Playboy Investor Conference Presentation Deck

PLAYBOY 2020

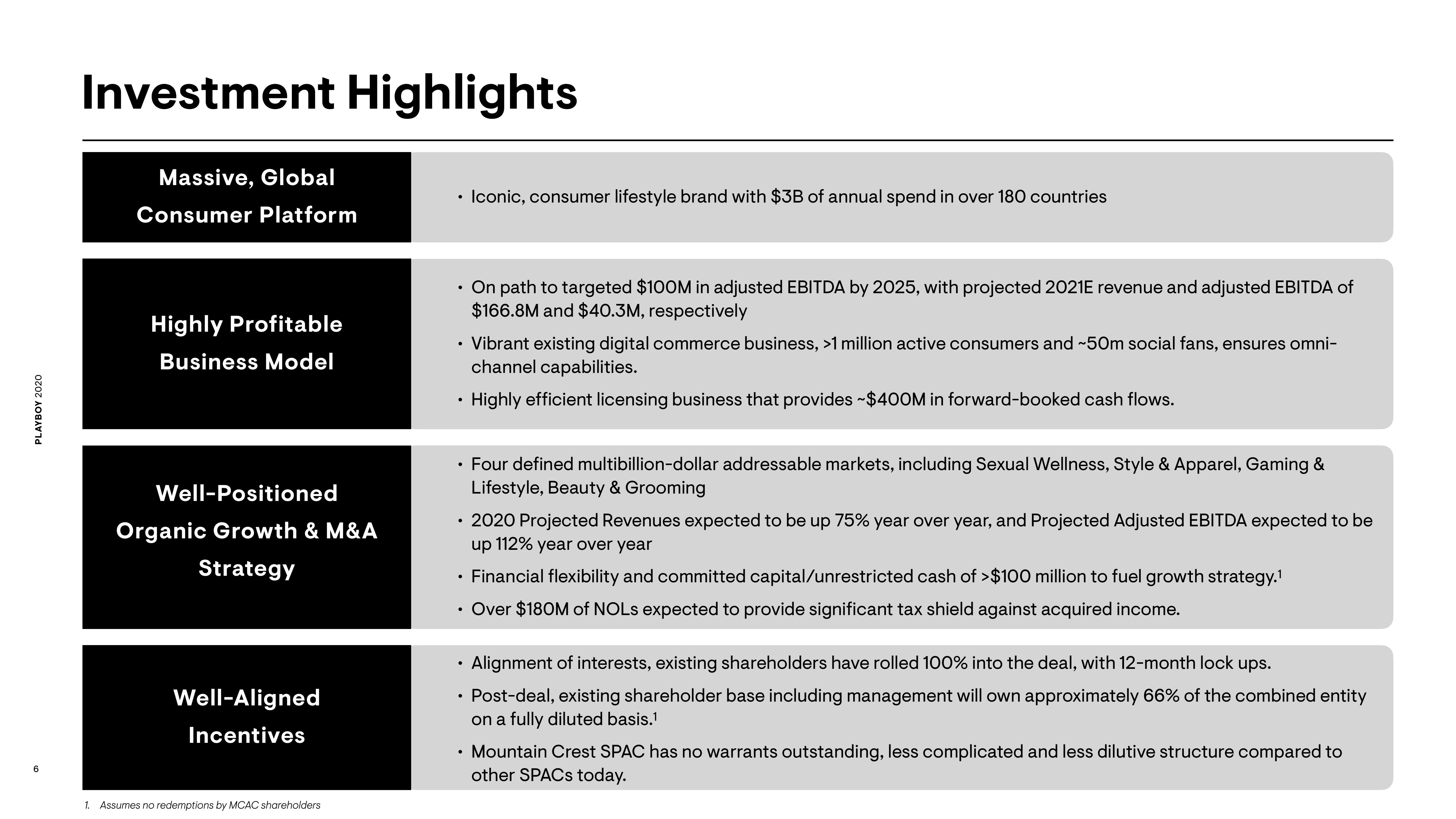

Investment Highlights

Massive, Global

Consumer Platform

Highly Profitable

Business Model

Well-Positioned

Organic Growth & M&A

Strategy

Well-Aligned

Incentives

1. Assumes no redemptions by MCAC shareholders

●

.

●

Vibrant existing digital commerce business, >1 million active consumers and ~50m social fans, ensures omni-

channel capabilities.

• Highly efficient licensing business that provides ~$400M in forward-booked cash flows.

●

Iconic, consumer lifestyle brand with $3B of annual spend in over 180 countries

• Four defined multibillion-dollar addressable markets, including Sexual Wellness, Style & Apparel, Gaming &

Lifestyle, Beauty & Grooming

On path to targeted $100M in adjusted EBITDA by 2025, with projected 2021E revenue and adjusted EBITDA of

$166.8M and $40.3M, respectively

●

.

• Alignment of interests, existing shareholders have rolled 100% into the deal, with 12-month lock ups.

Post-deal, existing shareholder base including management will own approximately 66% of the combined entity

on a fully diluted basis.¹

2020 Projected Revenues expected to be up 75% year over year, and Projected Adjusted EBITDA expected to be

up 112% year over year

Financial flexibility and committed capital/unrestricted cash of >$100 million to fuel growth strategy.¹

Over $180M of NOLs expected to provide significant tax shield against acquired income.

Mountain Crest SPAC has no warrants outstanding, less complicated and less dilutive structure compared to

other SPACs today.View entire presentation