Nerdy SPAC Presentation Deck

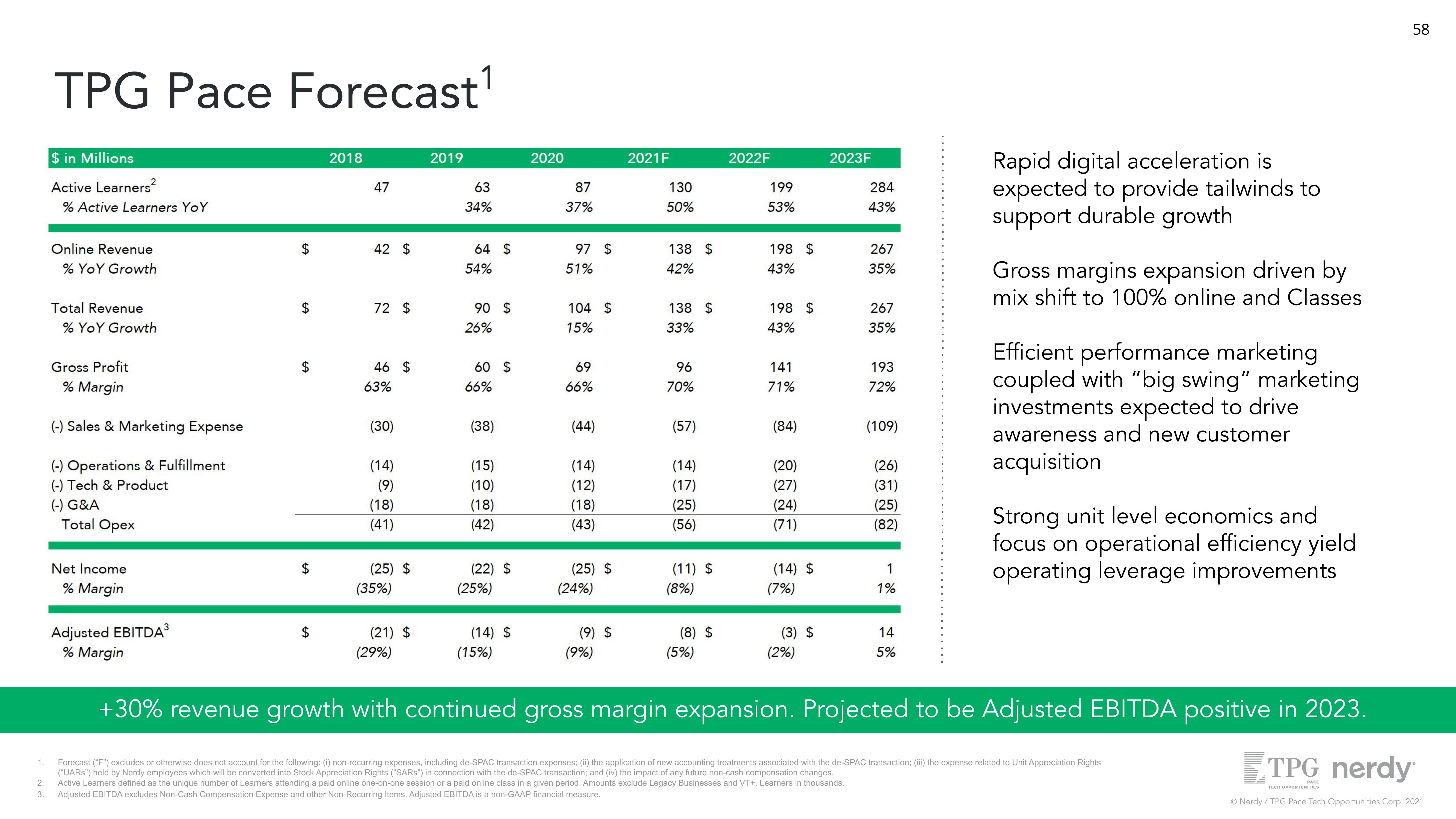

TPG Pace Forecast¹

1

$ in Millions

Active Learners²

% Active Learners YoY

Online Revenue

% YoY Growth

Total Revenue

% YoY Growth

Gross Profit

% Margin

(-) Sales & Marketing Expense

(-) Operations & Fulfillment

(-) Tech & Product

(-) G&A

Total Opex

Net Income

% Margin

Adjusted EBITDA³

% Margin

$

$

$

$

$

2018

47

42 $

72 $

46 $

63%

(30)

(14)

(9)

(18)

(41)

(25) $

(35%)

(21) $

(29%)

2019

63

34%

64 $

54%

90 $

26%

60 $

66%

(38)

(15)

(10)

(18)

(42)

(22) $

(25%)

(14) $

(15%)

2020

87

37%

97 $

51%

104 $

15%

69

66%

(44)

(14)

(12)

(18)

(43)

(25) $

(24%)

(9) $

(9%)

2021F

130

50%

138 $

42%

138 $

33%

96

70%

(57)

(14)

(17)

(25)

(56)

(11) $

(8%)

(8) $

(5%)

2022F

199

53%

198 $

43%

198 $

43%

141

71%

(84)

(20)

(27)

(24)

(71)

(14) $

(7%)

(3) $

(2%)

2023F

284

43%

267

35%

267

35%

193

72%

(109)

(26)

(31)

(25)

(82)

1

1%

14

5%

Rapid digital acceleration is

expected to provide tailwinds to

support durable growth

Gross margins expansion driven by

mix shift to 100% online and Classes

Efficient performance marketing

coupled with "big swing" marketing

investments expected to drive

awareness and new customer

acquisition

Strong unit level economics and

focus on operational efficiency yield

operating leverage improvements

Forecast ("F") excludes or otherwise does not account for the following: (i) non-recurring expenses, including de-SPAC transaction expenses; (ii) the application of new accounting treatments associated with the de-SPAC transaction; (iii) the expense related to Unit Appreciation Rights

("UARS") held by Nerdy employees which will be converted into Stock Appreciation Rights ("SARS") in connection with the de-SPAC transaction; and (iv) the impact of any future non-cash compensation changes.

2. Active Learners defined as the unique number of Learners attending a paid online one-on-one session or a paid online class in a given period. Amounts exclude Legacy Businesses and VT+. Learners thousands.

3. Adjusted EBITDA excludes Non-Cash Compensation Expense and other Non-Recurring Items. Adjusted EBITDA is a non-GAAP financial measure.

58

+30% revenue growth with continued gross margin expansion. Projected to be Adjusted EBITDA positive in 2023.

TPG nerdy

PACE

TECH OPPORTUNITIES

Ⓒ Nerdy / TPG Pace Tech Opportunities Corp. 2021View entire presentation