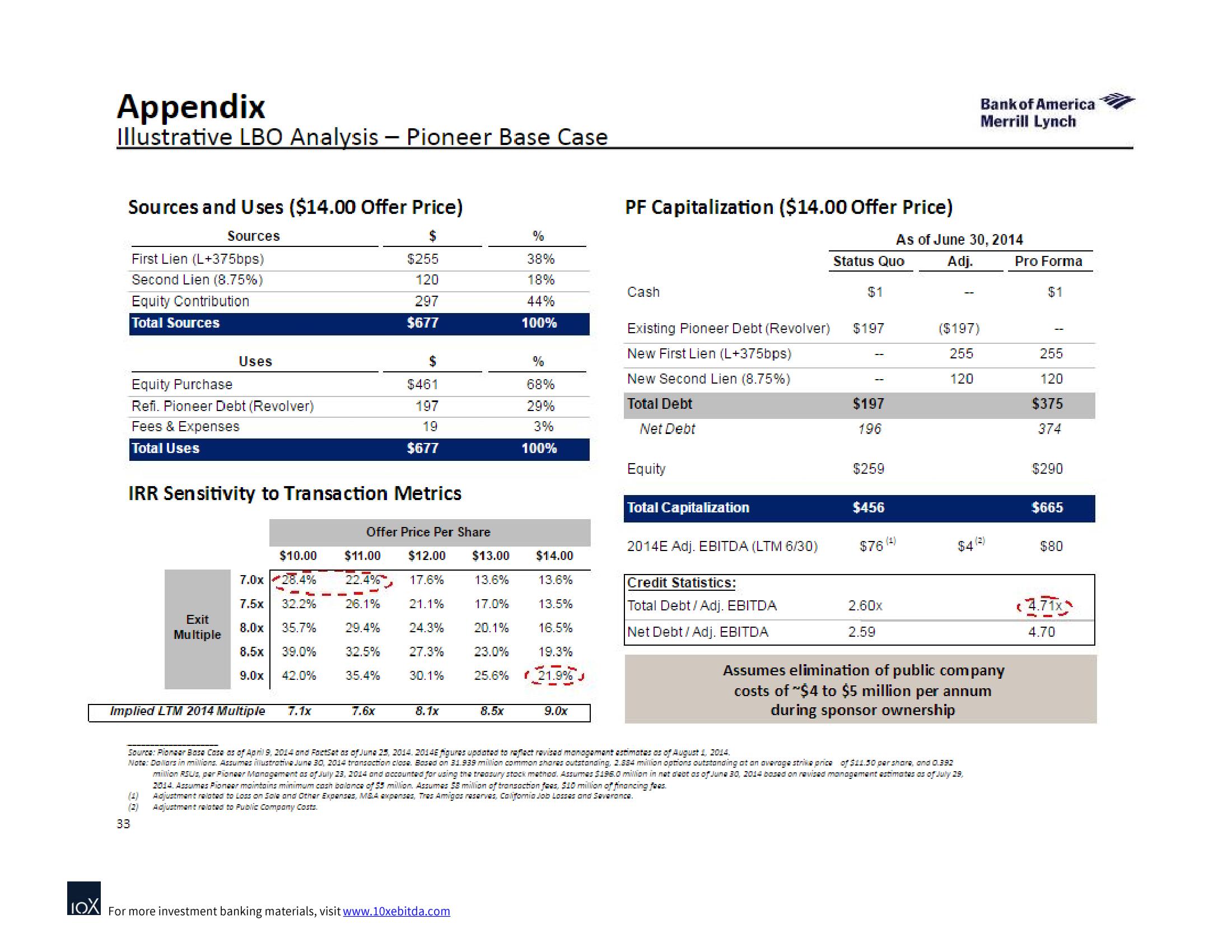

Illustrative LBO Analysis - Pioneer Base Case

Sources and Uses ($14.00 Offer Price)

Sources

$

55

120

297

$677

First Lien (L+375bps)

Second Lien (8.75%)

Equity Contribution

Total Sources

Equity Purchase

Refi. Pioneer Debt (Revolver)

Fees & Expenses

Total Uses

Uses

IRR Sensitivity to Transaction Metrics

Exit

Multiple

(2)

33

$10.00

28.4%

7.0x

7.5x 32.2%

8.0x 35.7%

8.5x 39.0%

9.0x 42.0%

Implied LTM 2014 Multiple

-

7.1x

$461

197

19

$677

7.6x

✓

Offer Price Per Share

$11.00 $12.00 $13.00 $14.00

13.6%

13.6%

22.4%

26.1%

29.4%

17.6%

21.1%

17.0%

13.5%

24.3%

20.1%

32.5%

35.4%

23.0%

16.5%

19.3%

25.6% 21.9%

27.3%

30.1%

8.1x

%

38%

18%

44%

100%

8.5x

IOX For more investment banking materials, visit www.10xebitda.com

68%

29%

3%

100%

r

9.0x

PF Capitalization ($14.00 Offer Price)

Cash

Equity

Existing Pioneer Debt (Revolver) $197

New First Lien (L+375bps)

New Second Lien (8.75%)

Total Debt

Net Debt

Total Capitalization

2014E Adj. EBITDA (LTM 6/30)

Credit Statistics:

Total Debt/Adj. EBITDA

Net Debt/Adj. EBITDA

Status Quo

$1

$197

196

$259

$456

$76

2.60x

2.59

(1)

As of June 30, 2014

Adj.

($197)

255

120

$4

Source: Pioneer Base Casa as of April 9, 2014 and FactSet as of June 25, 2014. 2014E jfigures updated to reflect revisad management estimates as of August 1, 2014.

Note: Dollars in millions. Assumes illustrative June 30, 2014 transaction close. Based on 31.939 million common shares outstanding. 2.884 million options outstanding at an average strike price of $11.30 pershare, and 0.392

milion RSUS, per Pioneer Management as of July 23, 2014 and accounted for using the treasury stock method. Assumes $195.0 million in net d'eot as of June 30, 2014 based on ravised management estimates as of July 29,

2014. Assumes Pioneer maintains minimum cash balance of 53 million. Assumes 58 million of transaction fees, $10 million of financing fees

Adjustment related to Loss on Sola and Other Expenses, M&A expenses, Tres Amigos reservas, California Job Losses and Savarance.

Adjustment related to Public Company Costs.

Bank of America

Merrill Lynch

(2)

Assumes elimination of public company

costs of $4 to $5 million per annum

during sponsor ownership

Pro Forma

$1

(

255

120

$375

374

$290

$665

$80

4.71x

4.70View entire presentation