Evercore Investment Banking Pitch Book

Valuation Analyses

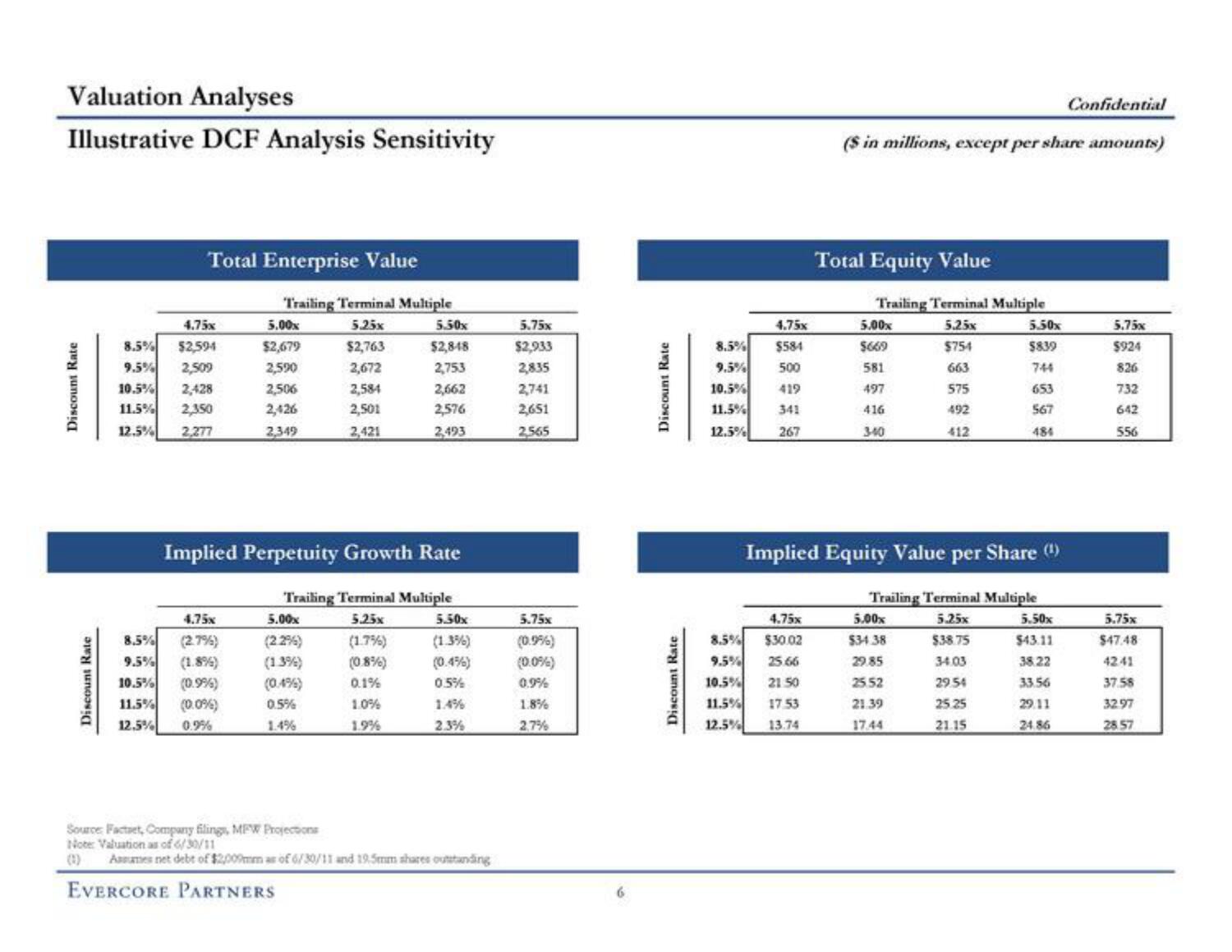

Illustrative DCF Analysis Sensitivity

Discount Rate

Discount Rate

Total Enterprise Value

4.75x

8.5% $2,594

9.5% 2,509

10.5% 2,428

11.5% 2,350

12.5% 2,277

4.75x

8.5% (2.7%)

9.5% (1.8%)

10.5% (0.9%)

11.5% (0.0%)

12.5% 0.9%

Trailing Terminal Multiple

5.25x

$2,763

2,672

2,584

2,501

2,421

5.00x

$2,679

2,590

2,506

2,426

2,349

Implied Perpetuity Growth Rate

5.00x

(22%)

(1.3%)

(0.4%)

0.5%

Trailing Terminal Multiple

5.25x

Source: Factaet, Company filings, MFW Projections

Note: Valuation as of 6/30/11

EVERCORE PARTNERS

5.50x

$2,848

2,753

2,662

2,576

2,493

(1.7%)

(0.8%)

0.1%

1.0%

1.9%

5.50x

(1.3%)

(0.4%)

0.5%

2.3%

Assumes net debt of $2009mm as of 6/30/11 and 19.5mm shares outstanding

5.75x

$2,933

2,835

2,741

2,651

2,565

5.75x

(0.9%)

(0.0%)

0.9%

1.8%

2.7%

Discount Rate

Discount Rate

8.5%

9.5%

10.5%

11.5%

12.5%

4.75x

$584

500

419

341

267

4.75x

8.5% $30.02

9.5% 25.66

10.5% 21.50

11.5%

17.53

12.5%

13.74

($ in millions, except per share amounts)

Total Equity Value

Trailing Terminal Multiple

5.25x

$754

663

575

492

412

5.00x

$669

581

497

416

340

Implied Equity Value per Share (¹)

5.50x

$839

744

5.00%

$34.38

29.85

25.52

21.39

17.44

653

567

484

Trailing Terminal Multiple

5.25x

$38.75

34.03

29.54

25.25

21.15

Confidential

5.50x

$43.11

38.22

33.56

29.11

24.86

5.75x

$924

826

732

642

556

5.75x

$47.48

4241

37.58

32.97

28.57View entire presentation