BMO Capital Markets Investment Banking Pitch Book

BMO Capital Markets

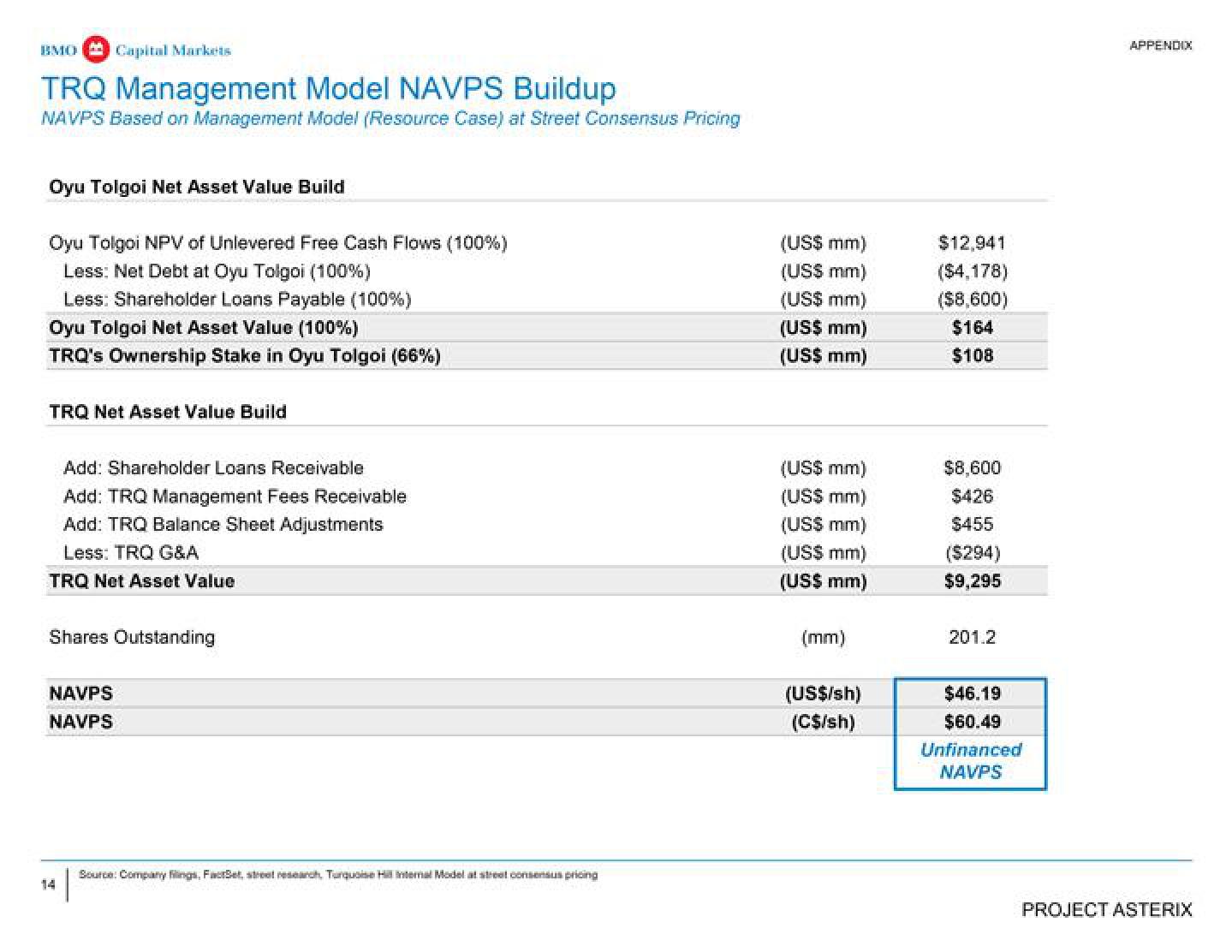

TRQ Management Model NAVPS Buildup

NAVPS Based on Management Model (Resource Case) at Street Consensus Pricing

Oyu Tolgoi Net Asset Value Build

Oyu Tolgoi NPV of Unlevered Free Cash Flows (100%)

Less: Net Debt at Oyu Tolgoi (100%)

Less: Shareholder Loans Payable (100%)

Oyu Tolgoi Net Asset Value (100%)

TRQ's Ownership Stake in Oyu Tolgoi (66%)

TRQ Net Asset Value Build

Add: Shareholder Loans Receivable

Add: TRQ Management Fees Receivable

Add: TRQ Balance Sheet Adjustments

Less: TRQ G&A

TRQ Not Asset Value

Shares Outstanding

NAVPS

NAVPS

Source: Company Fings, FactSet, street research, Turquoise Hill Internal Model at street consensus pricing

(US$ mm)

(US$ mm)

(US$ mm)

(US$ mm)

(US$ mm)

(US$ mm)

(US$ mm)

(US$ mm)

(US$ mm)

(US$ mm)

(mm)

(US$/sh)

(C$/sh)

$12,941

($4,178)

($8,600)

$164

$108

$8,600

$426

$455

($294)

$9,295

201.2

$46.19

$60.49

Unfinanced

NAVPS

APPENDIX

PROJECT ASTERIXView entire presentation